🚀 Bi Weekly Payroll

Master Your Bi Weekly Payroll with Ease

Streamline Your Bi Weekly Payroll Process

- Apartment Leasing Process

- Mortgage Qualification

- Small Business Loan Request

- Income Verification for Dependents Support

- Health Insurance Application Process

- Empower Employee Finance

- Uphold Employment Laws

- Transparent Pay

- Auto Pay Stub Calculation

- Payroll Document Management

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding Bi Weekly Payroll

Bi-weekly payroll is a structured payment system where employees receive their wages every two weeks, typically resulting in 26 pay periods annually. This approach is prevalent across various sectors in the USA, offering a balanced compromise between frequent weekly pay and the extended interval of monthly payments. In a bi-weekly payroll system, employers need to be vigilant about accurately calculating hours worked, especially when overtime is involved. This system requires adherence to specific labor laws that govern minimum wage, overtime pay, and record-keeping.

The bi-weekly schedule can be particularly advantageous for budgeting and financial planning, both for employers and employees. For employees, it provides a more consistent and predictable income stream, allowing for better personal budget management. Employers benefit from a more streamlined payroll process compared to handling weekly payrolls, yet it offers more frequent compensation to employees than a monthly schedule, which can be a morale and retention booster.

However, managing a bi-weekly payroll system demands meticulous attention to detail. Employers must ensure compliance with federal and state regulations, which may vary significantly. This includes accurate calculation of taxes, benefits deductions, and adherence to the Fair Labor Standards Act (FLSA) guidelines. Failure to comply with these regulations can lead to legal complications and financial penalties.

Moreover, bi-weekly pay periods can sometimes result in ‘triple paycheck’ months for employees, depending on how the pay dates fall within the calendar year. This occurrence requires additional planning and budgeting considerations for both parties.

In summary, bi-weekly payroll, while offering several advantages, comes with its own set of challenges and responsibilities. It’s crucial for businesses to have a robust system in place, whether through sophisticated payroll software or by partnering with payroll service providers, to manage these complexities effectively and ensure a smooth, compliant payroll process.

Challenges in Bi Weekly Payroll Management

The bi-weekly payroll system, while popular, presents unique challenges, especially for small to medium-sized businesses. These challenges include the accurate tracking of work hours, especially overtime, and ensuring compliance with varying state and federal payroll regulations. The complexity increases with the need for precise tax calculations and benefits deductions. Many businesses struggle with these aspects, leading to potential payroll errors, which can result in employee dissatisfaction and legal issues. Additionally, the administrative burden of managing a bi-weekly payroll can be significant, consuming valuable time and resources that could be better utilized in core business activities.

Innovative Solutions for Bi Weekly Payroll Challenges

Addressing the complexities of bi-weekly payroll, the market offers innovative solutions tailored for efficiency and compliance. Advanced payroll software and services have emerged as key tools, simplifying the intricate processes of time tracking, tax calculations, and legal compliance. These solutions automate many of the labor-intensive tasks, reducing the likelihood of errors and ensuring adherence to state and federal regulations. For businesses, this translates to a more streamlined payroll process, freeing up resources to focus on growth and development. Additionally, these solutions often come with user-friendly interfaces and support systems, making payroll management accessible to businesses of all sizes. By leveraging these technological advancements, companies can overcome the hurdles of bi-weekly payroll, ensuring a smooth, compliant, and efficient payroll operation.

Advanced Features of Our Bi Weekly Payroll Service

Our bi-weekly payroll service is meticulously designed to address the specific needs of modern businesses, offering a suite of advanced features that streamline the payroll process. At its core, the service boasts an automated calculation system, ensuring accuracy in wage computation, tax deductions, and benefits allocations. This automation significantly reduces the risk of human error, a common issue in manual payroll processing. Additionally, our service offers customizable paystub templates, allowing businesses to tailor their payroll documents to specific requirements and branding.

The compliance tracking feature is another cornerstone, keeping businesses updated with ever-changing payroll laws and regulations. This proactive approach to compliance helps avoid legal pitfalls and ensures that your payroll practices are always in line with current regulations. Furthermore, the user-friendly interface of our service simplifies the payroll process, making it accessible even to those with limited payroll management experience. This ease of use is crucial for small and medium-sized businesses that may not have dedicated payroll specialists.

Efficiency

Our service automates and streamlines the payroll process, saving valuable time and resources. This efficiency is crucial for businesses looking to optimize operations and focus on growth.

