🚀 1099-MISC Form 2023

Get Your 1099-MISC Form 2023 Ready with Ease

Streamline Your Tax Filing with Our 1099-MISC Form 2023 Solutions

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

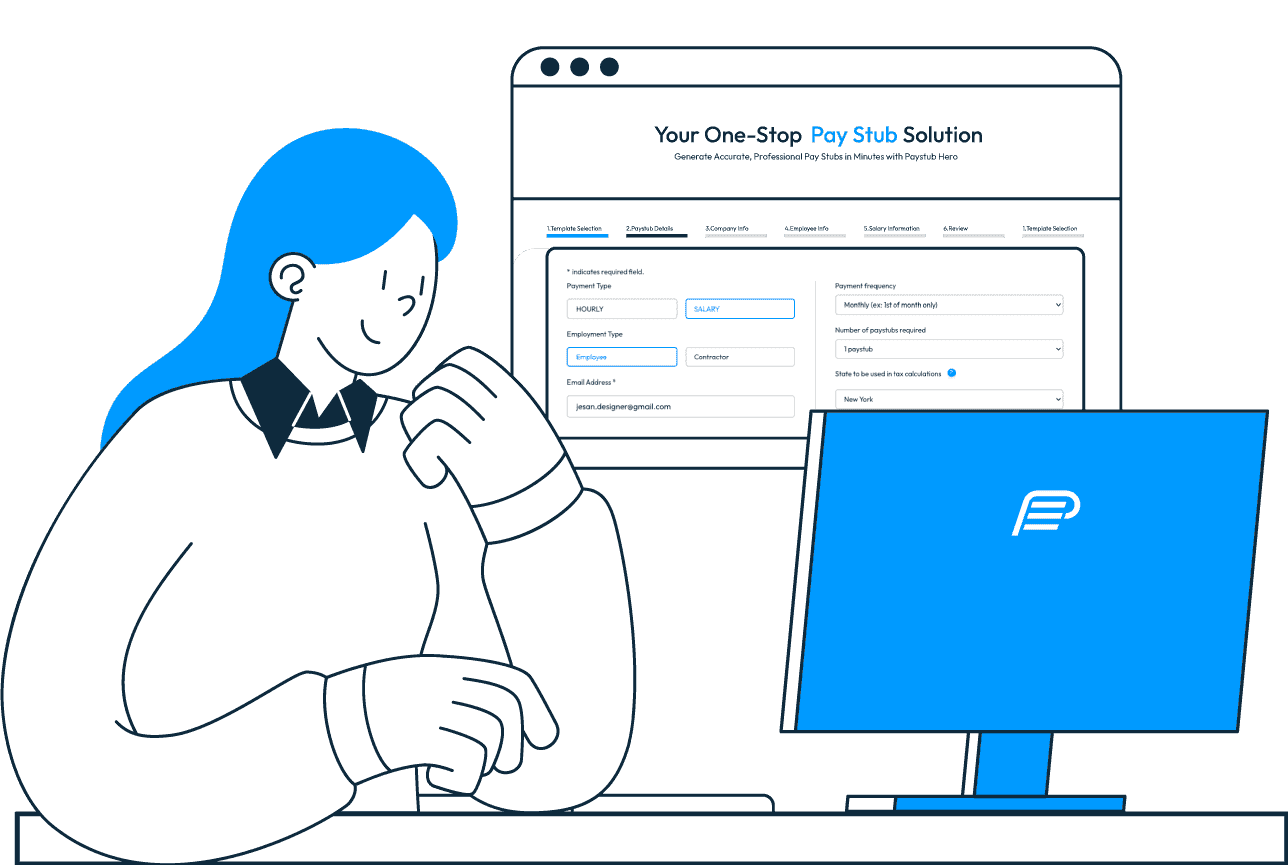

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

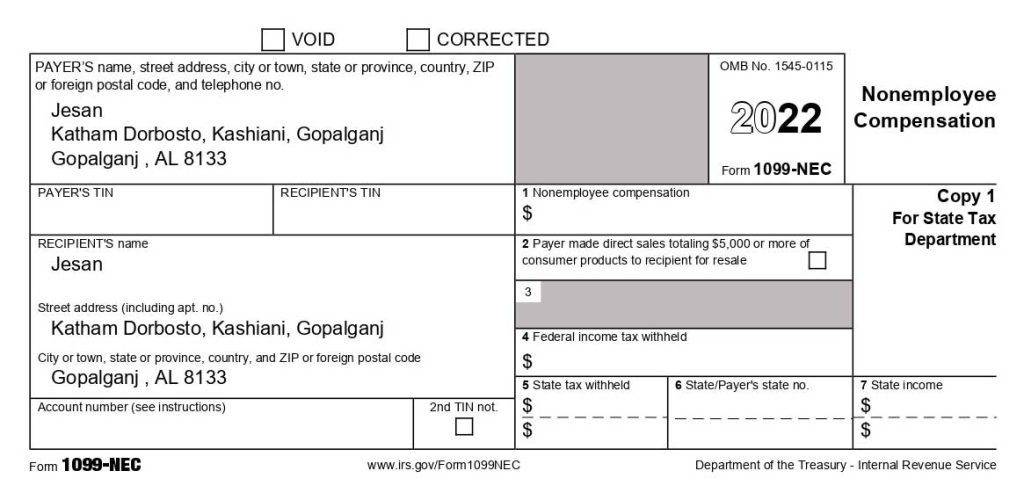

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

What is the 1099-MISC Form 2023?

The 1099-MISC Form is an essential document in the U.S. tax system, used for reporting various types of income other than wages, salaries, and tips. As we approach the 2023 tax year, understanding the specificities of the 1099-MISC Form becomes crucial for individuals and businesses alike.

For the tax year 2023, the 1099-MISC Form is primarily utilized to report payments such as rents, prizes, awards, medical and healthcare payments, and other income payments. It’s also used for reporting direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

The form is a critical tool for the IRS to ensure all income is reported accurately. It’s required for any payer who has paid at least $600 during the year in rents, services performed by someone who is not an employee, prizes and awards, other income payments, medical and healthcare payments, crop insurance proceeds, cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish, or, generally, the cash paid from a notional principal contract to an individual, partnership, or estate.

Any individual or entity that makes certain types of payments as outlined by the IRS is responsible for filling out and sending a 1099-MISC Form to both the recipient of the payment and the IRS. This includes freelancers, independent contractors, landlords, and others who make payments as part of their trade or business.

The 1099-MISC Form 2023 is particularly important because it reflects the latest tax laws and regulations. Staying compliant with these regulations is vital to avoid penalties. The form requires detailed information, including the amount paid during the year and the recipient’s legal name and Taxpayer Identification Number (TIN).

Filing the 1099-MISC Form accurately and on time is crucial. The deadline for filing the form with the IRS and providing a copy to the income recipient typically falls at the end of January of the year following the tax year. For instance, for the 2023 tax year, the form would generally need to be filed by January 31, 2024.

