🚀 1099 Form California

1099 Form California - Simplify Your Income Reporting

Generate Your 1099 Form California with Ease

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

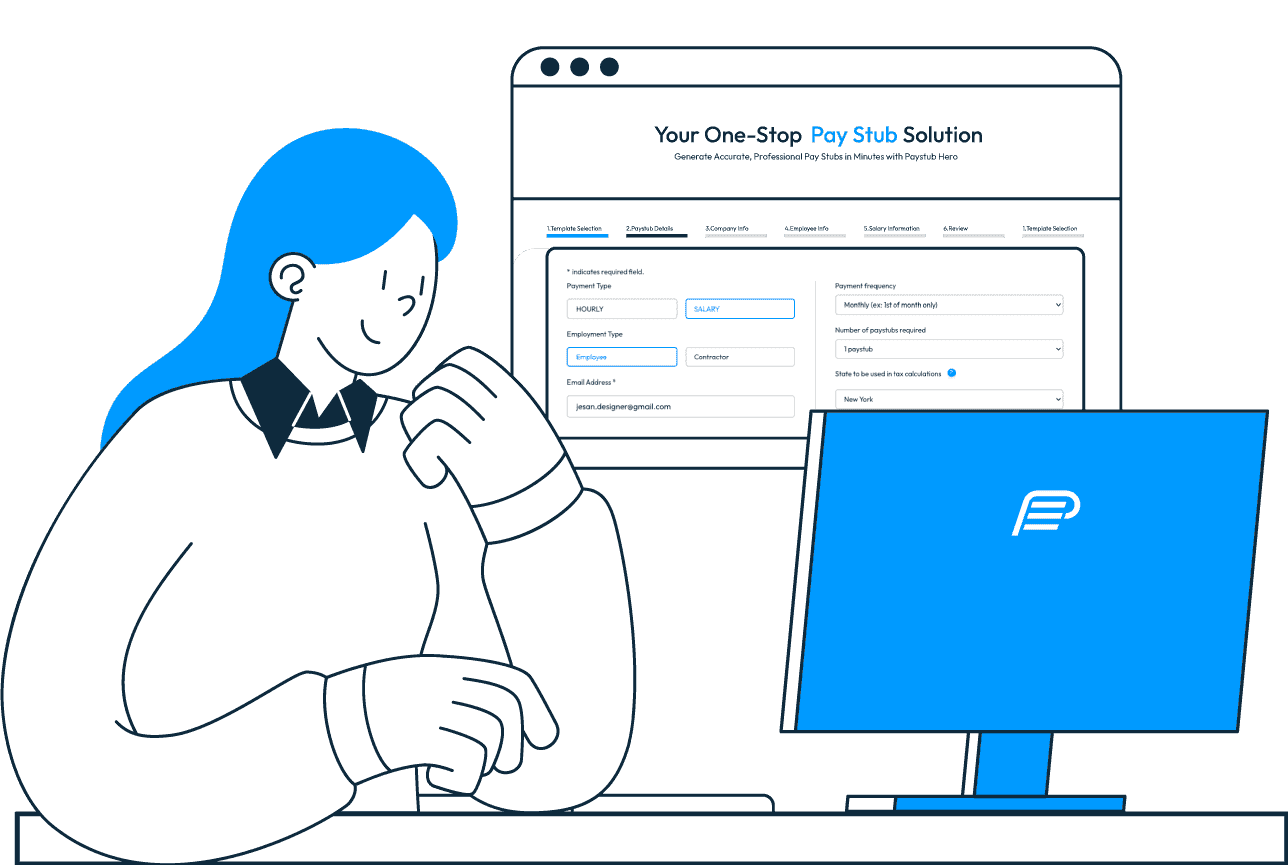

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Deciphering the 1099 Form California

In the diverse economic landscape of California, the 1099 Form is a fundamental tax document for individuals and entities operating outside of traditional employment structures. It is designed to report various types of income, from independent contracting to dividends and interest earnings. For Californians, this form is not merely a federal obligation but also a critical component of state tax compliance, ensuring that all income streams are transparently reported to the tax authorities.

The 1099 Form is categorized into several versions, each tailored to specific income types. The most commonly utilized in California is the 1099-NEC, which records payments to non-employees, reflecting the state’s burgeoning gig economy and freelance workforce. This form captures the payer’s and recipient’s identification details and the total amount paid during the tax year, which is indispensable for accurate tax reporting.

California’s tax system is rigorous, and adherence to its rules is non-negotiable. Any oversight in filing the 1099 Form can attract penalties, making it imperative for payers to meticulously document and report all qualifying transactions. The form is not just a bureaucratic requirement; it’s a legal instrument that aids in maintaining the integrity of the state’s tax infrastructure.