Accuracy

With automated calculations, the risk of errors in payroll processing is significantly reduced. This accuracy is vital for maintaining employee trust and ensuring compliance with tax and wage laws.

Compliance

Our service stays abreast of the latest payroll regulations, ensuring your business is always compliant with state and federal laws. This feature is particularly beneficial as it reduces the risk of costly legal issues and penalties.

Convenience

Accessible online, our service allows you to manage payroll anytime, anywhere. This convenience is essential for businesses operating in a dynamic, fast-paced environment.

By integrating these features, our bi-weekly payroll service not only simplifies payroll management but also enhances the overall operational efficiency of your business.

Enhancing Your Business with Bi Weekly Payroll Benefits

Unlock the Full Potential of Bi Weekly Payroll

Maximizing Efficiency with Bi Weekly Payroll Advantages

Explore the Strategic Benefits of Bi Weekly Payroll Systems

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

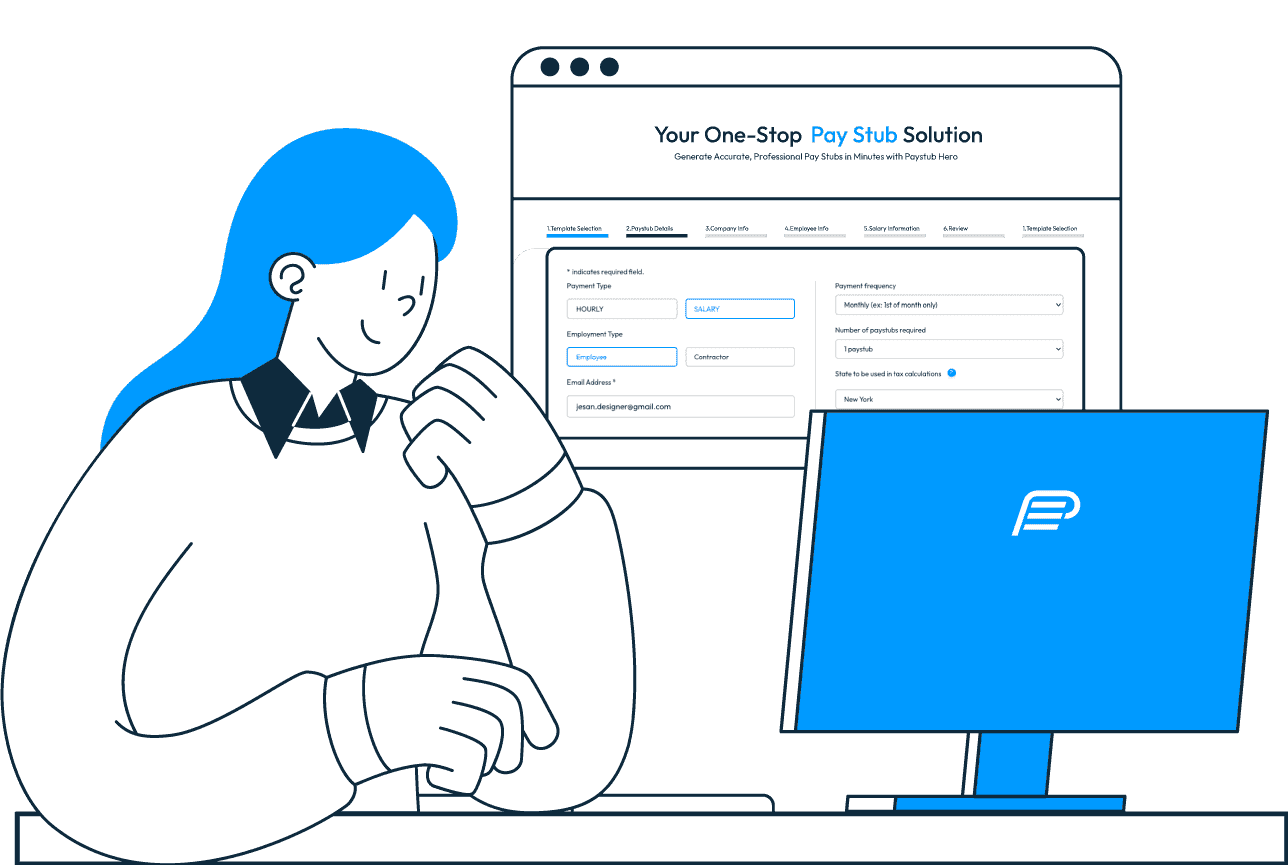

Create Your

Paystub in Minutes

Follow our simple step-by-step process

1. Enter Your Information

Start by entering the necessary details directly on our homepage. This includes your employer's details, your personal information, income details, and any additional information required.

