🚀 Paystub Creator

A paystub creator is like your no-nonsense business partner who never complains about coffee shortages or piles of paperwork. In plain English, it’s an online tool that automates the generation of professional, legally compliant pay stubs. Whether you’re a freelance graphic designer pulling all-nighters in Miami or a small boutique owner juggling multiple employees in Seattle, a paystub creator takes the guesswork out of payroll—so you can focus on the stuff that really matters, like growing your business or finally learning that TikTok dance your kids keep raving about.

I’ll never forget when I first started my consulting gig back in 2022. I was buried in spreadsheets, trying to wrap my brain around tax codes, deductions, and overtime pay. My “system” consisted of notes in three different apps, a flurry of sticky notes plastered on my desk, and one very overworked calculator. Fast-forward to 2025, and I can’t stop recommending paystub creators to friends who run side hustles, family-owned shops, or remote teams. These platforms handle all the taxing parts (pun fully intended), so you don’t have to. They calculate gross pay, net pay, state-specific taxes, Medicare, Social Security, and any custom deductions or perks you’d like to include.

It’s no wonder the term “2025 paystub creator” is buzzing in searches these days. A solid paystub creator means you’re not only saving yourself from potential math mishaps but also giving your employees or partners the clarity they crave. And who couldn’t use a little more clarity in the bustling business environment we’ve got today?

In today’s fast-paced world, small business owners, freelancers, and employees alike often find themselves caught in the payroll pinch. Traditional payroll software can be expensive, complicated, and often feels like it was designed to test your patience. On the other hand, manually creating paystubs can lead to errors, missed details, and hours of unnecessary work. It’s a lose-lose situation that leaves many searching for a more straightforward, cost-effective solution. This is where the need for a reliable, free paystub generator becomes crystal clear—something that simplifies the process without adding to the financial burden.

Here’s the good news: there’s a way out of the payroll maze, and it doesn’t involve complicated software or hefty fees. The paystub generator free is designed to take the hassle out of payroll, offering a quick, reliable solution at no cost. It’s like having a personal payroll assistant that’s available 24/7, ready to generate accurate, professional paystubs with just a few clicks. Whether you’re managing payroll for a small team or need a paystub for personal use, this tool streamlines the entire process, saving you time, money, and a whole lot of frustration.