With the gig economy’s expansion, the relevance of the 1099 Form has surged, symbolizing the evolving nature of work and income in California. It underscores the necessity for those engaged in non-traditional work arrangements to be vigilant about their tax responsibilities. Platforms like PayStubHero.com are pivotal in this regard, offering a streamlined, user-friendly service that demystifies the process of generating 1099 Forms, thereby ensuring that Californians can fulfill their tax obligations with ease and precision.

Navigating the Market Problem with 1099 Forms in California

The process of managing and filing 1099 Forms in California presents a significant challenge for many. Independent contractors and small businesses often grapple with the complexities of tax reporting, struggling to understand the nuances of state requirements. The risk of errors is high, and the consequences can be costly, including fines and audits. This burden is compounded by the time-consuming nature of manual form preparation, which can detract from the core activities of running a business or servicing clients. There’s a clear need for a solution that simplifies this aspect of financial administration, ensuring accuracy and compliance without the traditional hassle.

The Optimal Market Solution for 1099 Forms in California

Recognizing the hurdles faced in tax documentation, PayStubHero.com emerges as the market solution for effortlessly creating 1099 Forms in California. Our platform alleviates the stress of tax compliance by providing a streamlined, error-proof system that generates accurate forms quickly. This not only minimizes the risk of penalties but also frees up valuable time for businesses and individuals to focus on their primary operations. With PayStubHero.com, the once daunting task of 1099 form preparation becomes a seamless, user-friendly experience, ensuring that Californians can navigate their tax responsibilities with confidence and ease.

Advanced Features of Our 1099 Form California Generator

Our 1099 Form California generator at PayStubHero.com is engineered to address the specific needs of the modern taxpayer. It’s not just about meeting legal requirements; it’s about enhancing the user experience with a suite of features designed for convenience, accuracy, and reliability. Our platform’s intuitive design simplifies the form generation process, making it accessible even to those with minimal tax preparation experience.

Guaranteed Accuracy

Our system is embedded with the latest tax calculation software, ensuring every figure on your 1099 Form is computed with pinpoint precision. This eliminates common manual errors, giving you peace of mind that your tax reporting is accurate.

Efficiency at Its Best

Time is of the essence, especially when it comes to tax preparation. Our generator is optimized for speed, allowing you to create and download your 1099 Form in a matter of minutes. This rapid turnaround is invaluable during the hectic tax season.

Stay Legally Compliant

Tax laws are constantly evolving, and our platform stays abreast of the latest changes. You can trust that your 1099 Form will meet all current federal and California state tax regulations, safeguarding you from potential legal complications.

Simplicity and Support

We believe that tax form generation should be straightforward, not frustrating. Our user-friendly interface is designed for easy navigation, and should you need assistance, our customer support team is ready to help at every step.

