🚀 Florida Payroll Calculator

Your Ultimate Florida Payroll Calculator: Accurate & Easy-to-Use

Streamline Your Payroll Process with Our Florida Payroll Calculator

- Apartment Leasing Process

- Mortgage Qualification

- Small Business Loan Request

- Income Verification for Dependents Support

- Health Insurance Application Process

- Empower Employee Finance

- Uphold Employment Laws

- Transparent Pay

- Auto Pay Stub Calculation

- Payroll Document Management

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Efficient Florida Payroll Calculator: Compliance Made Simple

Unlock the full potential of payroll management with our Florida Payroll Calculator, a tool meticulously designed to cater to the specific needs of Florida-based businesses and HR professionals. This calculator stands as a beacon of precision and compliance, effortlessly navigating the intricate landscape of Florida’s payroll laws and tax regulations.

Our tool is more than just a calculator; it’s a comprehensive solution that addresses the unique challenges of Florida payroll processing. From accurately calculating state and federal taxes to considering local surtaxes, it ensures every aspect of payroll is covered. This includes the latest updates on minimum wage changes, unemployment tax rates, and other statutory requirements specific to Florida, making it an indispensable asset for businesses of all sizes.

The Florida Payroll Calculator simplifies what is often seen as a complex and error-prone process. It offers a user-friendly interface that allows you to input data with ease, while its advanced algorithms take care of the heavy lifting. Whether you’re calculating for hourly wages or salaried employees, this tool provides precise breakdowns of gross pay, net pay, and all deductions, ensuring every paycheck is accurate to the cent.

Moreover, our calculator is designed with the future in mind. As Florida’s payroll laws evolve, so does our tool, with regular updates to keep you ahead of the curve. This proactive approach to compliance not only saves you from potential legal pitfalls but also instills confidence in your employees, knowing their paychecks are calculated accurately and fairly.

In summary, the Florida Payroll Calculator is more than just a tool; it’s a partner in your payroll process. It brings efficiency, accuracy, and peace of mind to an otherwise complex task, allowing you to focus on growing your business while we take care of the calculations. Embrace the future of payroll with our Florida Payroll Calculator – where precision meets compliance.

Navigating the Complexities of Florida Payroll

The task of managing payroll in Florida presents a labyrinth of challenges for businesses. Navigating through the intricate web of state-specific tax laws and regulatory updates can be overwhelming, often leading to costly errors and compliance risks. Traditional payroll methods, while familiar, fall short in efficiency and accuracy, burdening businesses with unnecessary complexities. This scenario not only strains resources but also heightens the risk of legal issues and employee dissatisfaction, underscoring the need for a more streamlined, error-proof approach to payroll management in the Sunshine State.

Simplifying Payroll in Florida: A Tailored Solution

Our Florida Payroll Calculator emerges as the quintessential solution to the intricate challenges of Florida payroll management. It transforms a traditionally complex process into a streamlined, user-friendly experience. By automating and accurately handling all aspects of payroll calculations, it ensures compliance with the latest Florida tax laws and regulations. This tool not only saves valuable time but also significantly reduces the risk of errors and non-compliance penalties. It’s an essential asset for businesses seeking to enhance efficiency, ensure accuracy, and maintain peace of mind in their payroll processes.

Features That Make Payroll Management Effortless

Our Florida Payroll Calculator is not just a tool; it’s a comprehensive solution equipped with a suite of features designed to revolutionize your payroll process. It offers a perfect blend of accuracy, efficiency, and compliance, tailored to meet the specific payroll needs of Florida-based businesses. With its intuitive interface, the calculator simplifies complex calculations, adapting to various payroll scenarios with ease. From handling standard payroll runs to accommodating unique payroll situations, our tool ensures every aspect of your payroll is managed with precision.

Accurate Tax Deductions

Navigate Florida's tax landscape with confidence. Our calculator accurately computes state and federal taxes, including specific local surtaxes, ensuring every paycheck adheres to the latest tax regulations. This precision eliminates the risk of costly tax errors and keeps your business compliant.

