🚀 Form 1099-MISC Instructions

Complete Guide to Form 1099-MISC Instructions - Simplified

Understanding Form 1099-MISC Instructions: A Step-by-Step Approach

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

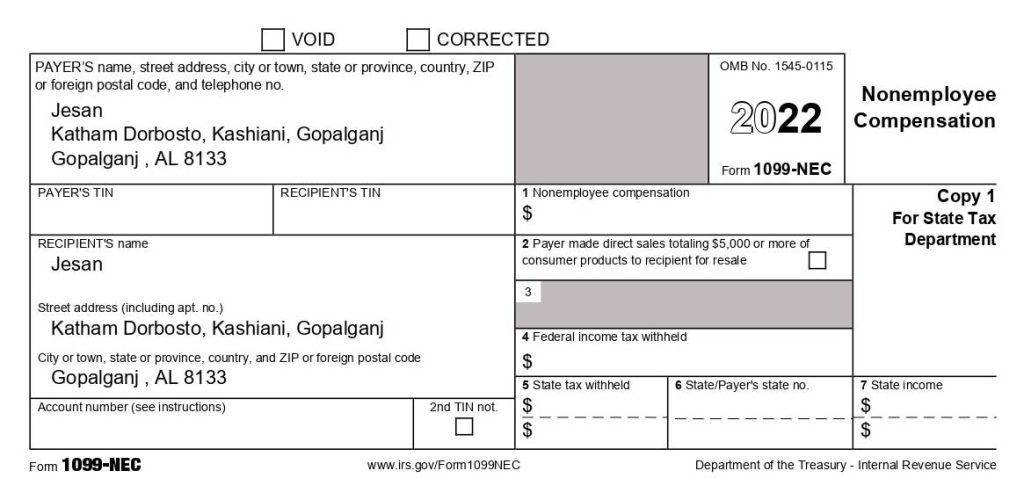

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding the 1099-MISC Form: A Comprehensive Overview

The 1099-MISC Form, issued by the Internal Revenue Service (IRS) in the United States, is a critical document for reporting various types of non-employee compensation. This form is primarily used by businesses to report payments made to independent contractors, freelancers, and other individuals who provide services but are not considered employees. The 1099-MISC is essential for accurately declaring payments such as rent, prizes, awards, healthcare payments, and other miscellaneous income.

As we step into 2023, it’s crucial to understand the evolving guidelines and laws surrounding the 1099-MISC Form. The IRS mandates specific filing requirements, including thresholds for reporting: typically, any payment over $600 within a year to an individual or entity must be reported. This form plays a pivotal role in the tax documentation process, ensuring that the government receives accurate information about income distributed outside of traditional employment.

For businesses, the accurate completion and timely submission of the 1099-MISC are vital. Errors or omissions can lead to penalties, making it imperative to understand the form’s various boxes and what each represents. For instance, Box 7, previously used for reporting non-employee compensation, has now been replaced by Form 1099-NEC, highlighting the importance of staying updated with IRS changes.

The 1099-MISC also serves as a crucial document for the recipients of these funds. It informs them of the income they need to report when filing their own tax returns. For independent contractors and freelancers, this form is often the primary means of understanding and declaring their annual income to the IRS.

In summary, the 1099-MISC Form is more than just a tax form; it’s a key component in the financial reporting ecosystem of the United States. It ensures transparency and accountability in the reporting of non-employee compensation, playing a significant role in the tax obligations of both businesses and individuals. As tax laws and requirements evolve, understanding and correctly utilizing the 1099-MISC becomes increasingly important for all parties involved in this type of financial transaction.

Navigating the Challenges of Form 1099-MISC Compliance

The process of managing and filing Form 1099-MISC presents several challenges, particularly for small businesses and independent contractors. One primary issue is the complexity of tax regulations, which can be daunting and often require specialized knowledge. Misinterpretations or errors in filing can lead to costly penalties and legal complications. Additionally, staying updated with the frequent changes in tax laws adds another layer of difficulty. For many, the time and effort needed to ensure accurate reporting are significant, often necessitating external assistance. This complexity not only increases the risk of compliance issues but also places a considerable administrative burden on those responsible for filing these forms.

Simplifying Form 1099-MISC Compliance with PaystubHero

PaystubHero emerges as a robust solution to the complexities surrounding Form 1099-MISC. Our platform is designed to demystify the process of generating and understanding this crucial tax form. By integrating the latest IRS guidelines and offering a user-friendly interface, we make it easier for businesses and individuals to manage their tax reporting accurately. Our tools automate the calculation process, reducing the likelihood of errors and ensuring compliance. Additionally, PaystubHero provides up-to-date resources and expert support, simplifying the tax filing process. This not only saves valuable time and resources but also instills confidence in users that their tax reporting is handled efficiently and correctly. With PaystubHero, the daunting task of 1099-MISC compliance becomes a streamlined, stress-free process.