Key Benefits of Using Our 1099 Form California Generator

Maximize Your Tax Season Efficiency with 1099 Form California Expertise

Enhancing Your Financial Workflow with 1099 Form California Solutions

Discover the Advantages of Streamlined 1099 Form California Processing

Streamlined Process

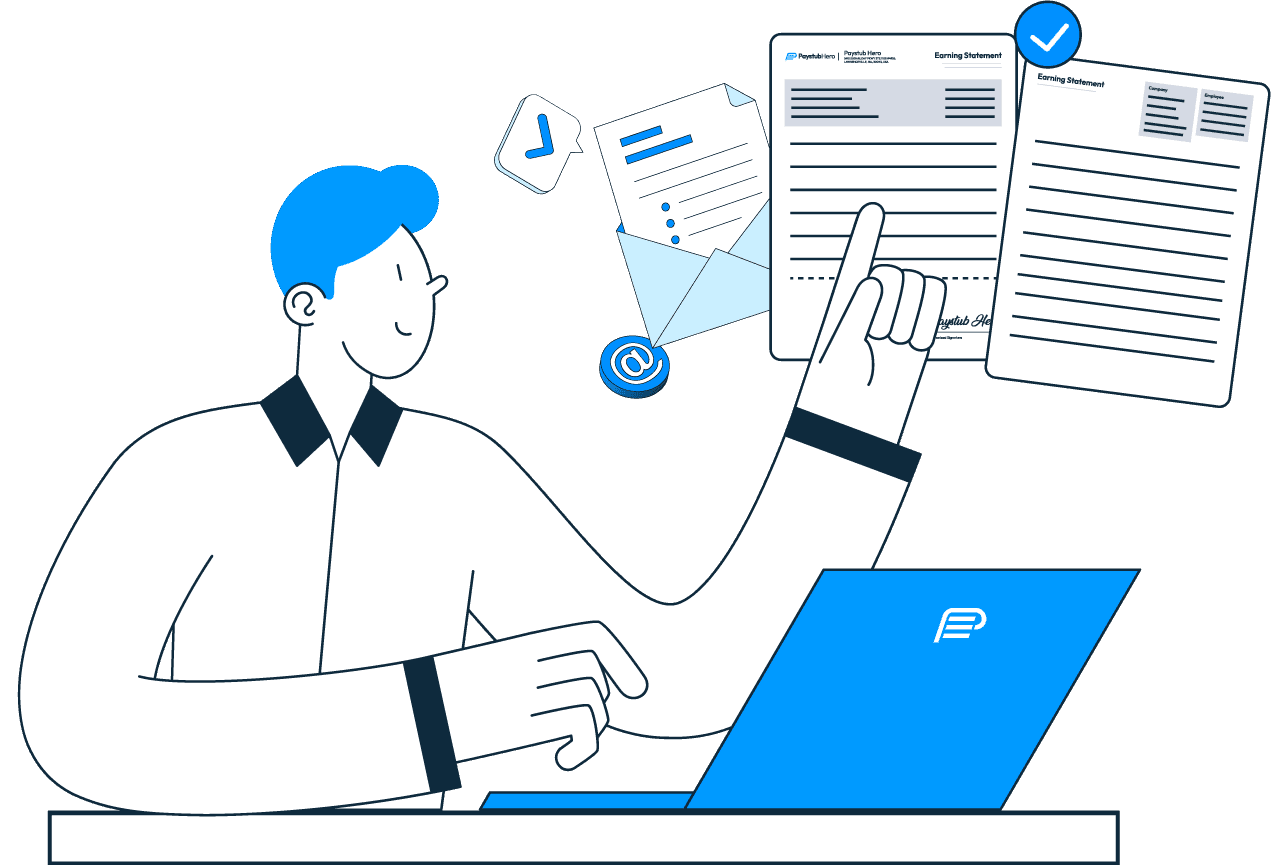

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The 1099 Form in California is a critical tax document used by the IRS to report income earned from sources other than a salary or wages. This includes freelance work, independent contracting, and other forms of self-employment. It's important because it ensures that all income is reported accurately, which is essential for maintaining compliance with state and federal tax laws. In California, where the economy is bolstered by a significant number of independent contractors and gig workers, the 1099 Form becomes a pivotal piece of documentation during tax season.

In California, any individual or business that makes a payment totaling $600 or more to a non-employee service provider within a tax year is required to file a 1099 Form. This mandate applies to all trade and business-related payments and is designed to ensure that the state can accurately track and tax income that might otherwise go unreported. It's a key component of tax compliance for businesses of all sizes, from large corporations to small startups.

Not filing a 1099 Form in California can lead to a range of penalties, including fines that increase over time and interest on the unpaid taxes. The California Franchise Tax Board is stringent about these requirements, and failure to comply can also result in an audit, which can be both time-consuming and costly. It's crucial for businesses to stay on top of their reporting obligations to avoid these potential issues.

In California, you can submit your 1099 Form either electronically through the IRS FIRE system or via mail. The electronic method is often preferred for its efficiency and immediate confirmation of receipt. Businesses with a large number of forms to file are actually required to submit them electronically. The state also provides resources and guidelines on its Franchise Tax Board website to assist taxpayers with the submission process.

Yes, you can generate and file a 1099 Form online for California using platforms like PayStubHero.com. The process involves entering the relevant financial information into the online form generator, which then creates a form ready for review and submission. This method is particularly advantageous as it reduces the likelihood of errors and streamlines the entire filing process.

Before filling out a 1099 Form for California, you'll need to collect the taxpayer identification numbers (TINs), names, and addresses of both the payer and the recipient. Additionally, you must have accurate records of all payments made to the recipient during the tax year. Keeping detailed financial records throughout the year can greatly simplify this process when tax season arrives.

The deadline for filing 1099 Forms in California aligns with the federal deadline, which is typically January 31st following the tax year in which the payments were made. If you miss this deadline, you may be subject to late filing penalties. These penalties can accrue over time, so it's important to file as soon as possible, even if the deadline has passed.

Yes, if you earn income in California, you are required to report it using a 1099 Form, regardless of your state of residence. This is because California taxes income earned within its borders. It's important to consult with a tax professional to understand how this may affect your overall tax situation.

PayStubHero.com ensures the accuracy and compliance of the 1099 Form California by using up-to-date tax tables and compliance checks. The platform is regularly updated to reflect the latest tax laws and regulations. Additionally, the system is designed to minimize user input errors and provide prompts and guidance to ensure that all the necessary information is accurately reported.

Yes, PayStubHero.com is equipped to handle multiple 1099 Forms for California, making it an ideal solution for businesses with several contractors. The platform offers bulk processing capabilities, which allows users to input multiple sets of information and generate several forms at once. This feature is particularly useful for streamlining the tax filing process for businesses with numerous vendors or service providers.