🚀 2023 1099 Form

2023 1099 Form: Simplifying Your Tax Documentation Needs

Effortless 2023 1099 Form Generation for Accurate Reporting

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

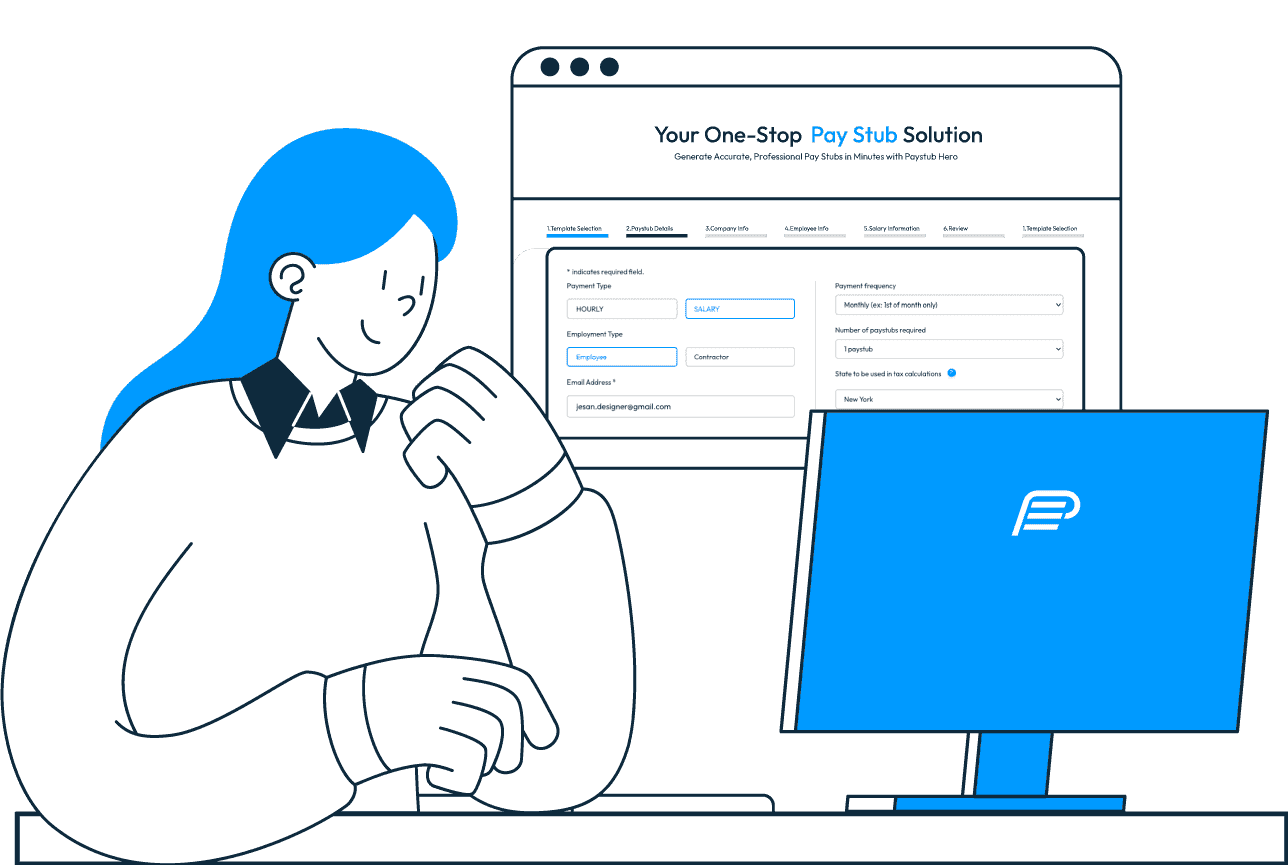

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

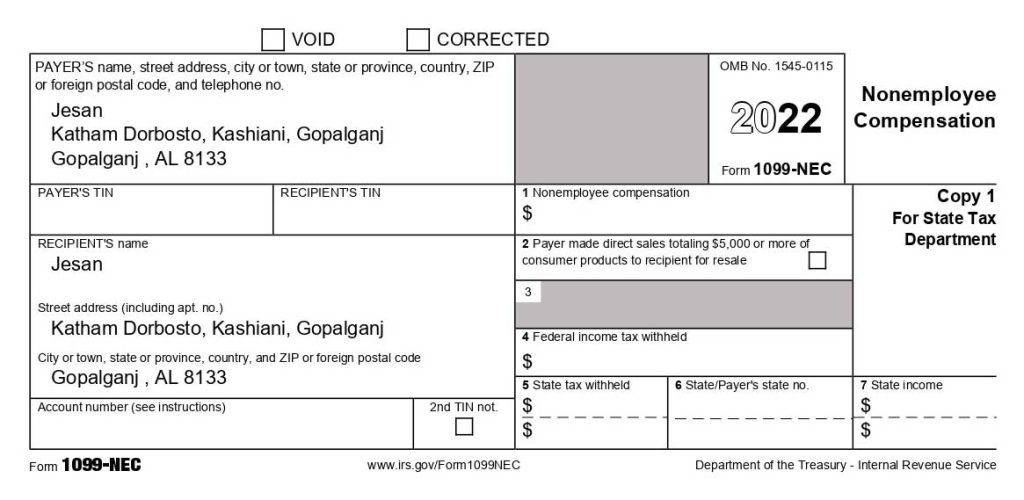

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding the 2023 1099 Form

The 2023 1099 form is a crucial document in the United States tax system, serving as a record for various types of income that are not part of traditional salary wages. This form is particularly relevant for self-employed individuals, freelancers, and contractors, as well as businesses that make specific types of payments. The importance of the 1099 form lies in its role in reporting income to the IRS, ensuring transparency and compliance with tax regulations.

For the 2023 tax year, the 1099 form has been updated to reflect any changes in tax laws and filing requirements. It’s essential for users to understand these updates to avoid any potential pitfalls in tax reporting. The form details income from various sources such as rent, dividends, interest, and non-employee compensation, making it a versatile tool for financial documentation.

Completing the 1099 form accurately is vital. It requires a comprehensive understanding of the types of income that must be reported, the thresholds for reporting, and the specific variants of the form applicable to different income types. For example, the 1099-MISC is used for miscellaneous income, while the 1099-NEC is dedicated to non-employee compensation.

This form not only assists in individual tax filing but also plays a key role in the financial management of small businesses and corporations. It helps in maintaining clear records of payments made, which is crucial for both tax purposes and internal financial tracking. Therefore, understanding and correctly using the 2023 1099 form is imperative for anyone involved in non-traditional income streams, ensuring compliance with IRS requirements and aiding in efficient financial management.