Understanding and complying with the requirements of the 1099-MISC Form 2023 is essential for accurate tax reporting and maintaining good standing with the IRS. It’s a key component of the tax filing process for those who engage in non-employee compensation and other forms of miscellaneous income.

Challenges with 1099-MISC Form 2023

Navigating the complexities of the 1099-MISC Form 2023 presents a significant challenge for many. Individuals and businesses often find themselves overwhelmed by the intricate requirements and updates in tax laws. The process of accurately reporting various types of income, understanding the specific categories, and meeting strict IRS deadlines can be daunting. This complexity leads to common errors, such as incorrect or missed entries, which can result in penalties and added stress. Additionally, staying abreast of the latest tax regulations and ensuring compliance adds to the burden, making the task of filing the 1099-MISC Form 2023 a source of anxiety and potential financial risk.

Simplifying 1099-MISC Form 2023 Filing

Addressing the complexities of the 1099-MISC Form 2023, our online document generation platform offers a streamlined and user-friendly solution. We alleviate the common pain points of tax reporting by providing an intuitive system that guides users through the process of accurately completing their forms. Our platform is equipped with features that ensure compliance with the latest IRS regulations, reducing the risk of errors and penalties. By simplifying data entry, offering clear instructions, and automating calculations, we transform a traditionally cumbersome process into a manageable and stress-free experience. This solution not only saves valuable time but also instills confidence in users, ensuring their tax reporting for 2023 is accurate and IRS-compliant.

Features of Our 1099-MISC Form 2023 Generator

Our online platform revolutionizes the way you handle the 1099-MISC Form 2023, offering a suite of features designed to streamline the entire process. These features are meticulously crafted to cater to the needs of both individuals and businesses, ensuring a seamless, accurate, and stress-free tax filing experience.

User-Friendly Interface

We understand that dealing with tax forms can be daunting. That's why our platform is designed with simplicity in mind. The user-friendly interface makes navigation effortless, allowing users to fill out their forms without needing extensive tax knowledge. This approachable design is particularly beneficial for those who are managing their tax reporting independently, ensuring that every step from data entry to form submission is straightforward and clear.

