🚀 1099 Employee Form

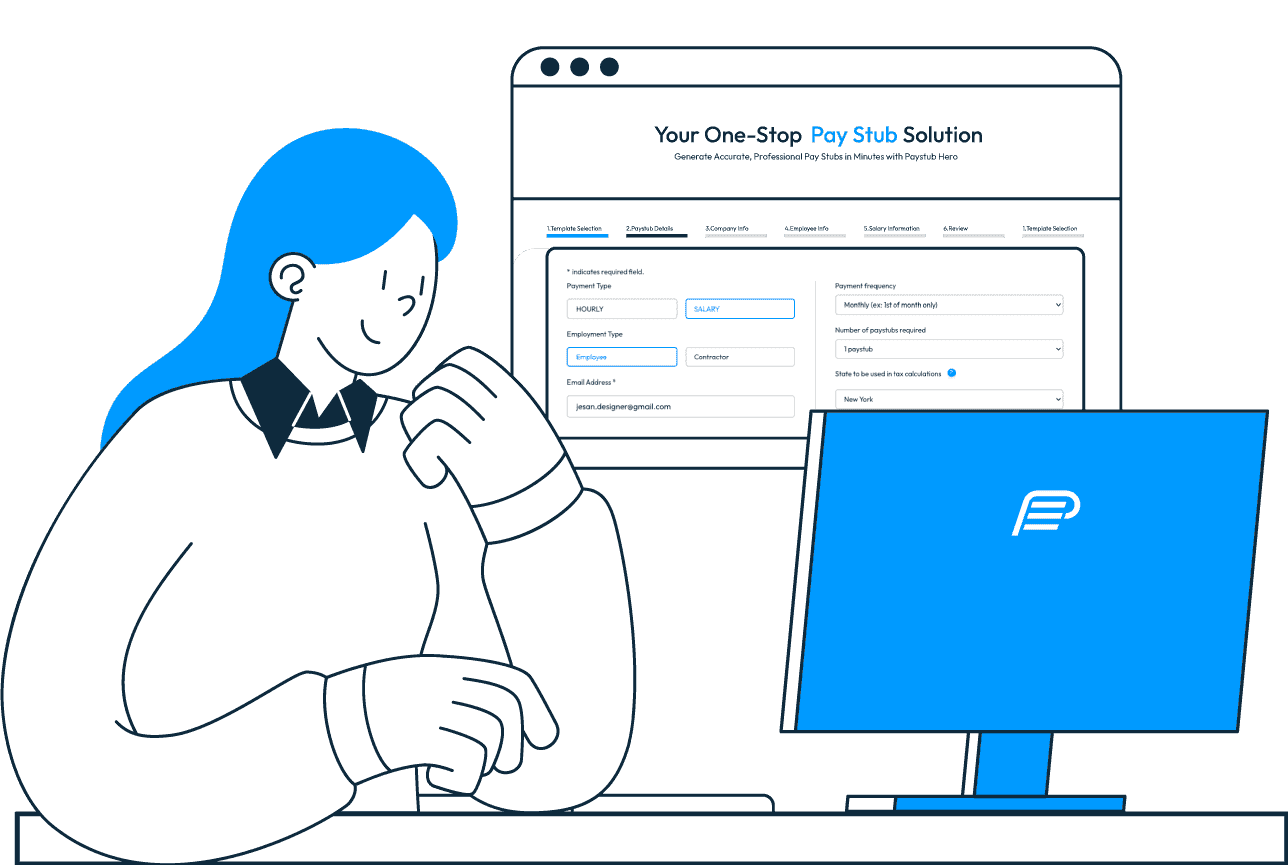

Effortlessly Generate Your 1099 Employee Form with PaystubHero

Streamline Your 1099 Employee Form Process with Our User-Friendly Platform

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding the 1099 Employee Form in Detail

The 1099 employee form, a critical document in the United States tax system, plays a pivotal role in how businesses report payments made to non-traditional workers. This form is primarily used for individuals who are not classified as regular employees, such as freelancers, independent contractors, and consultants. The significance of the 1099 form lies in its function as a means to report income that might otherwise go unrecorded in the traditional payroll framework.

For businesses, the 1099 form is an essential tool for maintaining compliance with IRS regulations. It is required for any entity that pays more than $600 to a non-employee over the course of a tax year. This form helps the IRS track and collect taxes owed on these various forms of income. It’s not just a document but a compliance necessity that ensures both parties – the payer and the payee – fulfill their tax obligations accurately.

