🚀 Form 1099-NEC 2023

Effortlessly Generate Your Form 1099-NEC 2023 with PayStubHero

Navigate Form 1099-NEC 2023 with Ease and Precision

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

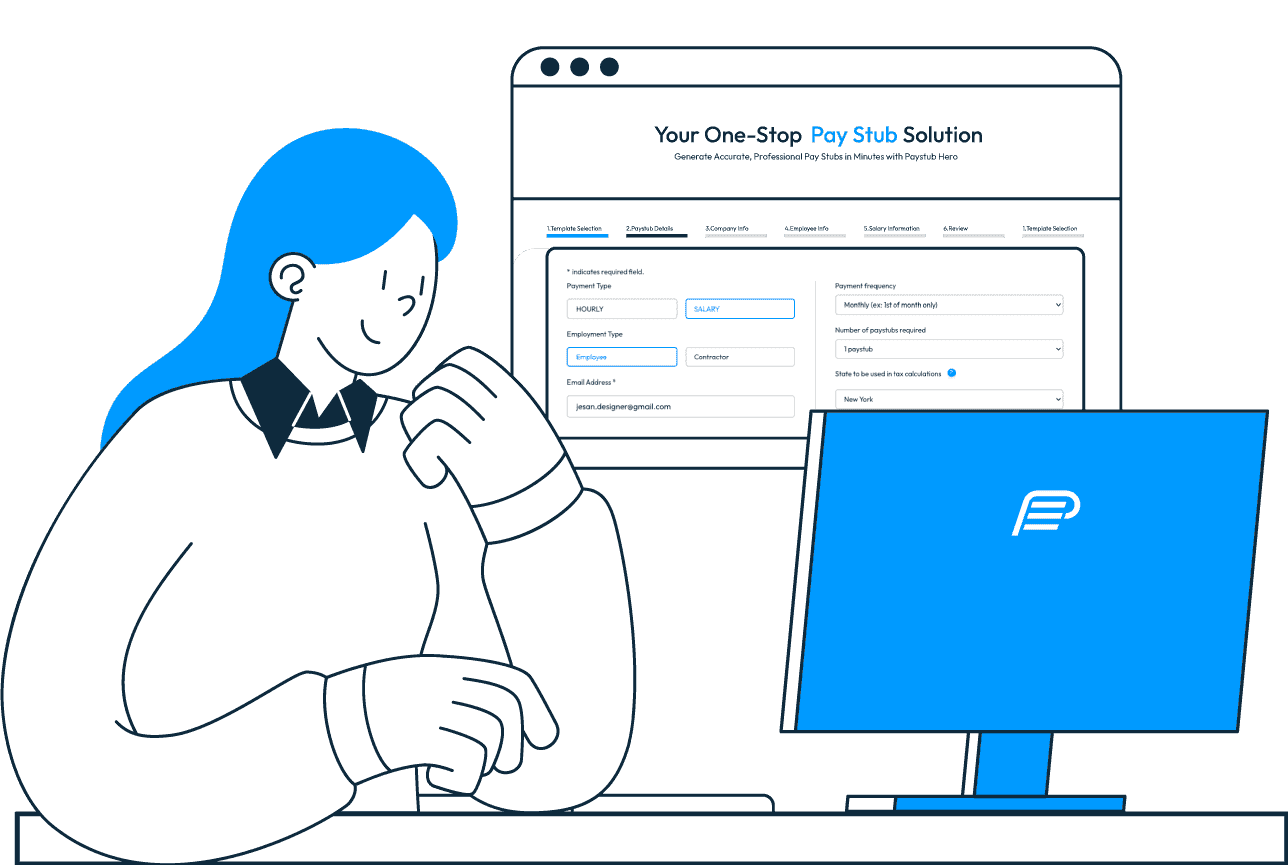

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding Form 1099-NEC 2023

The Form 1099-NEC, an integral component of the U.S. tax system, is specifically designed for reporting non-employee compensation. This form, crucial for the 2023 tax year, is primarily used by businesses to report payments made to freelancers, independent contractors, and other individuals who provide services but are not classified as employees. The significance of Form 1099-NEC lies in its role in ensuring tax compliance and accurate income reporting to the Internal Revenue Service (IRS).