2. Review Your Information

Once you've input all your details, take a moment to review everything for accuracy. Make sure all information is correct to avoid any issues with your pay stub.

3. Generate Your Paystub

Click on the 'Generate Paystub' button. Our advanced system will create a professional, compliant paystub based on the details you've provided.

4. Download and Print

Finally, download your paystub instantly! You can print it immediately or save it for future use. It's as simple as that. No sign-up, no fuss!

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

Bi-weekly payroll is a payment system where employees are paid every two weeks, typically resulting in 26 pay periods per year. In this system, employers calculate wages based on the hours worked during the two-week period, including any overtime. The key to a successful bi-weekly payroll system lies in its regularity and predictability, which benefits both the employer and the employee. Employers benefit from a consistent payroll schedule that's easier to manage compared to weekly payrolls, while employees enjoy a steady and predictable income stream. This system requires meticulous record-keeping and accurate time-tracking to ensure compliance with labor laws and correct payment calculations.

Bi-weekly payroll differs in the frequency of payments. While weekly payroll involves paying employees once every week, and monthly payroll once a month, bi-weekly payroll strikes a balance by paying employees every two weeks. This results in 26 pay periods per year, compared to 52 for weekly and 12 for monthly payrolls. The choice between these systems depends on various factors, including the nature of the business, cash flow stability, and employee preferences. Bi-weekly payroll is often favored for its balance between operational convenience for the employer and frequency of income for the employee.

When managing a bi-weekly payroll, it's crucial to comply with federal and state labor laws. This includes adhering to the Fair Labor Standards Act (FLSA) for minimum wage, overtime pay, and record-keeping requirements. Employers must ensure accurate calculation of overtime, especially since bi-weekly pay periods can sometimes lead to more than 40 hours worked in a week. Additionally, employers should be aware of state-specific laws that might dictate the minimum frequency of employee payments. Failure to comply with these laws can result in legal complications and financial penalties.

Transitioning to a bi-weekly payroll system requires careful planning and clear communication. Businesses should start by reviewing their current payroll processes and identifying any changes needed to accommodate a bi-weekly schedule. This includes updating payroll software, reconfiguring payment calculations, and ensuring compliance with labor laws. Communication with employees is key; they should be informed about the change in advance, including how it will affect their pay schedule and any other payroll-related matters. Providing a clear timeline and addressing any concerns promptly can help ensure a smooth transition.

Yes, there are several legal considerations. Businesses must comply with the Fair Labor Standards Act (FLSA) regarding minimum wage and overtime payments. Each state may also have additional labor laws that need to be followed. Regularly reviewing these regulations and consulting with a legal expert or using updated payroll software can help ensure compliance and avoid potential legal issues.

Bi-weekly payroll can positively impact employee satisfaction as it provides a predictable and regular income, which is essential for personal budgeting and financial planning. This regularity can enhance job satisfaction and financial security for employees. However, it's crucial that the payroll is processed accurately and consistently on the designated pay dates to maintain this satisfaction.

Bi-weekly payroll affects tax calculations in that taxes must be withheld from each paycheck based on the frequency of pay periods. Employers must accurately calculate federal, state, and local taxes for each pay period, which can be more complex than in monthly payroll systems. This requires up-to-date knowledge of tax rates and regulations, as well as meticulous record-keeping to ensure accurate tax withholding and reporting.

Yes, bi-weekly payroll can be automated using modern payroll software. Automation can significantly reduce the time and effort required to process payroll, minimize errors, and ensure compliance with tax and labor laws. Automated systems can handle calculations for wages, taxes, and deductions, as well as generate paystubs and reports, making the payroll process more efficient and reliable.

Best practices for managing bi-weekly payroll include using reliable payroll software to automate calculations and ensure accuracy. Staying informed about and compliant with labor and tax laws is crucial. Regularly reviewing and updating payroll processes, maintaining clear communication with employees regarding payroll schedules, and ensuring accurate timekeeping and record-keeping are also important. Additionally, planning for cash flow variations due to the bi-weekly schedule can help in maintaining financial stability.

Transitioning to a bi-weekly payroll system involves several steps. Firstly, businesses should evaluate their current payroll process and determine the necessary changes for a bi-weekly schedule. Consulting with a payroll specialist or using a professional payroll service can be beneficial. It's important to update payroll policies, inform and train employees about the new schedule, and ensure the payroll software or system can accommodate the bi-weekly format. Careful planning and communication are key to a smooth transition.