🚀 Paystub Generator Free

Master Your Finances with Our Easy-to-Use Paystub Calculator

Discover How Our Paystub Calculator Simplifies Payroll Calculations in Seconds

- Apartment Leasing Process

- Mortgage Qualification

- Small Business Loan Request

- Income Verification for Dependents Support

- Health Insurance Application Process

- Empower Employee Finance

- Uphold Employment Laws

- Transparent Pay

- Auto Pay Stub Calculation

- Payroll Document Management

PaystubHero has solutions to All Your document needs

What is a Paystub Calculator?

Imagine this: It’s payday, and you’re eager to see just how much of your hard-earned cash is finally making its way into your bank account. But when you look at your paystub, it’s a maze of numbers, deductions, and tax codes. You feel like you need a magnifying glass and a degree in accounting just to understand it all. That’s exactly where a paystub calculator swoops in to save the day.

A paystub calculator is an online tool designed to take the guesswork out of payroll. It breaks down your gross income, accounts for taxes, deductions, and other withholdings, and gives you a crystal-clear view of your net pay—the amount you actually get to take home. Whether you’re an employee looking to double-check your paycheck or a small business owner who needs to generate accurate paystubs for your team, this tool is your new best friend.

With a paystub calculator, there’s no need to fumble around with complicated spreadsheets or worry about making a costly mistake. It’s quick, accurate, and incredibly easy to use—think of it as your own personal finance assistant that never takes a day off. Plus, you get to say goodbye to the anxiety that comes with manual calculations. Just input your details, and within seconds, you have a precise, professional-looking paystub ready to go. So, whether you’re planning your budget, securing a loan, or simply curious about where all your money is going, a paystub calculator has you covered, leaving you more time for the things that truly matter—like finally booking that vacation you’ve been dreaming about!

The Problem with Manual Payroll Calculations

Let’s be real—manual payroll calculations can be a nightmare. It’s not just about the time it takes, but also the margin for error that’s always lurking. One misplaced decimal, and suddenly, someone’s paycheck is either too much or too little, leading to disgruntled employees and a headache for you. On top of that, keeping up with constantly changing tax laws and regulations is like trying to hit a moving target. It’s no wonder so many businesses struggle with accuracy and compliance. Without the right tools, even the most diligent business owner can find themselves lost in a sea of numbers and paperwork, leading to costly mistakes and wasted hours.

The Paystub Calculator: Your Simple Solution

Thankfully, there’s a smarter way to handle payroll—enter the paystub calculator. This tool is a game-changer, taking all the complexity out of payroll calculations. With just a few clicks, you can generate accurate, detailed paystubs that account for every deduction, tax, and benefit, all without breaking a sweat. The best part? It’s designed for anyone to use, no accounting degree required. The paystub calculator ensures you’re always compliant with the latest tax laws, so you can focus on running your business instead of getting bogged down by paperwork. It’s fast, reliable, and practically foolproof—making payroll a breeze and freeing up your time for what really matters.

Features of Our Paystub Calculator

Our paystub calculator is more than just a simple tool—it’s a comprehensive solution designed to make payroll processing as effortless as possible. Imagine having a tool that not only simplifies the process but also ensures complete accuracy every time you use it. That’s exactly what our paystub calculator offers. It’s been meticulously crafted to cater to the needs of both employees and employers, whether you’re dealing with hourly wages or salaried income.

But what sets our paystub calculator apart from the rest? It’s all in the features. From a user-friendly interface that anyone can navigate, to the ability to customize calculations to fit your unique circumstances, this tool does it all. Whether you’re looking to calculate taxes, deductions, or net pay, our calculator handles it with ease. Plus, it’s lightning fast—no more waiting around for results. Just enter your information, hit calculate, and you’re done. With our paystub calculator, you can finally take control of your finances without the hassle of traditional payroll methods.

Let’s dive into some of the key benefits that make our paystub calculator the ultimate tool for anyone dealing with payroll:

User-Friendly Interface

Our calculator is designed with simplicity in mind. Whether you’re tech-savvy or a complete novice, you’ll find it incredibly easy to use. The interface is clean, intuitive, and guides you through the process step by step. No more struggling with confusing software—our paystub calculator makes payroll calculations accessible to everyone.

Accurate Calculations Every Time

Accuracy is crucial when it comes to payroll, and our calculator doesn’t disappoint. It uses the latest tax rates and deduction guidelines to ensure that your paystubs are 100% accurate. You can trust that the numbers you get are correct, down to the last cent, helping you avoid costly errors and compliance issues.

Customizable Settings

One size doesn’t fit all, especially when it comes to payroll. That’s why our paystub calculator allows you to customize your calculations to fit your specific needs. Whether you need to adjust for different tax rates, deductions, or employee benefits, our tool is flexible enough to handle it all. It’s perfect for businesses of all sizes.