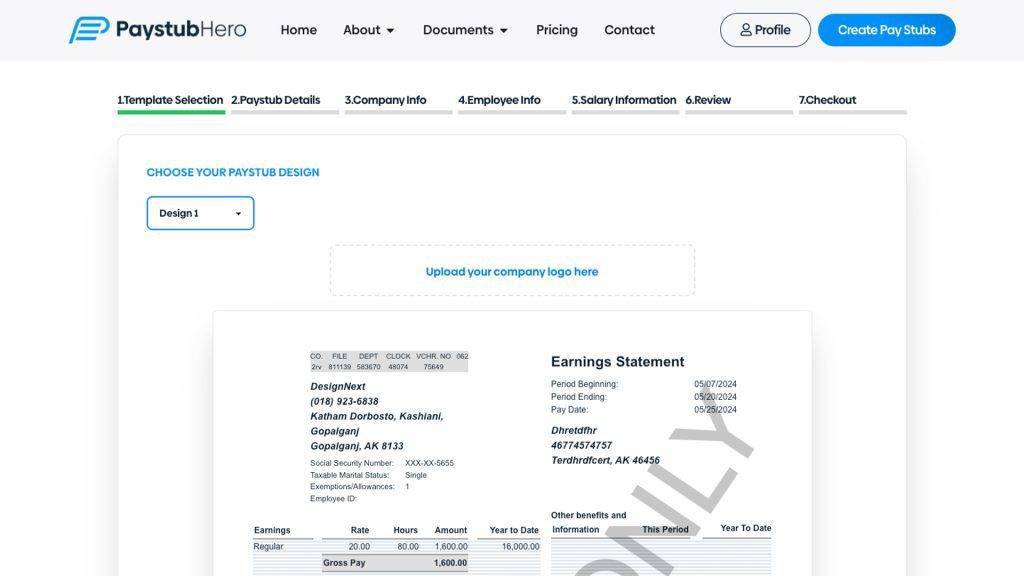

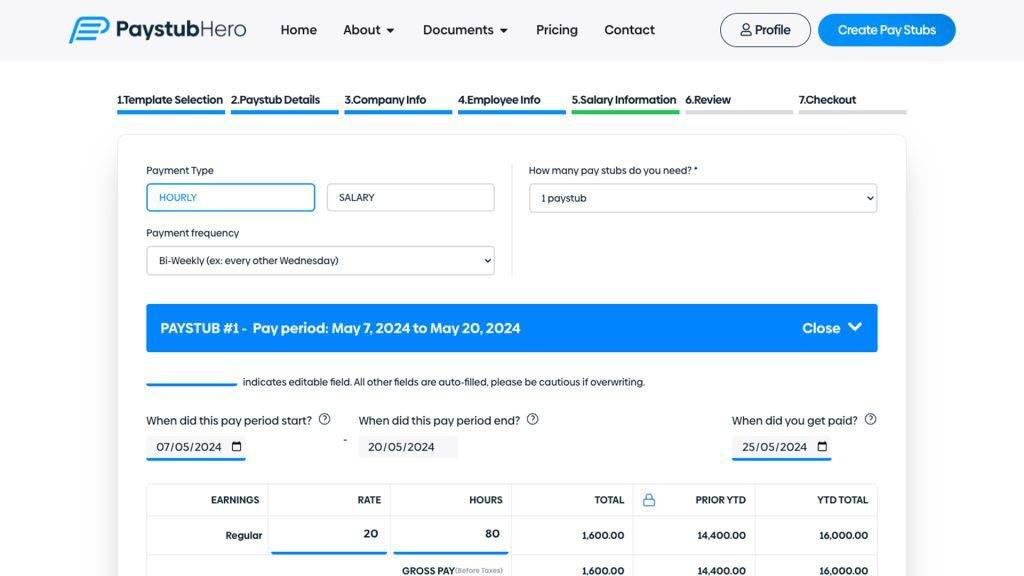

A well-designed paystub creator is the Swiss Army knife of payroll: compact, efficient, and brimming with useful functions.

Why fiddle with pivot tables or the dreaded #REF error? A paystub creator does the math for you. Enter your data, and watch the magic happen.

Because first impressions matter. You can typically add your company’s logo, adjust fonts, and tailor the layout to your brand. Nothing screams “legit” like a sleek, uniform design.

Taxes are about as predictable as the weather. Good thing many paystub creators track legal changes in real-time, ensuring your calculations stay accurate from year to year—and state to state.

We live in an era where digital safety is everything. Top platforms keep your payroll data encrypted, giving you peace of mind that your sensitive info isn’t floating around in cyberspace.

Picture it: you’re generating pay stubs with a few clicks, sipping your coffee, and giving yourself a pat on the back for ditching those old-school spreadsheets. It’s a far cry from the days when payroll meant endless cross-referencing and late nights at the office. Now, you can spend that newfound time binge-watching your favorite reality show or catching up on the latest Marvel film. Life’s too short to be a full-time accountant—unless that’s your actual job.

*10% discount going on for the first time. Use coupon code: WELCOME10

Take Payroll Off the Back Burner, for Good!

/ Per Paystub

Unbeatable Value at Just Only $7.50

/ Per W-2

Unbeatable Value at Just Only $12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

A paystub creator is an online platform that calculates and formats a pay stub based on data you provide—such as wage rates, hours worked, and tax details. Enter those numbers, and the tool instantly prepares a professional document showing gross pay, net pay, and every deduction in between. It’s like hiring an on-demand accountant who never takes a vacation or complains about your weird coffee preferences.

Yes, so long as the information you provide is accurate and truthful. Think of it like using a digital tax-filing service—fully legitimate, as long as you’re playing by the rules. Many small businesses and freelancers rely on paystub creators not only for speed and convenience, but also for peace of mind. Financial institutions typically accept pay stubs generated this way for loan applications, mortgage processing, or income verification, assuming all the data is correct.

Absolutely. The more robust paystub creators can navigate the maze of federal, state, and even local tax codes. If you’ve got employees in multiple states, the software adapts automatically based on the zip code or location info you input. No more frantic searches for “2025 tax rates in Montana” at 2 a.m.—the tool has you covered.

Not at all! If you can follow basic prompts and know how to fill in your basic payroll info, you’re golden. The whole point is to eliminate the need for advanced accounting know-how. Many tools even have simple video tutorials or step-by-step guides that hold your hand through the entire process. In other words, it’s so easy, your grandma could do it—assuming she’s up to date with technology.

Security is paramount in 2025, and reputable providers use top-notch encryption methods to keep your data safe from prying eyes. Many also implement regular software updates and third-party security checks. Still, it’s a good habit to create strong, unique passwords and avoid sharing your login credentials. With a trustworthy platform, your data’s as secure as a cat in a sunny window—blissfully unbothered.

You bet! Freelancers often wear multiple hats: salesperson, marketing specialist, accountant, and chief coffee-fetcher. A paystub creator makes it easy to generate stubs that document your income, which is invaluable for everything from applying for a car loan to proving income for a potential landlord. If you’re someone who thrives on staying organized (or desperately needs to), this will be your new best friend.

Most paystub creators include an “edit” function, so you can revise any details and re-generate a corrected stub in seconds. Whether you forgot to add overtime hours or realized you typed in the wrong pay rate, it’s easy to fix. Gone are the days of printing out a new set of documents and scribbling “Oops” in the margins!

In a word, yes. Since it handles all the calculations for taxes, deductions, and net pay, your chances of making a slip-up plummet. Of course, the system is only as good as the information you feed it, so always double-check that you’re inputting the correct hours, rates, and personal data. But as long as the numbers are right, the margin of error is practically nil.

A paystub creator scales easily. Whether you’re a scrappy startup with three employees or a growing enterprise managing several departments across multiple states, it can handle the load. It’s also a big help if you’re dealing with contract workers, seasonal employees, or gig-economy hires. Payroll complexities don’t discriminate by company size—if you need pay stubs, a paystub creator can save you time, money, and stress.

Look for reliability, security, and user-friendly features. Read reviews, compare prices, and see if the platform updates regularly to keep up with changing tax regulations. Also, make sure they offer solid customer support—nothing is worse than running into an issue on payday and having no one to call for help. Bottom line: the best paystub creator should simplify your life, not complicate it. If it feels like an uphill battle just to figure out the interface, keep shopping around.

Copyright © 2025 PayStub Hero. All rights reserved.

To get 10% off on your first purchase