No. You don’t always need good credit to rent an apartment. In fact, many landlords care more about whether you have a steady income and can pay your rent on time.

Keep reading for some tips that could help you secure an apartment without relying on your credit score.

The Role of Credit in Apartment Rentals

Credit scores range from 300 to 850. If your score is above 620, it’s usually seen as good and shows you handle money well. Scores below 580 might make landlords worried.

In short, your credit score shows how well you manage debt and pay bills. A higher score means you’re more likely to pay rent on time, which helps landlords feel more confident about renting to you.

When landlords check potential tenants, they look at credit scores to guess how likely you are to pay rent on time.

Is Credit Always Required to Rent an Apartment?

Landlords might run a credit check when you apply to rent an apartment since it helps them assess your financial responsibility and reliability. However, if your credit is bad, there’s no need to stress.

As mentioned earlier, many landlords are willing to consider other factors that can show you’re a dependable tenant.

Alternative Ways to Demonstrate Financial Stability

While credit scores are often requested, there are other ways to show your financial stability that can be just as important.

These methods can help you stand out as a strong candidate for an apartment.

1. Proof of Income:

When renting an apartment, proving your income is a vital part of showing you’re financially stable. It’s often easier than it seems. You’ll need to provide documents that show you have a steady income, which helps reassure landlords that you can manage the rent.

Here’s a quick guide on what documents you can use:

⦿ Pay Stubs:

If you have a job, recent pay stubs are a straightforward way to show your income. They show how much you make and how often you get paid.

Landlords usually want to see a few months’ worth to make sure your income is steady.

⦿ Tax Returns:

For those who are self-employed or have fluctuating income, tax returns are a good choice. They give a full picture of what you’ve earned over the past year, helping landlords see if you’re financially stable.

⦿ Bank Statements:

Recent bank statements can be helpful too. They should show regular deposits from your job or business, which proves you have a steady income.

This is especially useful if you’re self-employed or have different sources of income.

⦿ 1099 Forms:

If you’re a freelancer or contractor, 1099 forms are important. They show what you’ve earned from various clients or projects and can help prove your income.

2. Employment Verification

Providing employment verification is a strong way to show you can afford the rent and have a stable job. This letter from your employer confirms your job status and income.

It usually includes your job title, how long you’ve been with the company and your salary. This helps landlords see you have a steady income and can be relied on to pay rent on time.

Here’s an example of what such a letter might look like:

[Employer’s Letterhead]

Date: September 15, 2024

To Whom It May Concern:

This letter is to confirm that Von is employed with XYZ Company. Von has been with us since March 1, 2022, and currently holds the position of Marketing Manager. Her annual salary is $60,000.

Should you require any further information, please feel free to contact us at (123) 456-7890.

Best regards,

Barrack S

Human Resources Manager

XYZ Company

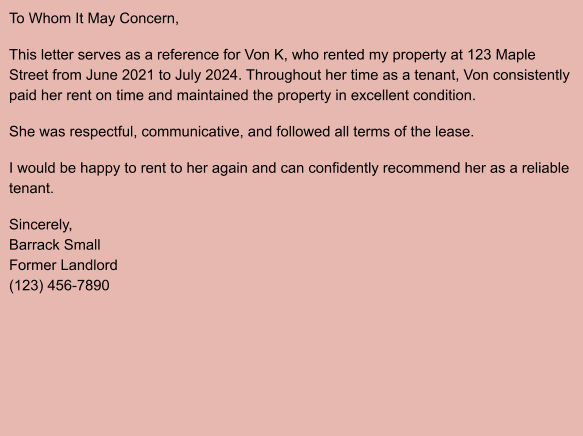

3. References from Previous Landlords

Another way to show you’re a reliable tenant is by providing references from your previous landlords.

A landlord reference letter doesn’t have to be long, but it can be very effective. It usually includes how long you lived at the property, if you paid rent on time, and whether you were a respectful tenant.

This helps give landlords confidence that you’ve been responsible and dependable in the past.

Here’s an example of what a landlord reference letter might look like:

4. Savings Account Statements

Do you have a savings account?

It can be a great way to show landlords you have a financial backup, especially if your income isn’t steady or you’re between jobs. Having savings reassures them that even if things get tough, you’ll still be able to cover the rent.

Just provide a few recent bank statements showing you’ve set aside money for emergencies. Make sure your balance is consistent and shows enough to cover a few months of rent.

This can be really helpful if your credit score isn’t the best or you don’t have a traditional job.

5. Rental History

If you’ve always paid your rent on time and kept up with lease terms, that’s a great indicator of your reliability as a tenant. It shows that you take your rental obligations seriously.

To highlight your rental history, you can share the contact details of your previous landlords and the dates you lived at each place. This makes it easy for new landlords to check your track record.

A strong rental history can really boost your rental application.

6. Offer to Pay a Higher Security Deposit

Offering a higher deposit is a great way to ease a landlord’s concerns about potential damages or unpaid rent.

For instance, if the usual deposit is one month’s rent, consider paying an additional half or even a full month upfront. This gesture shows you’re serious about the property and can help reassure landlords.

By making a larger deposit, you demonstrate financial stability and a commitment to maintaining the property. It’s a straightforward yet effective way to make your rental application more appealing.

7. Get a Cosigner

A cosigner, often a trusted friend or family member, agrees to cover the rent if you’re unable to pay. This reassurance can make landlords feel more secure. To boost your rental application, choose a cosigner with a stable income and solid financial background.

Their support can greatly enhance your chances of securing the apartment you want.

Getting the Documents for Renting

Now that we’ve covered ways to rent an apartment without good credit let’s talk about getting the documents you need. Landlords usually ask for proof of income, employment verification, and rental history.

Key documents like pay stubs, tax returns, and 1099 forms can show you’re able to pay rent on time. If you need these quickly, PaystubHero has you covered.

FAQs

Here are the most frequently asked questions about renting an apartment without good credit.

While landlords might check credit scores, it’s possible to rent your first apartment without strong credit. Landlords may consider other factors like proof of income, rental history, or a co-signer.

A credit score of 620 is generally considered the minimum for renting an apartment. However, requirements can vary by landlord and location. Some landlords may accept lower scores with additional assurances like a higher deposit or a co-signer.

Yes, you can rent an apartment in NYC without credit. Landlords may look at other factors such as proof of income, employment verification, or rental history.

Offering a larger security deposit or having a co-signer can also improve your chances.

In Canada, you can rent without a credit score by providing alternative documentation like proof of income, employment letters, and rental history. Some landlords may also accept a larger security deposit or a co-signer to offset concerns.

It’s important to demonstrate financial reliability through these other means.