2025 is here, and we all know how important it is to have the right documents ready when you need them. Being prepared can save you a lot of stress down the road.

One document that can really make things easier is an income verification letter. Whether you’re renting an apartment or dealing with other financial matters, it’s a simple way to prove your earnings.

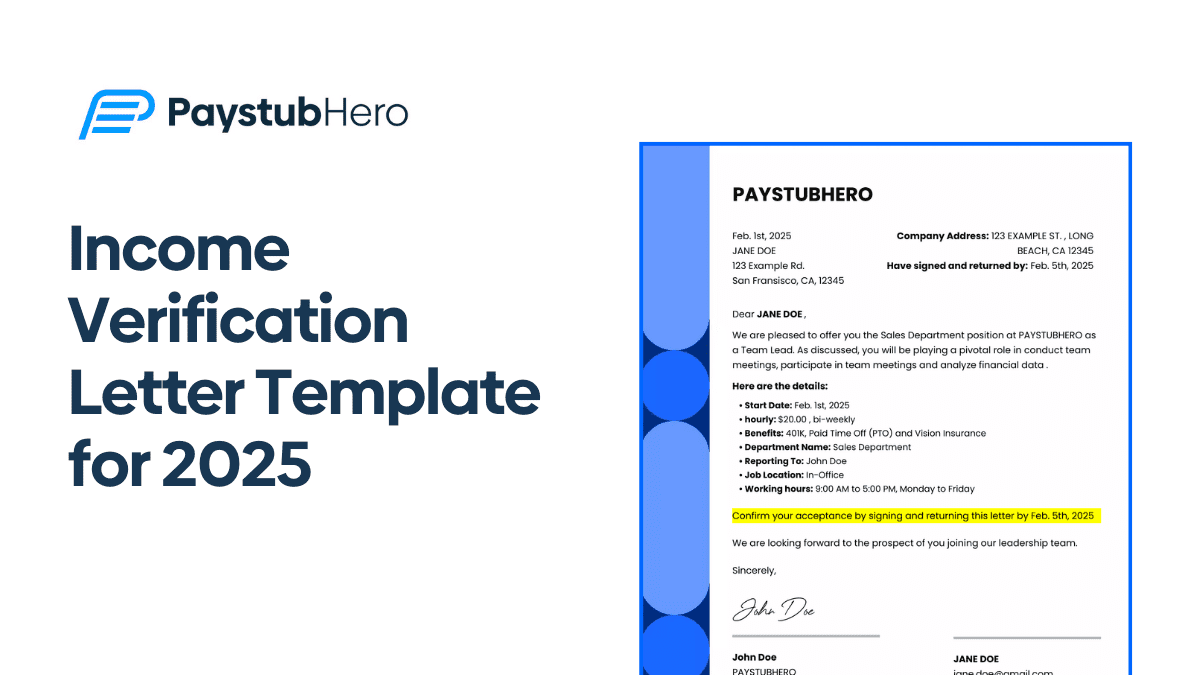

Let’s check out the 2025 income verification letter template below.

What Is an Income Verification Letter?

An income verification letter is a document that confirms how much money you earn, usually provided by your employer. It can be requested by a third party, such as a bank, landlord, or government agency, for a variety of reasons.

The letter typically outlines:

⦿ Your job title

⦿ Salary or hourly wage

⦿ The length of your employment

⦿ Sometimes additional benefits or bonuses

For example, when you’re applying for an apartment, a landlord might ask for an income verification letter to make sure you can afford the rent.

Or, when applying for a loan, a bank may need this letter to ensure you have a stable income to repay the loan.

Why Do You Need an Income Verification Letter?

There are several reasons why you might need to submit an income verification letter:

➡ Renting an Apartment

When you’re trying to rent an apartment, landlords want to make sure you can pay the rent. That’s why they might ask for an income verification letter.

This letter shows them how much money you earn and lets them know you can afford to pay your rent on time every month.

➡ Applying for a Loan

If you’re applying for a loan, like for a house or car, the bank needs to be sure you can pay it back. An income verification letter is a quick way to show them that you have a steady income.

It helps them feel confident that you’ll be able to make the payments.

➡ Government Benefits or Assistance

Sometimes, when you’re applying for government help, like unemployment or food assistance, they ask for proof of income. The income verification letter helps show them how much you earn so they can decide if you’re eligible for the program.

It helps speed up the process, too.

➡ Tax Purposes

You might need an income verification letter when doing your taxes. If you work for yourself or have extra income, this letter can help show what you’ve earned.

It can also help if the IRS needs to confirm your income or if you’re being audited.

What to Include in Your Income Verification Letter

Before we see the templates, let’s cover the main components your letter should include:

➼ Your Full Name and Contact Information: Clearly state who you are and how you can be reached.