Time-Saving Automation

Streamline your payroll process with our automation feature. It significantly reduces the time spent on manual calculations and data entry, allowing you to focus on more strategic aspects of your business. This feature ensures payroll is processed quickly and efficiently, every time.

Customizable Options

Tailor your payroll experience with our customizable options. Whether you're a small startup or a large corporation, our calculator can be adjusted to fit your specific payroll requirements. From different pay schedules to varied employee types, customize the tool to suit your unique business needs.

Up-to-Date Compliance

Stay ahead of legislative changes with our constantly updated system. Our tool is regularly revised to reflect the latest in Florida payroll laws and federal regulations, ensuring your payroll remains compliant. This proactive approach to compliance safeguards your business against potential legal issues and penalties.

Each of these features is designed to provide a seamless, stress-free payroll experience, ensuring that your business operates smoothly and your employees are paid accurately and on time. With our Florida Payroll Calculator, you’re not just getting a tool; you’re gaining a partner in efficient and compliant payroll management.

Florida Payroll Calculator: Enhancing Your Payroll Efficiency

Discover the Key Benefits of Our Florida Payroll Calculator

Maximize Your Payroll Potential with Our Florida Payroll Calculator

Explore the Comprehensive Benefits of Using the Florida Payroll Calculator

Streamlined Process

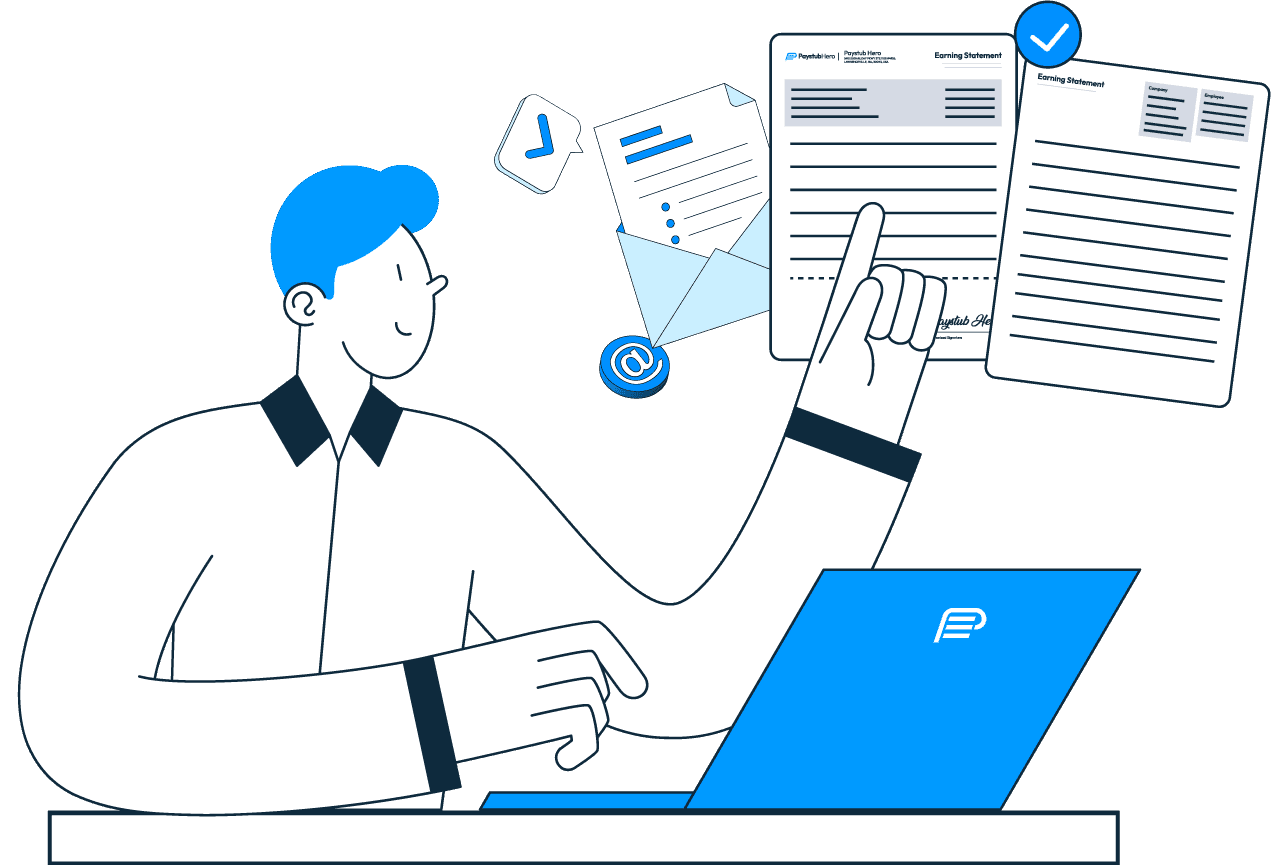

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

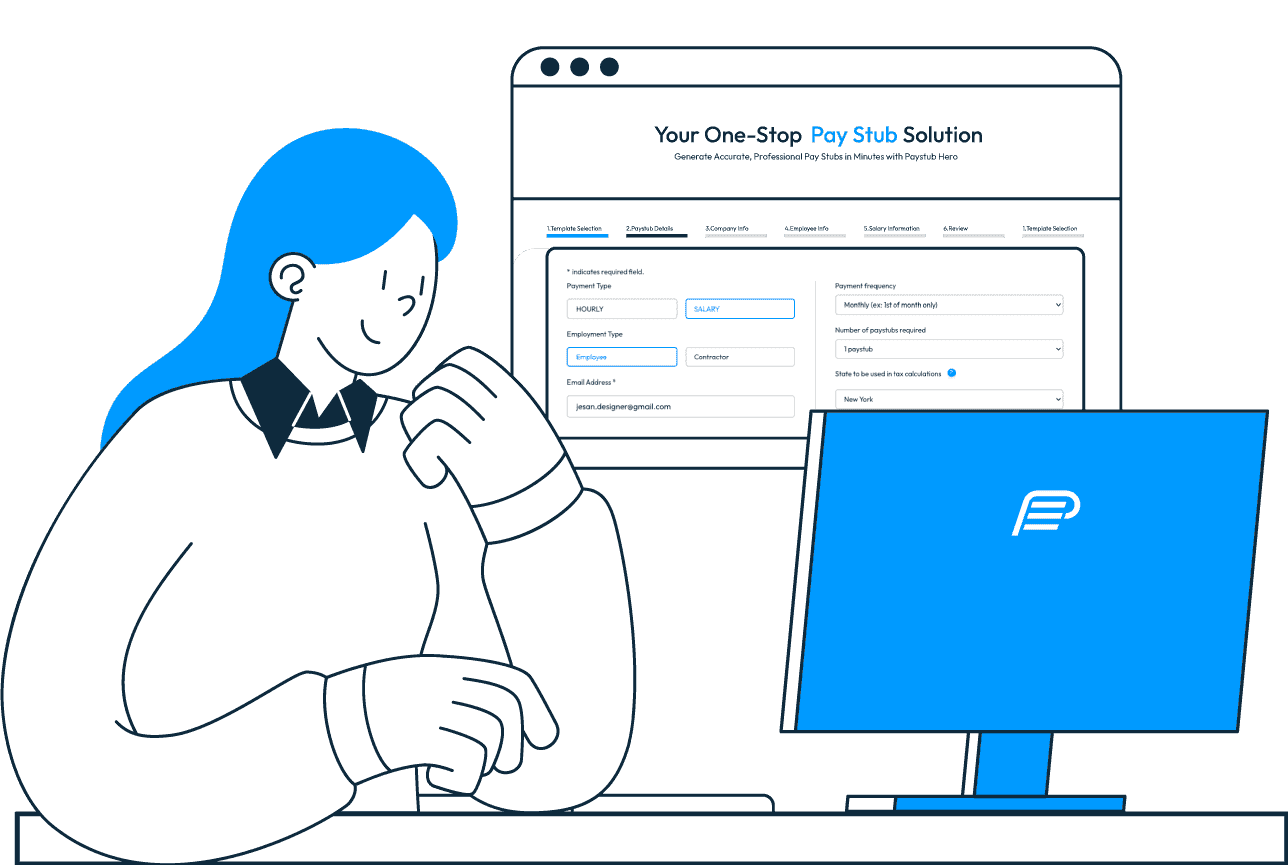

Create Your

Paystub in Minutes

Follow our simple step-by-step process

1. Enter Your Information

Start by entering the necessary details directly on our homepage. This includes your employer's details, your personal information, income details, and any additional information required.

2. Review Your Information