Challenges in Handling 2023 1099 Forms

The process of managing and filing the 2023 1099 forms presents several challenges, particularly for small businesses, freelancers, and independent contractors. The primary issue lies in the meticulous detail and accuracy required to correctly report various types of income. Keeping track of different payment sources, categorizing them accurately, and understanding the updated tax regulations for 2023 can be daunting and time-consuming. Mistakes in these forms can lead to IRS audits, penalties, and reputational damage. This complexity is compounded for those with limited accounting resources or tax expertise, making the need for a simplified, reliable solution more pronounced than ever in the market.

Streamlined Solution for 2023 1099 Form Generation

Addressing the complexities of the 2023 1099 forms, our online generator provides a streamlined, user-friendly solution. It is designed to simplify the entire process, from data entry to form submission. Our platform automatically updates with the latest IRS regulations and guidelines, ensuring that all forms are compliant and accurate. This significantly reduces the risk of errors and the associated stress of non-compliance. The intuitive interface makes it easy for users of all backgrounds to navigate and complete their forms efficiently. By automating the most challenging aspects of 1099 form generation, our solution empowers users to manage their tax reporting with confidence and ease.

Key Features of Our 2023 1099 Form Generator

Our 2023 1099 Form Generator is a comprehensive solution designed to tackle the specific challenges of tax form preparation and submission. It integrates a suite of features that cater to the diverse needs of users, from freelancers to small business owners. The platform’s core functionality revolves around simplifying and streamlining the form generation process while ensuring the highest standards of accuracy and compliance.