Accurate Calculations

Accuracy in tax reporting is non-negotiable. Our platform features advanced automated calculation tools that eliminate the common errors associated with manual data entry. Whether it's calculating total income, deductions, or understanding specific tax implications, our system ensures that every number on your 1099-MISC Form is precise. This feature is invaluable for maintaining compliance and avoiding the pitfalls of over or under-reporting income.

Up-to-Date Compliance

Tax laws are constantly evolving, and staying abreast of these changes is crucial. Our platform is continuously updated to align with the latest IRS guidelines and regulations for the 2023 tax year. This commitment to compliance means users can rest assured that their 1099-MISC Forms meet all current legal requirements, reducing the risk of complications or penalties from the IRS.

Secure and Reliable

In an era where data breaches are a significant concern, our platform prioritizes the security of your sensitive financial information. We employ state-of-the-art security protocols to safeguard your data, ensuring confidentiality and protection against unauthorized access. Additionally, our platform's reliability is unmatched. We understand the importance of having consistent access to your tax documents, especially as deadlines approach. Our robust infrastructure guarantees that the platform is operational when you need it, providing a dependable solution for your tax preparation needs.

Comprehensive Support

Navigating tax forms can sometimes raise questions or require assistance. Our platform is backed by a team of knowledgeable support professionals ready to assist with any inquiries or challenges you might encounter. This support extends beyond technical issues, encompassing guidance on how to effectively use the platform and understand the nuances of the 1099-MISC Form 2023.

Real-Time Updates and Notifications

Stay informed with real-time updates and notifications. Our platform keeps you updated on the progress of your form submission, any changes in tax laws that might affect your filing, and reminders for critical deadlines. This proactive approach ensures you're always on top of your tax obligations, avoiding last-minute rushes and potential oversights.

By integrating these features into our platform, we aim to provide a comprehensive, reliable, and user-friendly solution for managing and filing your 1099-MISC Form 2023. Our goal is to transform what is traditionally a complex and time-consuming task into a streamlined and hassle-free experience, giving you more time to focus on what matters most in your business or personal life.

Maximize Efficiency and Accuracy with Our 1099-MISC Form 2023 Solution

Discover the Advantages of Simplified Tax Reporting for 1099-MISC Form 2023

Elevate Your Tax Filing Process with Our 1099-MISC Form 2023 Expertise

Seamlessly Navigate Tax Season with Our Enhanced Features for 1099-MISC Form 2023