Instant Results, Anytime, Anywhere

Time is money, and our paystub calculator saves you both. Get your paystub results instantly, without any delays. Whether you’re at your desk or on the go, you can generate accurate paystubs from any device with internet access. It’s all about convenience and efficiency, so you can focus on what really matters—growing your business.

*10% discount going on for the first time. Use coupon code: WELCOME10

Why You’ll Love Our Paystub Calculator

The Smartest Way to Handle Payroll with Our Paystub Calculator—Here’s Why

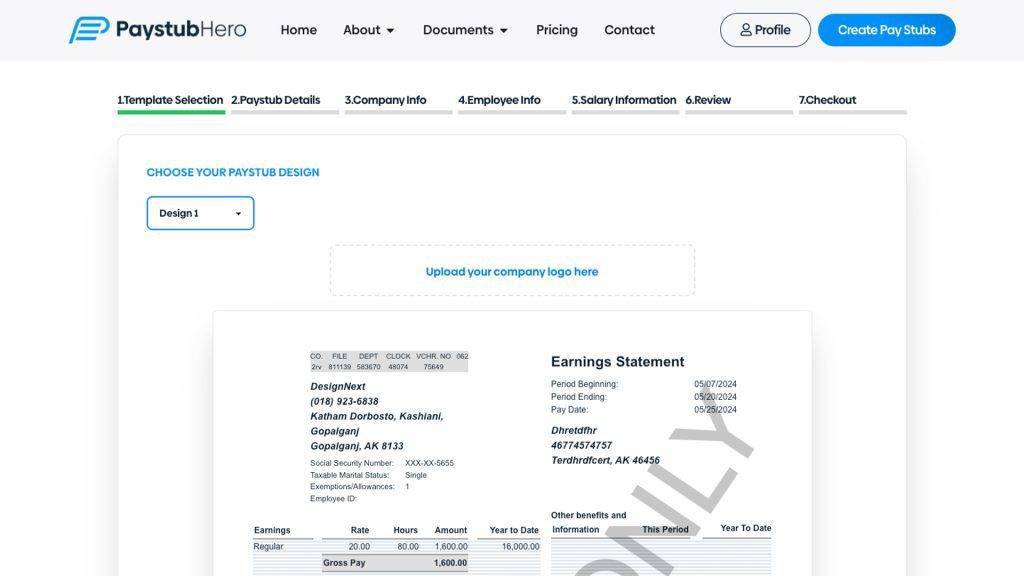

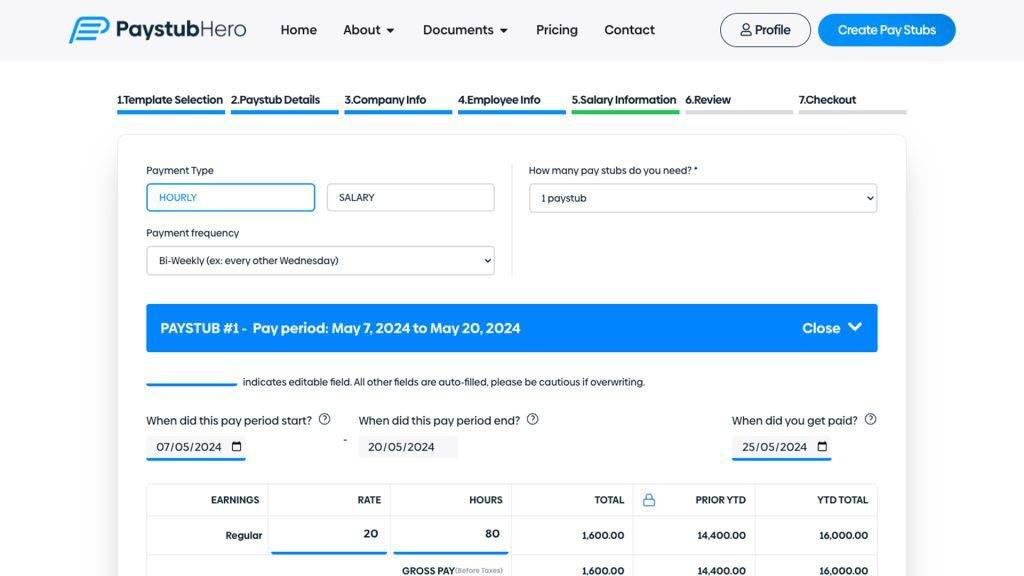

How to use our Paystub Generator?

Choose a pay stub template from our 6 designs

Enter Information such as company name, your work schedule and salary details

Download your paycheck stubs directly from your email in PDF format

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$11.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$12.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Frequently Asked Questions about the Paystub Calculator

A paystub calculator is an online tool designed to simplify the process of calculating your net pay after taxes, deductions, and other withholdings. It works by taking your gross income and then applying relevant deductions such as federal and state taxes, Social Security, Medicare, and any other withholdings like retirement contributions or health insurance premiums. The result is your net pay—the amount you actually take home. The beauty of a paystub calculator is its ease of use. You simply input your income details, and the calculator does the rest, giving you a clear and accurate picture of your earnings. Whether you're an employee checking your paycheck, or an employer ensuring your payroll is correct, a paystub calculator takes the guesswork out of the equation, providing instant and reliable results.