Firstly, the generator is equipped with real-time data validation, a feature that instantly checks the information entered against standard tax reporting requirements. This significantly minimizes the risk of errors, which are common in manual entries, and can lead to costly penalties or IRS audits.

Secondly, our platform offers customizable templates. This feature allows users to tailor their 1099 forms according to their specific income streams and requirements. Whether it’s miscellaneous income, rent, or non-employee compensation, each form can be adapted to fit the exact needs of the user, ensuring that all relevant information is captured accurately and in accordance with IRS guidelines.

Moreover, the 2023 1099 Form Generator ensures the security of user data. With robust encryption and data protection protocols, users can trust that their sensitive financial information is safeguarded against unauthorized access or breaches.

Finally, the user-friendly interface of our platform stands out. Designed with simplicity in mind, it allows users with varying levels of tax knowledge to navigate and complete their forms with ease. The intuitive layout, clear instructions, and accessible support resources make the process of generating a 1099 form as straightforward as possible.

Real-Time Accuracy Check

Our platform integrates advanced algorithms that perform real-time accuracy checks, significantly reducing the likelihood of errors. This feature meticulously scans each entry for common mistakes and discrepancies, providing users with immediate feedback and correction suggestions. This proactive approach to accuracy ensures that the forms submitted are precise, reducing the risk of IRS audits and penalties.

Customizable Templates

Recognizing that each user's needs are unique, our generator offers customizable templates. These templates allow users to tailor their 1099 forms according to their specific requirements, ensuring that every necessary detail is captured accurately. This level of customization not only enhances the user experience but also ensures that each form meets the exact standards set by the IRS.

Secure Data Handling

Security is paramount in tax reporting. Our platform employs state-of-the-art encryption and security protocols to protect sensitive user data. This feature ensures that all information entered into the system is secure from unauthorized access, providing peace of mind to our users regarding the confidentiality of their financial information.

User-Friendly Interface

Designed with user experience in mind, our interface is intuitive and easy to navigate. Whether you are tech-savvy or new to online tax filing, our platform guides you through the process step-by-step, making the task of form generation as straightforward as possible. This approach significantly reduces the time and effort required to complete and submit a 1099 form, making it accessible and manageable for everyone.