From the perspective of the independent contractor or freelancer, receiving a 1099 form signifies the need to report this income on their tax returns. Unlike traditional employees, whose taxes are often withheld and managed by their employers, 1099 workers are responsible for calculating and paying their own taxes, including self-employment taxes. This underscores the importance of the 1099 form in the gig economy and freelance sectors, where it serves as a cornerstone for financial and tax planning.

Moreover, the 1099 form varies in types, each designated for different kinds of payments. For instance, the 1099-MISC is used for miscellaneous income, while the 1099-NEC is specific to non-employee compensation. Understanding which 1099 form to use is crucial for both the payer and the recipient to ensure accurate reporting.

In summary, the 1099 employee form is more than just a piece of paper; it’s a fundamental element of the tax reporting process for millions of Americans working outside the traditional employee framework. Its proper management and understanding are key to ensuring tax compliance and financial accuracy in an increasingly diverse and independent workforce.

Navigating the Complexities of 1099 Employee Forms

The management of 1099 employee forms presents a significant challenge for many businesses and independent contractors. This complexity stems from the need to accurately track and report payments to non-traditional workers, a task that is often fraught with potential for errors and non-compliance. Small businesses, in particular, struggle with the administrative burden this imposes, as they may lack the resources or expertise to manage these forms effectively. For independent contractors, the challenge lies in understanding and fulfilling their tax obligations based on these forms. The risk of penalties for incorrect or late submissions adds a layer of stress and potential financial liability. This market problem highlights the need for a streamlined, reliable solution that simplifies the process and ensures compliance with tax regulations.

Streamlining 1099 Employee Form Management with PaystubHero

In response to the challenges posed by 1099 employee forms, PaystubHero offers a robust and user-friendly solution. Our platform is designed to simplify the entire process, from creation to submission, effectively addressing the pain points for both businesses and independent contractors. By automating the generation and management of these forms, PaystubHero minimizes the risk of errors and ensures compliance with IRS guidelines. This not only saves valuable time but also alleviates the stress associated with tax reporting obligations. For small businesses, this means less time spent on administrative tasks and more focus on core operations. Independent contractors benefit from a clear, straightforward approach to managing their tax documents, ensuring they meet their obligations without hassle. PaystubHero’s solution represents a significant step forward in making tax compliance accessible and manageable for all parties involved in the gig and freelance economy.

Enhanced Features of PaystubHero for Efficient 1099 Form Management

PaystubHero introduces a suite of advanced features specifically tailored to address the complexities of managing 1099 employee forms. Our platform is more than just a tool; it’s a comprehensive ecosystem designed to streamline the entire process of tax document management for businesses and independent contractors.

Automated Form Generation

At the heart of PaystubHero is our automated form generation feature. This functionality allows users to create accurate and compliant 1099 forms with minimal effort. The system intelligently populates forms based on user-provided data, significantly reducing the time and potential for errors associated with manual entry. This automation is a game-changer for businesses of all sizes, enabling them to manage their tax reporting obligations more efficiently.

Real-Time Error Checking

To ensure the highest level of accuracy, PaystubHero incorporates real-time error checking. This feature scrutinizes every entry for common mistakes and inconsistencies, alerting users immediately if discrepancies are detected. This proactive approach to error management is crucial in avoiding costly mistakes that could lead to IRS audits or penalties.

Customizable Templates

Understanding that each business has unique needs, PaystubHero offers customizable templates for 1099 forms. Users can tailor these templates to fit their specific requirements, ensuring that each form they generate is perfectly aligned with their business processes. This level of customization is particularly beneficial for businesses with diverse payment structures or those that operate in multiple sectors.

Secure Data Management

In an era where data security is paramount, PaystubHero provides robust protection for your sensitive information. Our platform employs advanced encryption and security protocols to safeguard user data, ensuring that all financial information remains confidential and secure. This commitment to security builds trust and confidence among users, knowing their sensitive data is well-protected against unauthorized access or breaches.

Easy Access and Retrieval

PaystubHero's cloud-based platform offers unparalleled convenience in accessing and managing your 1099 forms. Whether you're in the office or on the go, your tax documents are just a few clicks away. This easy access is complemented by efficient organizational features, allowing users to store, categorize, and retrieve past forms effortlessly. This accessibility not only saves time but also simplifies the process of referencing and auditing previous tax documents when needed.