➼ Employer’s Name and Contact Information: Include the details of the person or organization verifying your income.

➼ Employment Dates: Include the start date of your employment (and end date, if applicable).

➼ Income Amount: Specify your salary, hourly wage, or commission.

➼ Employment Status: Are you a full-time or part-time employee? Make sure to specify that.

➼ Signature and Date: The letter should be signed by a company representative, like HR, and dated.

Now that we know what’s important, let’s go over a few different templates you can use depending on your situation.

[Employer’s Company Letterhead]

Date: [Insert Date]

To Whom It May Concern,

I am writing to confirm the employment and income of [Employee Name]. [Employee Name] has been employed with [Company Name] since [Start Date] and currently holds the position of [Job Title].

[Employee Name] earns a salary of [Insert Salary Amount] per [Year/Month/Week]. This amount is paid [weekly/bi-weekly/monthly], and the employee is considered a [full-time/part-time] worker.

Should you require any further information, please do not hesitate to contact me at [Employer’s Phone Number] or via email at [Employer’s Email Address].

Sincerely,

[Employer’s Signature]

[Employer’s Name]

[Job Title]

[Company Name]

[Employer’s Contact Information]

[Your Business Letterhead]

Date: [Insert Date]

To Whom It May Concern,

I am writing to verify my income as part of the application process for [insert reason, e.g., applying for a loan, renting an apartment, etc.]. I am the owner of [Your Business Name], where I have been self-employed since [Start Date].

My business generates a monthly income of approximately [Insert Amount], based on the services/products I provide. Over the past [insert number of months/years], my business has consistently generated an average income of [Insert Amount].

I have attached my most recent financial records, including tax returns and bank statements, for verification purposes.

If you need further details, please feel free to contact me at [Your Phone Number] or [Your Email Address].

Thank you for your attention to this matter.

Sincerely,

[Your Signature]

[Your Name]

[Your Title]

[Your Business Name]

[Your Contact Information]

[Freelancer's Business Letterhead]

Date: [Insert Date]

To Whom It May Concern,

I am writing to confirm the income I have earned as a freelancer/independent contractor. I have been working as a [Insert Job Title] with various clients since [Start Date].

For the period of [Insert Date Range], my average monthly income is approximately [Insert Amount]. The payments I receive are primarily from [Describe Clients or Type of Work, e.g., “corporate clients for digital marketing services”], and I’ve attached supporting documents, including payment records and invoices, to help verify this information.

If further information is needed, please don’t hesitate to contact me at [Your Phone Number] or [Your Email Address].

Best regards,

[Your Signature]

[Your Name]

[Your Business Name]

[Your Contact Information]

[Employer’s Company Letterhead]

Date: [Insert Date]

To Whom It May Concern,

I am writing to verify the income of [Employee Name], who has been employed with us at [Company Name] since [Start Date]. [Employee Name] is currently employed as a [Job Title] and earns a salary of [Insert Salary Amount] per [Year/Month/Week].

This letter is being provided for the purpose of verifying income to support the application for [insert specific government assistance or benefits, e.g., unemployment benefits, housing assistance, etc.]. Should you need additional information, please feel free to contact me directly.

Sincerely,

[Employer’s Signature]

[Employer’s Name]

[Job Title]

[Company Name]

[Employer’s Contact Information]

[Employer’s Company Letterhead]

Date: [Insert Date]

To Whom It May Concern,

This letter is to confirm the income of [Employee Name], who has been employed with [Company Name] since [Start Date]. [Employee Name] is employed as a [Job Title] and earns a salary of [Insert Salary Amount] per [Year/Month/Week], which is paid on a [weekly/bi-weekly/monthly] basis.

This letter is provided at the request of [Employee Name] to support their application for a [Home Loan/Personal Loan, etc.]. Please contact me at [Employer’s Phone Number] if you need further clarification or documentation.

Sincerely,

[Employer’s Signature]

[Employer’s Name]

[Job Title]

[Company Name]

[Employer’s Contact Information]

Tips for Writing Your Income Verification Letter

Use these tips for your income verification letter.

⦿ Be Simple and Direct:

Keep your letter short and to the point. The recipient doesn’t need extra details, just the facts.

⦿ Use Official Letterhead:

Whenever possible, use your employer’s official letterhead to make the letter look more professional.

⦿ Include Contact Information:

Always provide a way for the recipient to reach the person verifying the income for follow-up questions.

⦿ Proofread:

Before sending, make sure all details are correct, especially income numbers, dates, and contact information.

Create Professional Income Verification Documents for Your Business

Being self-employed or a freelancer means providing solid proof of income can be a bit more involved. While an income verification letter is a good start, you might need supporting documents.

PaystubHero can help you create professional invoices and pay stubs to accompany your verification letter, giving lenders, landlords, or others a complete picture of your earnings.