Once you've input all your details, take a moment to review everything for accuracy. Make sure all information is correct to avoid any issues with your pay stub.

3. Generate Your Paystub

Click on the 'Generate Paystub' button. Our advanced system will create a professional, compliant paystub based on the details you've provided.

4. Download and Print

Finally, download your paystub instantly! You can print it immediately or save it for future use. It's as simple as that. No sign-up, no fuss!

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

The Florida Payroll Calculator is an advanced online tool designed to simplify payroll processing for businesses operating in Florida. It works by taking user-inputted data such as employee wages, hours worked, and tax information, and then accurately calculates the necessary payroll deductions. This includes state and federal taxes, Social Security, Medicare, and any other deductions relevant to Florida's payroll laws. The calculator is updated regularly to reflect the latest tax rates and legal requirements, ensuring compliance and accuracy in every payroll cycle.

Yes, our calculator is versatile and can handle various payment types. Whether your employees are on an hourly wage, salaried, or receive overtime, commissions, or bonuses, the calculator can accurately compute their pay. It's designed to adapt to different payroll scenarios, ensuring that no matter how your employees are compensated, their paychecks are calculated correctly.

Our Florida Payroll Calculator is maintained by a team of payroll experts who closely monitor changes in state and federal laws affecting payroll. Whenever there's an update in minimum wage rates, tax brackets, or other relevant regulations, the calculator is promptly updated. This commitment to staying current ensures that your payroll process remains compliant with the latest legal standards.

Absolutely! The calculator is designed with a user-friendly interface, making it accessible for users regardless of their payroll expertise. Clear instructions, simple input fields, and an intuitive layout ensure that even those new to payroll processing can use it with ease. Additionally, we provide support resources and customer service to assist with any questions.