Up-to-Date Compliance

Staying compliant with ever-changing tax laws and IRS guidelines is a significant challenge for many businesses. PaystubHero addresses this by ensuring that our platform is consistently updated to reflect the latest regulatory changes. This feature is invaluable for maintaining compliance, as it relieves businesses from the burden of constantly monitoring tax law amendments. Users can rest assured that the forms they generate are always in line with current legal requirements.

User-Friendly Interface

Designed with all levels of tech proficiency in mind, PaystubHero boasts a user-friendly interface that makes navigating the complexities of tax documentation straightforward and stress-free. The intuitive design and clear instructions guide users through each step of the form generation process, making it accessible even to those with minimal technical background.

Expert Support

In addition to our advanced platform features, PaystubHero offers professional support to assist users with any queries or challenges they may encounter. Our team of experts is readily available to provide guidance, ensuring that users can navigate the platform and manage their 1099 forms with confidence and ease.

By integrating these features, PaystubHero not only simplifies the management of 1099 forms but also transforms it into a more efficient, accurate, and stress-free process. Our platform is dedicated to empowering businesses and independent contractors to handle their tax reporting obligations with greater ease and confidence.

Benefits of Using PaystubHero for Your 1099 Employee Form

Maximize Efficiency and Compliance with 1099 Employee Form Management

Streamlining Your 1099 Employee Form Process

Enhance Your Tax Reporting with Our 1099 Employee Form Solutions

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The 1099 employee form is a tax document used in the United States to report income paid to individuals who are not regular employees, such as freelancers, independent contractors, and consultants. This form is crucial for businesses and individuals as it helps in reporting income to the IRS that is not subject to traditional payroll taxes. Understanding and correctly using the 1099 form is essential for tax compliance and accurate income reporting.

Any business or individual who pays more than $600 in a year to someone who is not an employee must file a 1099 form. This includes payments to independent contractors, freelancers, and other non-employees for services rendered. It's important for businesses to keep accurate records of these payments to ensure compliance with IRS regulations.

Failure to file a 1099 form can result in significant penalties from the IRS. These penalties can vary based on how late the form is filed and the amount of payment not reported. The IRS can impose fines for each form that is filed late, with additional charges if it's determined that there was intentional disregard for filing requirements.

PaystubHero streamlines the 1099 form process by providing an easy-to-use platform for generating these forms accurately and efficiently. Our system automates much of the process, reducing the likelihood of errors and ensuring compliance with IRS guidelines. This simplification is particularly beneficial for small businesses and independent contractors who may not have extensive accounting resources.

Yes, PaystubHero allows users to generate 1099 forms for previous tax years. This feature is especially useful for businesses and individuals who need to correct past filings or who have overlooked their filing obligations in previous years. Our platform provides the flexibility to access historical data and generate forms as needed, ensuring that users can stay compliant with their tax responsibilities, even retroactively.

Absolutely. PaystubHero supports electronic filing (e-filing) of 1099 forms, which is a convenient and efficient way to handle tax documents. E-filing through our platform ensures that your forms are processed more quickly than traditional paper filing, and it provides a digital record of submission for your records. This method is not only faster but also more environmentally friendly and reduces the likelihood of forms being lost or delayed in the mail.

Data security is a top priority at PaystubHero. We employ advanced encryption and security protocols to protect all user data on our platform. This includes personal information, financial details, and any tax forms generated or filed through our system. Users can have peace of mind knowing that their sensitive information is safeguarded with the highest standards of online security.

Yes, PaystubHero is designed to handle multiple 1099 forms efficiently. Whether you're dealing with a few contractors or managing a large network of freelancers, our platform can accommodate your needs. The system allows for easy management and organization of forms for different contractors, streamlining the process of generating, filing, and tracking multiple 1099 forms.

For first-time users, PaystubHero offers comprehensive support to guide you through the process of generating and filing 1099 forms. This includes detailed tutorials, user-friendly guides, and customer support assistance. Our goal is to make the process as straightforward and stress-free as possible, even for those who are new to managing 1099 forms.

PaystubHero stays current with all IRS regulations and updates concerning 1099 forms. Our team closely monitors any changes in tax laws and updates the platform accordingly to ensure full compliance. This proactive approach means that users don't have to worry about keeping up with the latest tax rules themselves. Our platform's automatic updates provide assurance that the forms you generate and file are always in line with the most current IRS guidelines and requirements.