In the evolving landscape of the gig economy and freelance work, the Form 1099-NEC has gained even more importance. It helps the IRS track the income of self-employed individuals and ensures that they pay the appropriate taxes. For businesses, it’s a critical tool for maintaining accurate financial records and avoiding penalties associated with misreporting. The form details the total amount paid to the individual or entity during the tax year, and it’s essential for recipients as it informs them of the income they need to report on their tax returns.

As tax laws and regulations continue to evolve, staying updated with the latest requirements for Form 1099-NEC becomes increasingly important. The 2023 version of the form may include specific changes or updates that businesses and contractors must be aware of to ensure compliance. Missteps in filing or inaccuracies can lead to audits, penalties, and added scrutiny from the IRS.

Understanding and managing Form 1099-NEC can be challenging, especially for small businesses and independent contractors who may not have dedicated accounting teams. This is where services like PayStubHero come into play, offering an easy-to-use, reliable solution for generating and managing these forms. By simplifying this process, PayStubHero helps users navigate the complexities of tax reporting, ensuring accuracy and compliance with the latest tax laws, and ultimately contributing to a smoother tax filing experience.

Challenges in Managing Form 1099-NEC 2023

The management of Form 1099-NEC presents significant challenges, particularly with the 2023 updates. Small businesses and independent contractors often find themselves grappling with the complexities of accurate and timely filing. The intricacies involved in understanding tax regulations, coupled with the administrative burden of correctly preparing these forms, can be overwhelming. This often leads to errors, missed deadlines, and the risk of incurring penalties. The task is further complicated by frequent tax law changes, making it difficult for those without specialized knowledge to stay compliant. These challenges underscore the need for a streamlined, user-friendly solution to manage Form 1099-NEC effectively.

Streamlining Form 1099-NEC 2023 Submission

Addressing the complexities of Form 1099-NEC, PayStubHero emerges as a streamlined, efficient solution for the 2023 tax year. Our platform simplifies the entire process, from generating to submitting Form 1099-NEC, ensuring full compliance with the latest IRS regulations. We offer an intuitive interface that guides users through each step, significantly reducing the likelihood of errors and saving valuable time. Designed to cater to the needs of both small businesses and individual contractors, PayStubHero transforms the daunting task of tax reporting into a hassle-free experience. Our solution not only eases the administrative burden but also instills confidence in accurate and timely filing, making it an indispensable tool for managing tax documentation.

Key Features of Our Form 1099-NEC 2023 Generator

PayStubHero’s Form 1099-NEC generator for the 2023 tax year is a culmination of advanced technology and user-centric design, offering a comprehensive solution for tax document generation. Our platform is tailored to address the core challenges faced by businesses and independent contractors in managing tax documentation, particularly Form 1099-NEC.

Automated Calculations

At the heart of our platform is the automated calculation feature, designed to eliminate human error and ensure the utmost accuracy in financial reporting. This tool meticulously processes all numerical data, ensuring that every entry on your Form 1099-NEC is precise. This level of precision is crucial for maintaining compliance and avoiding potential issues with the IRS.

Real-Time Updates

The tax world is constantly evolving, and staying updated with the latest regulations is essential. Our platform is continuously updated to reflect the most current tax laws and guidelines. This feature is invaluable for ensuring that your Form 1099-NEC submissions are always compliant with the latest IRS standards, providing peace of mind and saving the hassle of keeping up with frequent legal changes.

Secure Data Handling

In an era where data security is paramount, our platform employs advanced encryption and robust security protocols to protect your sensitive information. We understand the importance of confidentiality in financial matters, and our system is designed to safeguard your data against any unauthorized access or breaches. This commitment to security is a cornerstone of our service, ensuring that your financial information remains private and secure.

Easy-to-Use Interface

Recognizing that ease of use is key to a positive user experience, our interface is designed to be intuitive and straightforward. Whether you are a seasoned tax professional or a freelancer new to tax filings, you'll find our platform accessible and easy to navigate. This user-friendly approach significantly reduces the time and effort required to generate Form 1099-NEC, making the process efficient and stress-free.