Our Florida Payroll Calculator employs advanced algorithms and double-check systems to ensure the highest level of accuracy. It cross-verifies inputted data with current tax rates and legal requirements to prevent errors. Regular updates and rigorous testing further enhance its reliability, giving you confidence in the accuracy of your payroll.

Yes, customization is a key feature of our calculator. It allows you to input specific details about your business, such as pay cycle, types of employees, and any unique payroll requirements. This flexibility ensures that the calculator can adapt to your specific business model and payroll needs.

The calculator is programmed to automatically compute all necessary tax deductions and withholdings as per Florida and federal laws. It takes into account the latest tax brackets, exemption statuses, and any additional withholdings specified by the user. This automated process ensures that all tax obligations are accurately calculated and complied with.

Yes, our Florida Payroll Calculator includes a feature to generate detailed payroll reports. These reports provide a comprehensive breakdown of each payroll cycle, including gross wages, net pay, and all deductions. This feature is invaluable for record-keeping, audits, and providing employees with detailed paystubs.

Data security is a top priority for our calculator. We employ advanced encryption and security protocols to ensure that all data entered into the calculator is protected. User privacy and data integrity are maintained at all times, giving you peace of mind that your sensitive payroll information is secure.

We offer comprehensive support for our calculator users. This includes access to a knowledgeable customer service team, detailed FAQs, and user guides. Whether you have a specific query or need assistance with navigating the calculator, our support team is readily available to provide expert help and guidance.