Key Features of PaystubHero's 1099-MISC Services

PaystubHero’s 1099-MISC services are meticulously crafted to address the specific needs of businesses and independent contractors grappling with tax documentation. Our platform is not just a tool; it’s a comprehensive solution that blends technology with user-centric design to simplify the entire process of managing and filing Form 1099-MISC. We understand the intricacies involved in tax reporting and have developed features that cater to these nuances, ensuring a seamless and error-free experience.

Precision at Your Fingertips

Our automated calculation feature is a game-changer, significantly reducing the risk of human error. This tool meticulously calculates the necessary figures, ensuring that every entry on your 1099-MISC form is accurate and compliant with IRS standards. This precision is crucial in avoiding costly mistakes and penalties, providing peace of mind for users.

Stay Ahead with Compliance

Navigating the ever-changing landscape of tax laws can be overwhelming. PaystubHero stays abreast of the latest IRS regulations and updates, integrating these changes into our platform. This feature ensures that your 1099-MISC filings are always in line with current legal requirements, safeguarding you from inadvertent non-compliance.

Simplicity in Design

Our platform is designed with the user in mind, ensuring ease of use without compromising on functionality. The intuitive interface guides you through each step of the form 1099-MISC process, making it accessible even to those with limited tax filing experience. This user-friendly approach saves time and reduces the stress associated with tax documentation.

Expertise at Your Service

At PaystubHero, we understand that questions and complexities can arise. Our team of experts is always on hand to provide support and guidance. Whether it's a query about a specific part of the form or a more complex tax situation, our professional assistance ensures that you're never alone in the process, adding an extra layer of confidence to your tax reporting journey.

Enhancing Tax Reporting with Form 1099-MISC Instructions

Discover the Benefits of Simplified Form 1099-MISC Instructions with PaystubHero

Mastering Form 1099-MISC Instructions: Unveiling the Benefits with PaystubHero

Leverage the Power of PaystubHero for Effortless Form 1099-MISC Instructions Compliance

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

Form 1099-MISC is a tax form used in the United States to report payments made to non-employees, such as independent contractors, freelancers, and other service providers. This form is crucial for businesses as it helps them report any payments exceeding $600 in a year that are not salary or wages. For the recipients, it's an essential document for their tax records, as it indicates the income they must report to the IRS. Understanding and accurately completing this form is vital for both parties to ensure compliance with IRS regulations and avoid potential penalties.

Businesses or individuals who make payments totaling more than $600 in a year to a non-employee for services rendered are required to file a Form 1099-MISC. This requirement applies to all forms of business entities, including sole proprietorships, partnerships, and corporations. It's important to note that this form is not used for personal payments but strictly for business-related transactions.

Failing to file or incorrectly filing Form 1099-MISC can lead to significant penalties from the IRS. These penalties can vary based on the severity and nature of the error, such as late filing, incomplete information, or total failure to file. In some cases, if the IRS deems the failure to file as intentional disregard, the penalties can be more severe. Therefore, it's crucial to file accurately and on time to avoid these financial repercussions.

Yes, Form 1099-MISC can be filed electronically, and this method is often preferred for its convenience and efficiency. Electronic filing reduces the risk of errors, provides faster submission, and ensures better security of the information. Additionally, it's environmentally friendly and offers immediate confirmation of receipt, which is crucial for meeting filing deadlines and maintaining compliance.

To complete Form 1099-MISC, you need the payer's and payee's names, addresses, and Tax Identification Numbers (TINs), which can be a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Additionally, the total amount paid to the payee during the tax year needs to be reported. Depending on the type of payment, other specific details may be required, such as rent, royalties, or other income types.

PaystubHero simplifies the Form 1099-MISC filing process by providing an intuitive online platform that guides users through each step. Our system automates calculations, ensuring accuracy and compliance with IRS standards. We offer up-to-date information on tax laws and regulations, reducing the risk of errors. Additionally, our expert support team is available to assist with any questions or complexities, making the filing process smoother and more manageable.

Absolutely. PaystubHero offers comprehensive customer support for all Form 1099-MISC related queries. Our team of tax professionals is equipped to provide guidance and assistance on various aspects of the form, from general inquiries to more complex issues. This support is crucial in ensuring that our users feel confident and well-informed throughout their tax filing process.

The deadline for filing Form 1099-MISC typically falls on January 31st for the previous tax year. This deadline applies to both paper and electronic filings. It's important to adhere to this deadline to avoid penalties for late submission. PaystubHero's platform helps keep track of these deadlines, providing reminders to ensure timely filing.

If you discover an error on a filed Form 1099-MISC, it's important to correct it as soon as possible. This involves filing a corrected form with the IRS and furnishing a copy to the recipient. The corrected form must indicate what information is being corrected and provide the accurate details. PaystubHero's platform can assist in generating corrected forms, ensuring that the process is handled efficiently and accurately.

Security is a top priority at PaystubHero. We employ advanced security measures to protect all data entered into our system. This includes encryption of sensitive information, secure data storage, and compliance with privacy laws and regulations. Users can rest assured that their financial information and personal details are safeguarded throughout the filing process.