PayStubHero’s Form 1099-NEC generator is more than just a tool; it’s a comprehensive solution that blends accuracy, compliance, security, and ease of use. It’s designed to streamline the tax documentation process, allowing you to focus on what you do best while we handle the complexities of tax reporting.

Maximizing Benefits with Form 1099-NEC 2023 Generator

Enhance Your Tax Filing Experience with Form 1099-NEC 2023

Discover the Advantages of Using Form 1099-NEC 2023 Generator

Leverage the Power of Form 1099-NEC 2023 for Efficient Tax Management

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

Form 1099-NEC, which stands for Nonemployee Compensation, is a tax form used in the United States to report payments made to non-employees, such as independent contractors, freelancers, and other self-employed individuals. The 2023 version of this form is specifically for reporting payments made during the 2023 tax year. Businesses and individuals who have made payments totaling $600 or more to a non-employee for services provided during the year are required to complete and file this form. This form is crucial for ensuring that the IRS has accurate information regarding payments that are subject to income tax but not subject to withholding.

The Form 1099-NEC was reintroduced in 2020 to separate the reporting of nonemployee compensation from Form 1099-MISC, which was previously used for this purpose. The 2023 version of Form 1099-NEC may include updates or changes in compliance requirements as per IRS regulations. It's important for businesses to stay informed about these changes to ensure accurate reporting. Changes could include modifications in the form layout, reporting criteria, or submission deadlines.

The deadline for filing Form 1099-NEC is typically January 31st of the year following the tax year in which the payments were made. For the 2023 tax year, the form should be filed by January 31, 2024. This deadline applies to both the electronic and paper filing of the form. It's also the deadline for providing a copy of the form to the payment recipient. Meeting this deadline is crucial to avoid penalties and ensure compliance with IRS regulations.

Failing to file Form 1099-NEC on time can result in significant penalties from the IRS. These penalties vary based on how late the form is filed and can range from $50 to $270 per form, with a maximum penalty of over $500,000 for small businesses and over $1,000,000 for larger businesses. The penalty also applies if you fail to provide the recipient with their copy of the form or if the IRS deems the form to be incorrect or incomplete.

Yes, Form 1099-NEC can be filed electronically, and there are several benefits to this method. Electronic filing is faster, more secure, and provides immediate confirmation of receipt by the IRS. It's also more environmentally friendly and reduces the risk of errors associated with manual entry. For businesses filing 250 or more forms, electronic filing is mandatory. However, even for smaller quantities, electronic filing is highly recommended for its efficiency and accuracy.

To complete Form 1099-NEC, you'll need the following information: the payer's name, address, and Taxpayer Identification Number (TIN), the recipient's name, address, and TIN (which can be a Social Security Number for individuals), and the total amount of nonemployee compensation paid during the year. It's essential to ensure that all this information is accurate to avoid issues with the IRS.

PayStubHero simplifies the Form 1099-NEC 2023 generation process through its user-friendly platform. It automates calculations, reducing the risk of errors, and ensures that the form is compliant with the latest IRS regulations. The platform also securely stores data, making it easy to retrieve and use for future filings. Additionally, PayStubHero provides guidance and support throughout the process, making it accessible even for those who are not familiar with tax forms.

If you discover an error on a filed Form 1099-NEC, you should correct it as soon as possible. This involves filing a corrected form with the IRS and providing a copy to the recipient. The corrected form should include all the information from the original form, with the corrected information clearly indicated. It's important to address errors promptly to avoid potential penalties and to ensure accurate tax reporting.

Generally, payments to corporations, including S corporations and C corporations, do not require a Form 1099-NEC. However, there are exceptions, such as payments for legal services. Additionally, payments for merchandise, telegrams, telephone, freight, storage, and similar items are not reportable on Form 1099-NEC. It's important to consult the IRS guidelines or a tax professional to understand all the exemptions and ensure compliance.

To ensure compliance with IRS regulations when using Form 1099-NEC, it's important to stay informed about the latest tax laws and filing requirements. Utilizing a service like PayStubHero can greatly assist in this, as it provides up-to-date information and tools for accurate form generation. Additionally, maintaining accurate records of all payments made to non-employees and verifying the accuracy of all information on the forms before submission is crucial. When in doubt, consulting with a tax professional can provide added assurance of compliance.