Using a paystub calculator saves you from the hassle and potential errors that come with manual calculations. Manual payroll calculations can be time-consuming and prone to mistakes, especially when you’re dealing with multiple deductions and varying tax rates. A small mistake, such as misplacing a decimal point or forgetting a deduction, can lead to significant discrepancies, causing frustration for both employees and employers. With a paystub calculator, you eliminate these risks. It automates the entire process, ensuring accuracy every time. Additionally, the calculator is continuously updated with the latest tax laws and rates, so you don’t have to worry about keeping up with changes. It’s a fast, efficient, and reliable tool that simplifies payroll management, making it easier for you to focus on more important tasks.

Absolutely! One of the major advantages of our paystub calculator is its flexibility. Whether you’re calculating payroll for salaried employees who receive a fixed income or hourly employees whose pay varies based on the hours worked, the calculator can handle it all. For salaried employees, you simply input their annual salary, and the calculator will divide it by the number of pay periods to determine their gross pay. For hourly employees, you enter the hourly wage and the number of hours worked, and the calculator does the rest, accounting for overtime if applicable. This versatility makes the paystub calculator an invaluable tool for businesses of all sizes, ensuring that every employee's pay is calculated accurately and consistently.

The paystub calculator is designed to be highly accurate, providing precise calculations based on the information you input. It factors in the latest tax rates, deduction guidelines, and other relevant data to ensure that the calculations are correct down to the last cent. Accuracy is crucial when it comes to payroll, as even a small mistake can lead to significant issues, including underpayment or overpayment of employees. Our paystub calculator is regularly updated to reflect any changes in tax laws or rates, so you can trust that the results are up-to-date and reliable. However, it’s important to ensure that you input the correct data, as the accuracy of the results depends on the accuracy of the information provided.

Our paystub calculator offers a free version that provides all the basic features you need to calculate your pay accurately. This includes calculating gross pay, applying federal and state taxes, and deducting items like Social Security, Medicare, and other withholdings. For most users, the free version is more than sufficient to meet their needs. However, we also offer a premium version with additional features such as the ability to customize deductions, generate paystubs in bulk, and access advanced reporting tools. This premium version is ideal for businesses that require more robust payroll management capabilities. Whether you choose the free or premium version, you’ll find the paystub calculator to be a valuable tool in managing your payroll.

Once you’ve used the paystub calculator to generate your paystub, saving or printing it is a breeze. After the calculations are complete, the tool provides you with options to either download the paystub as a PDF file or print it directly from your browser. The PDF option is particularly useful if you need to store the paystub electronically for future reference or send it via email. The print option is convenient for those who prefer a hard copy, whether for filing or for providing a physical document to employees. The process is straightforward and doesn’t require any additional software, making it easy to manage your paystubs efficiently.

We take your privacy and security very seriously. All data entered into our paystub calculator is encrypted and securely processed to ensure that your personal and financial information is protected. We use industry-standard security measures, including SSL encryption, to safeguard your data from unauthorized access. Additionally, we do not store any of your information on our servers, which means that your data is not saved once you leave the site. This ensures that your sensitive information remains confidential and is only used for the purpose of generating your paystub. You can use our paystub calculator with confidence, knowing that your privacy is fully protected.

Yes, our paystub calculator is designed to accommodate the tax rates and regulations for all U.S. states. Each state has its own tax rates and deductions, and our calculator is equipped to handle these variations. When you use the paystub calculator, you simply select the state in which you or your employees work, and the tool will automatically apply the correct state tax rates and deductions. This feature ensures that your paystub is accurate no matter where you are located, making it an essential tool for businesses that operate in multiple states or for individuals who have recently relocated. Whether you're in California, Texas, New York, or any other state, our paystub calculator has you covered.

Certainly! Our paystub calculator is versatile enough to handle payroll calculations for multiple employees, making it an ideal tool for small business owners or managers who need to generate paystubs for their entire team. You can input the details for each employee individually, and the calculator will generate accurate paystubs for each one. Additionally, if you’re someone who works multiple jobs, you can use the calculator to calculate your pay for each job separately. This feature is especially useful for freelancers or gig workers who receive income from various sources. By using the paystub calculator, you can easily keep track of your earnings from different employers, ensuring that you have a clear picture of your overall income.

We understand that using a new tool can sometimes be a bit daunting, which is why we offer comprehensive support to help you get the most out of our paystub calculator. If you have any questions or encounter any issues while using the calculator, our customer support team is here to assist you. You can reach out to us via live chat, email, or phone, and one of our knowledgeable representatives will guide you through the process. Whether you need help inputting your data, understanding the calculations, or customizing your paystub, we’re here to make sure you have a smooth and successful experience. Don’t hesitate to get in touch if you need assistance—we’re always happy to help!