Advantages of Using Our 2023 1099 Form Generator

Mastering Tax Reporting with the 2023 1099 Form Generator

Maximizing Efficiency with 1099 Form Florida Filing Benefits

Leverage PayStubHero’s Capabilities for Seamless 1099 Form Florida Management

Streamlined Process

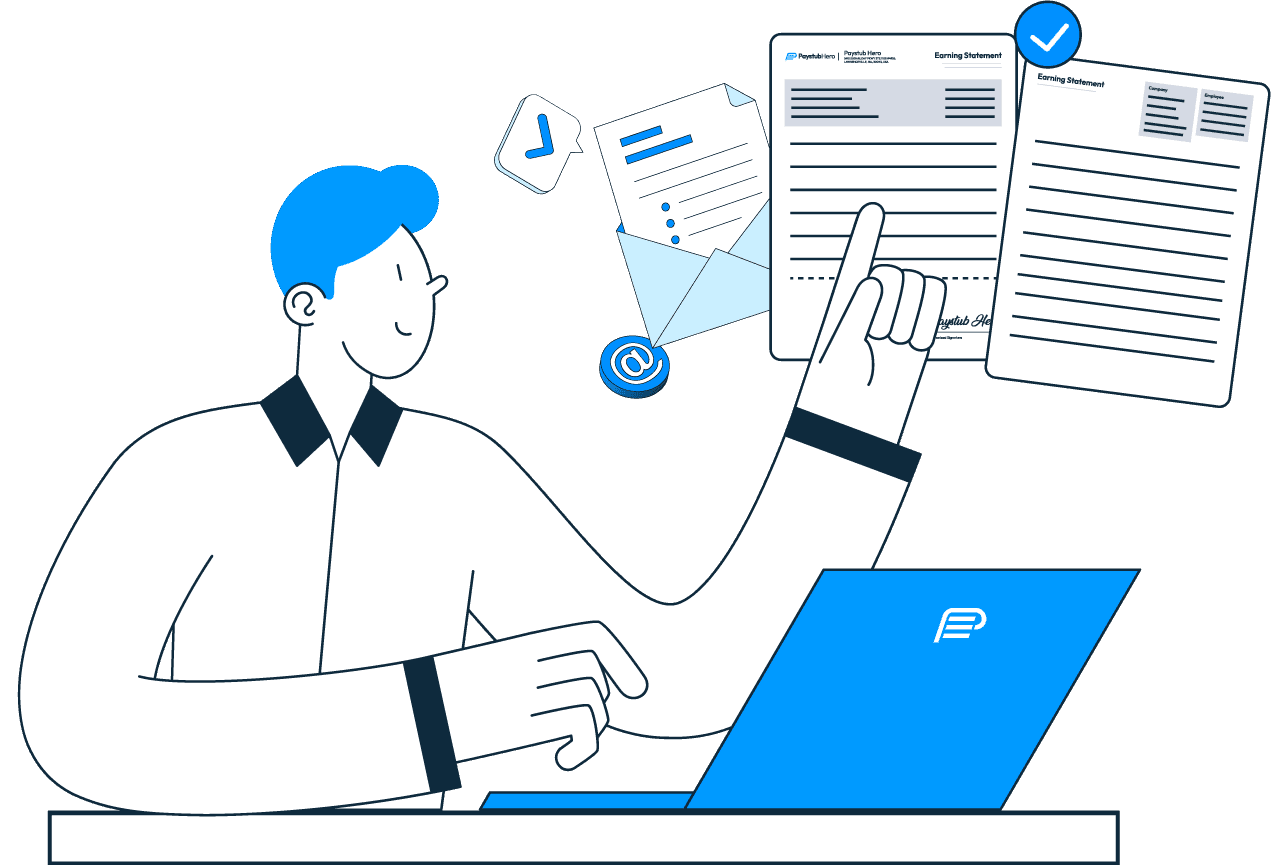

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The 1099 form is a critical document for Florida's workforce and businesses, serving as a record for income earned outside of traditional employment. This includes freelance work, independent contracting, rental income, or any other type of business or personal income that needs to be reported to the IRS. For businesses, it's a way to report money paid to contractors and service providers. Understanding and using the correct form is crucial for tax reporting and compliance with state and federal laws.

In Florida, any individual or business entity that makes a payment of $600 or more in a year to a non-employee for services provided must issue a 1099 form. This is a common scenario for businesses that hire independent contractors. It's also required for other forms of income such as rent, prizes, awards, and other income payments.

Not filing a 1099 form can lead to a range of penalties from the IRS, including fines that vary depending on how late the form is filed. The IRS can also impose interest on any taxes due that were not reported on time. In some cases, if the failure to file is deemed intentional, more severe penalties could apply.

Yes, PayStubHero supports the filing of 1099 forms for both the current and previous tax years. Our platform provides the necessary tools to generate and file these forms accurately, regardless of the tax year, ensuring that you can rectify any past filing omissions and stay compliant.

If you discover an error on a 1099 form filed through PayStubHero, our system allows you to make corrections swiftly. We provide guidance on how to amend the information and refile the form correctly, minimizing the potential for issues with the IRS.

Absolutely. PayStubHero is equipped to handle batch processing, allowing you to generate multiple 1099 forms simultaneously. This feature is particularly useful for businesses with several contractors, streamlining the end-of-year reporting process.

PayStubHero prioritizes the security of your financial data with advanced encryption and security protocols. We ensure that your information is protected against unauthorized access and breaches, giving you confidence in the confidentiality of your filings.

Our customer support team is well-versed in both the platform and the intricacies of 1099 form requirements in Florida. We offer comprehensive support through various channels, including email, phone, and live chat, to assist you with any questions or issues.

Yes, we believe in empowering our users with knowledge. PayStubHero offers a suite of educational resources, including articles, guides, and webinars, to help you understand the nuances of 1099 forms in Florida and ensure you're well-informed for accurate tax reporting.

Yes, PayStubHero is designed to cater to the specific requirements of Florida's tax laws. Our platform takes into account any state-specific rules and regulations that may affect how you file your 1099 forms, ensuring that you remain compliant with Florida's tax statutes.