Streamlined Process

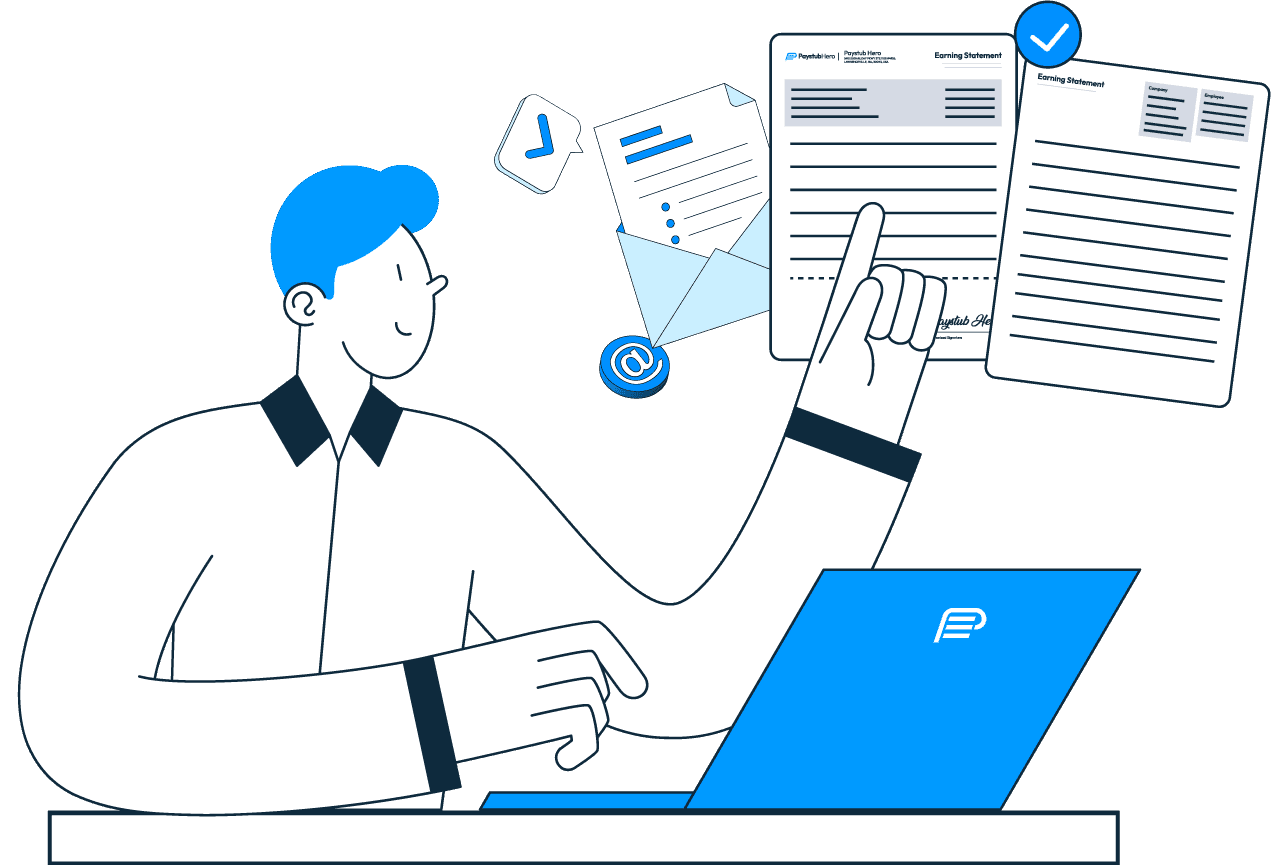

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The 1099-MISC Form 2023 is a tax document used in the United States for reporting various types of income other than wages, salaries, and tips. It's essential for individuals and businesses that have made payments totaling $600 or more during the year for services performed by someone who is not their employee. This includes payments for rent, prizes, awards, and other income payments. Understanding who needs to file and the specific types of payments to report is crucial for accurate tax reporting and compliance with IRS regulations.

The IRS occasionally updates tax forms to reflect changes in tax legislation and financial reporting requirements. For the 1099-MISC Form 2023, filers should be aware of any new categories of reportable income, revised thresholds for reporting, and any alterations in the form's layout or submission process. Staying informed about these changes is vital to ensure compliance and avoid potential penalties.

If you are a business owner or an individual who has made payments for services, rent, or other income categories that fall under the 1099-MISC criteria, you likely need to issue this form. The key threshold is $600: if you have paid $600 or more to a service provider or contractor, you are required to issue a 1099-MISC. It's important to keep accurate records of all transactions throughout the year to make this determination easier at tax time.

The 1099-MISC Form 2023 typically needs to be filed with the IRS and sent to the recipient by January 31, 2024. This deadline is crucial to meet to avoid penalties. For electronic filings, the IRS may offer a slightly extended deadline, but it's important to confirm the specific dates each tax year.

Yes, the 1099-MISC Form 2023 can be filed electronically, which is often more convenient and faster than paper filing. Electronic filing is secure, with the IRS and tax software providers implementing robust security measures to protect sensitive information. It's important to use a reputable and IRS-approved e-filing service to ensure the security and accuracy of your submission.

To file the 1099-MISC Form 2023, you'll need detailed information about both the payer and the recipient, including names, addresses, and taxpayer identification numbers (TINs). You also need to know the total amount paid to the recipient during the tax year and the type of payment made. Keeping detailed financial records and obtaining the necessary information from your payees in advance can simplify this process.

Our platform is designed with built-in checks and balances to ensure accuracy and compliance. It automatically updates to reflect the latest IRS regulations and guidelines. The platform also includes features for error detection and correction, ensuring that the information entered matches IRS requirements. Additionally, our support team is available to assist with any questions or concerns about compliance.

If you discover an error on a 1099-MISC Form 2023 after filing, you should correct it as soon as possible. This involves submitting a corrected form to both the IRS and the recipient. The process depends on the nature of the error but generally requires filling out a new form with the correct information and checking the 'corrected' box. Timely correction of errors is important to avoid penalties and ensure accurate tax reporting.

Yes, there are penalties for failing to file the 1099-MISC Form 2023 on time, not providing it to the income recipient, or filing incorrect information. These penalties vary based on the size of the business and how late the filing is, but they can be significant. It's crucial to understand these potential penalties and take steps to ensure timely and accurate filing.

Yes, when using our platform, you can access your filed 1099-MISC Forms for future reference. This feature is particularly useful for maintaining records, preparing for future tax seasons, or addressing any inquiries from the IRS or the income recipient. Keeping a history of your filed forms also helps in tracking your financial transactions over the years.