Choose a Pay Stub Template Today!

Looking for professional paystub templates to provide proof of income? Our paystub generator offers a range of realistic, fully customizable templates used by thousands of U.S.-based businesses for only $7.50.

Based on Google Reviews

Our Pay stub Templates

Our team of experts carefully researched the paystub designs of hundreds of successful businesses, including ADP, Walmart, 7-Eleven, Dollar General, and more. By analyzing their formats and best practices, we crafted our own top-notch templates, ensuring that every design we offer meets professional standards. Whether you’re looking for sleek simplicity or detailed layouts, our paystub templates are vetted for quality and designed to impress both employers and employees alike.

- Fast

- Easy

- Affordable

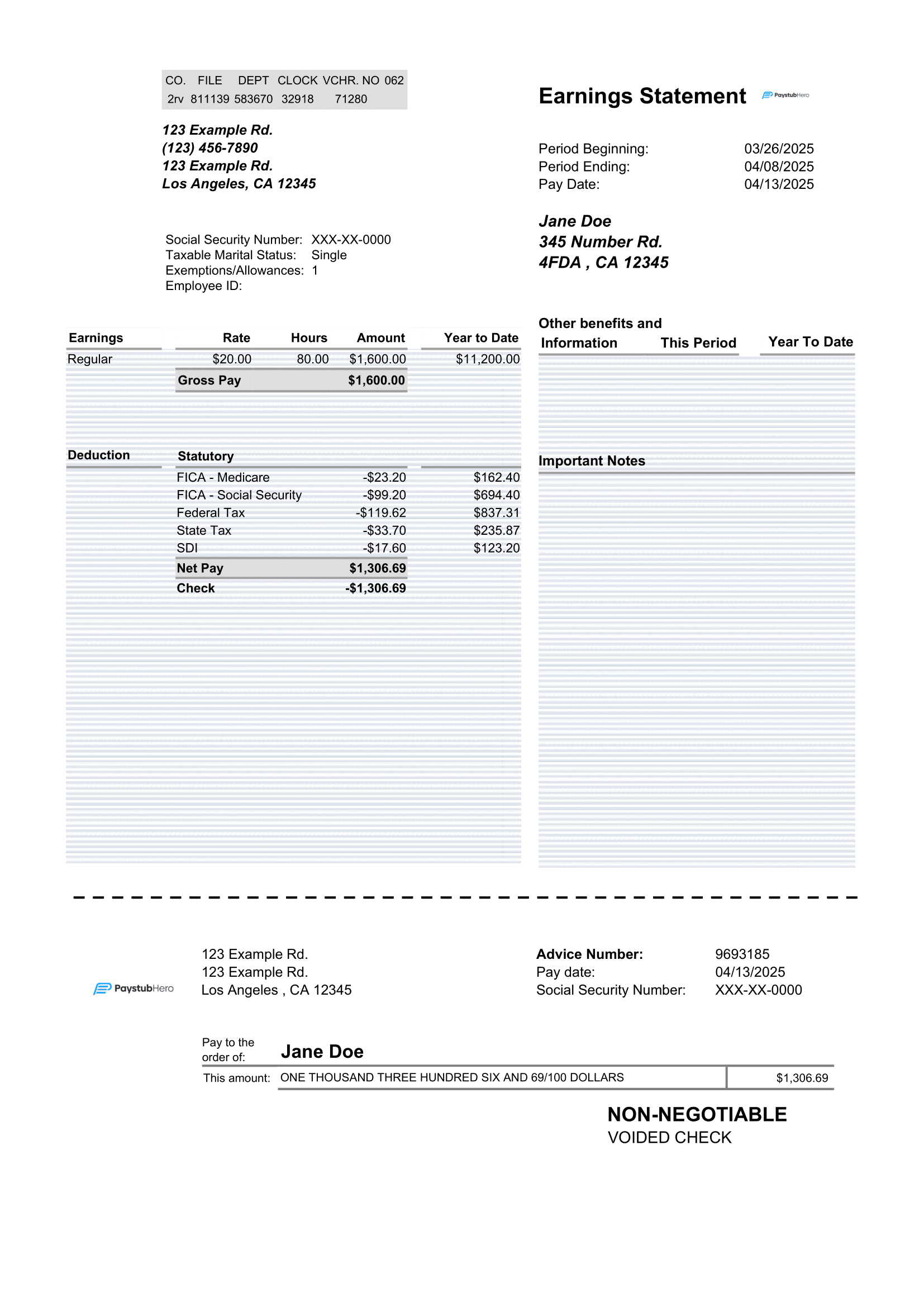

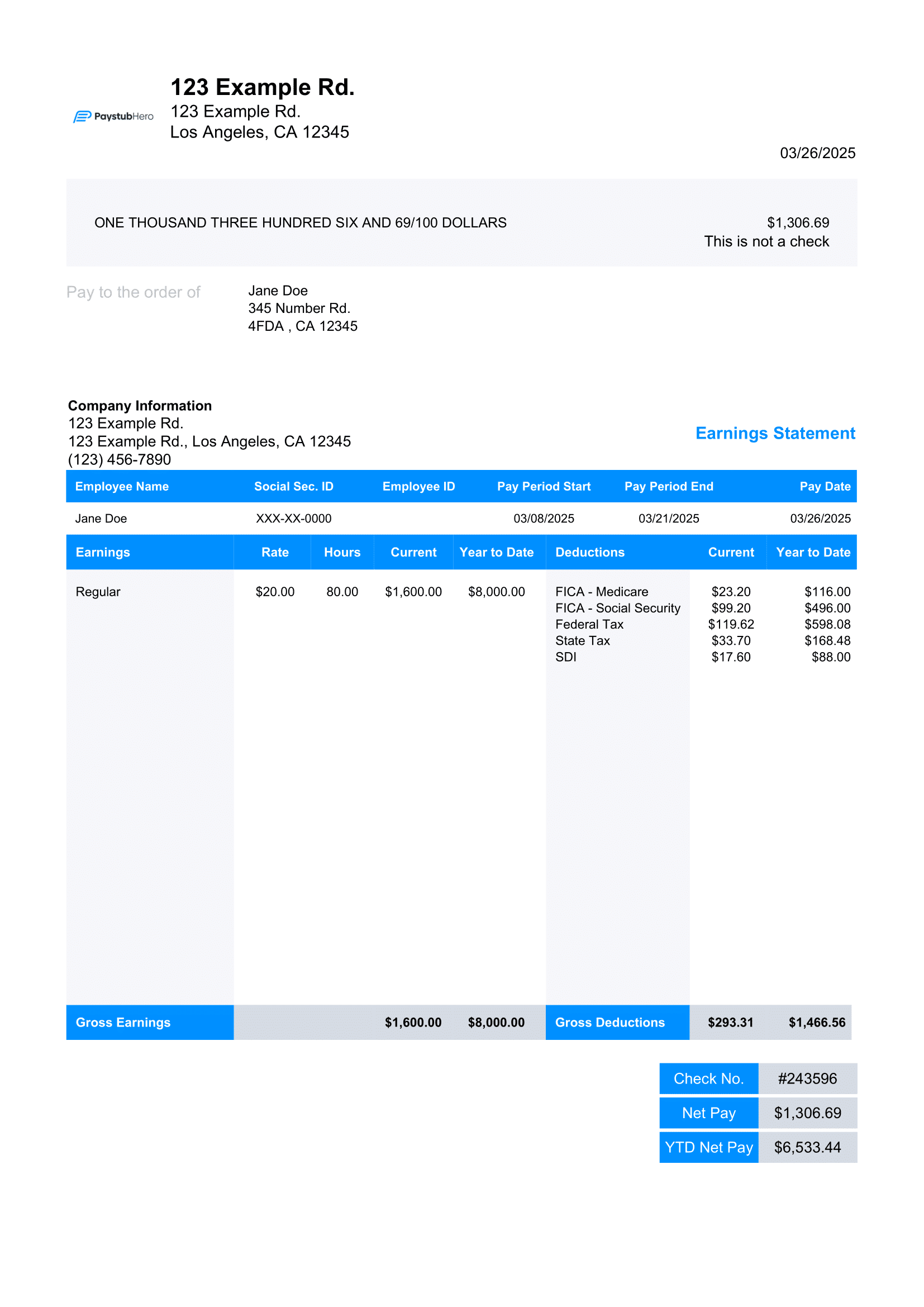

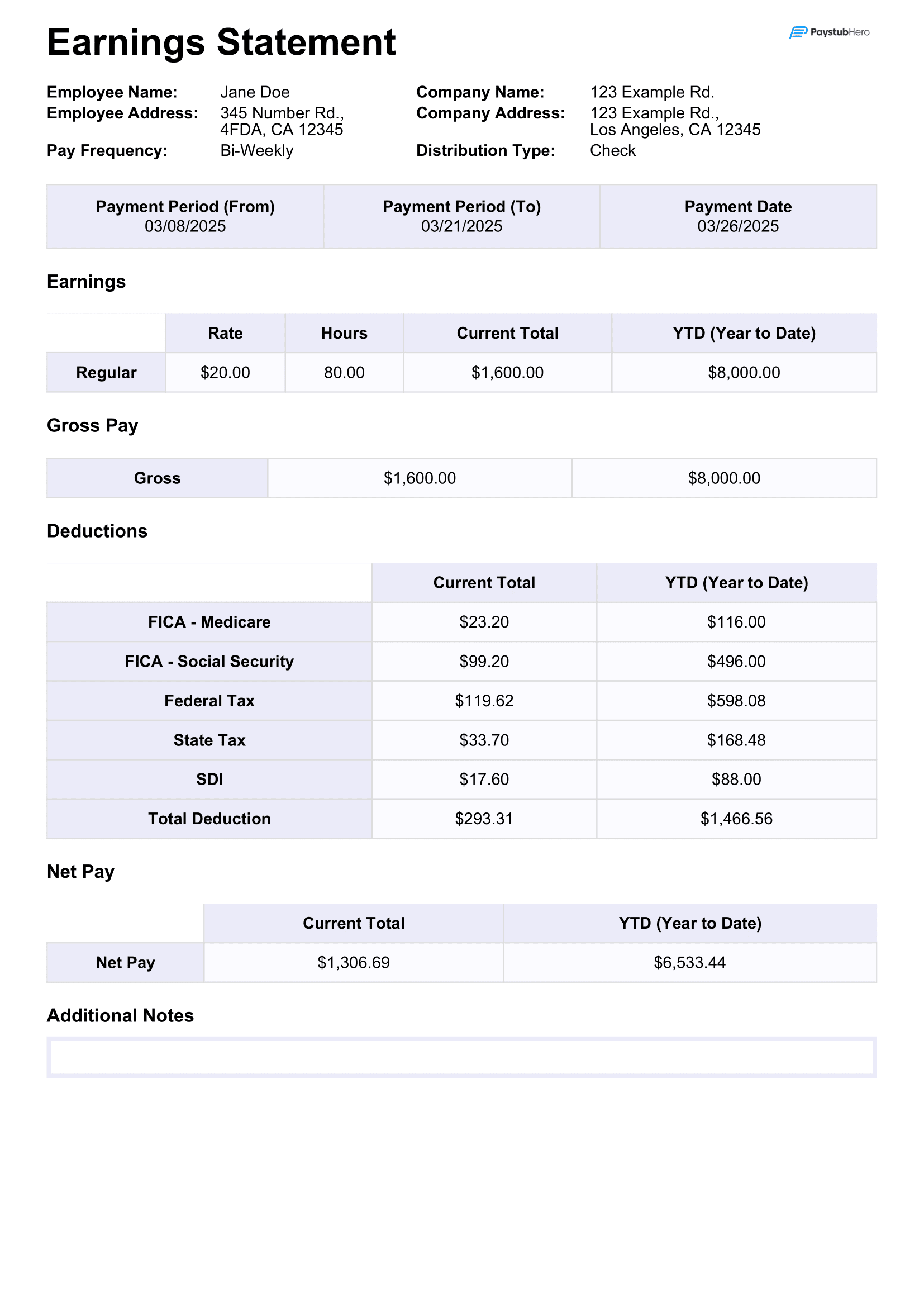

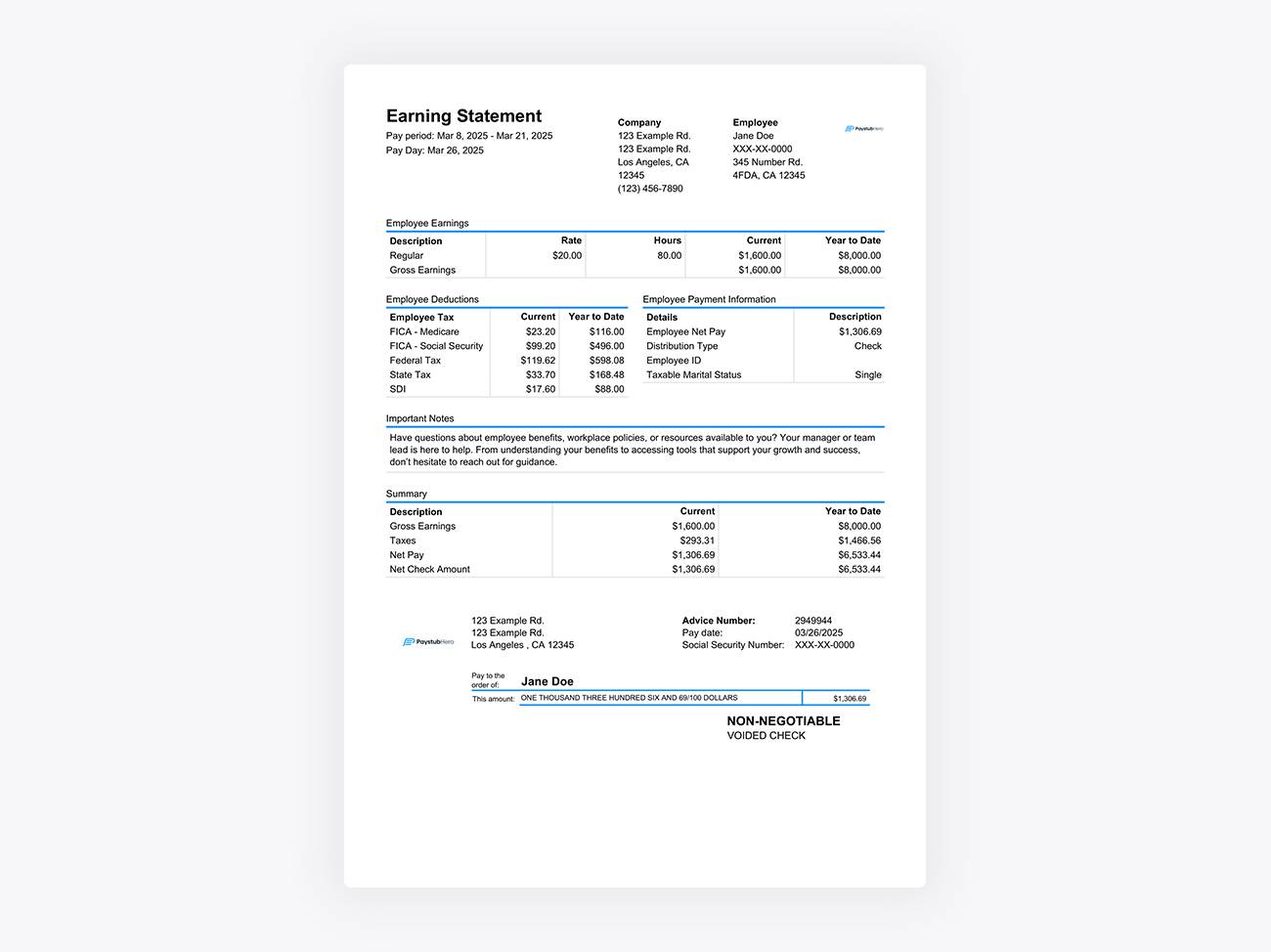

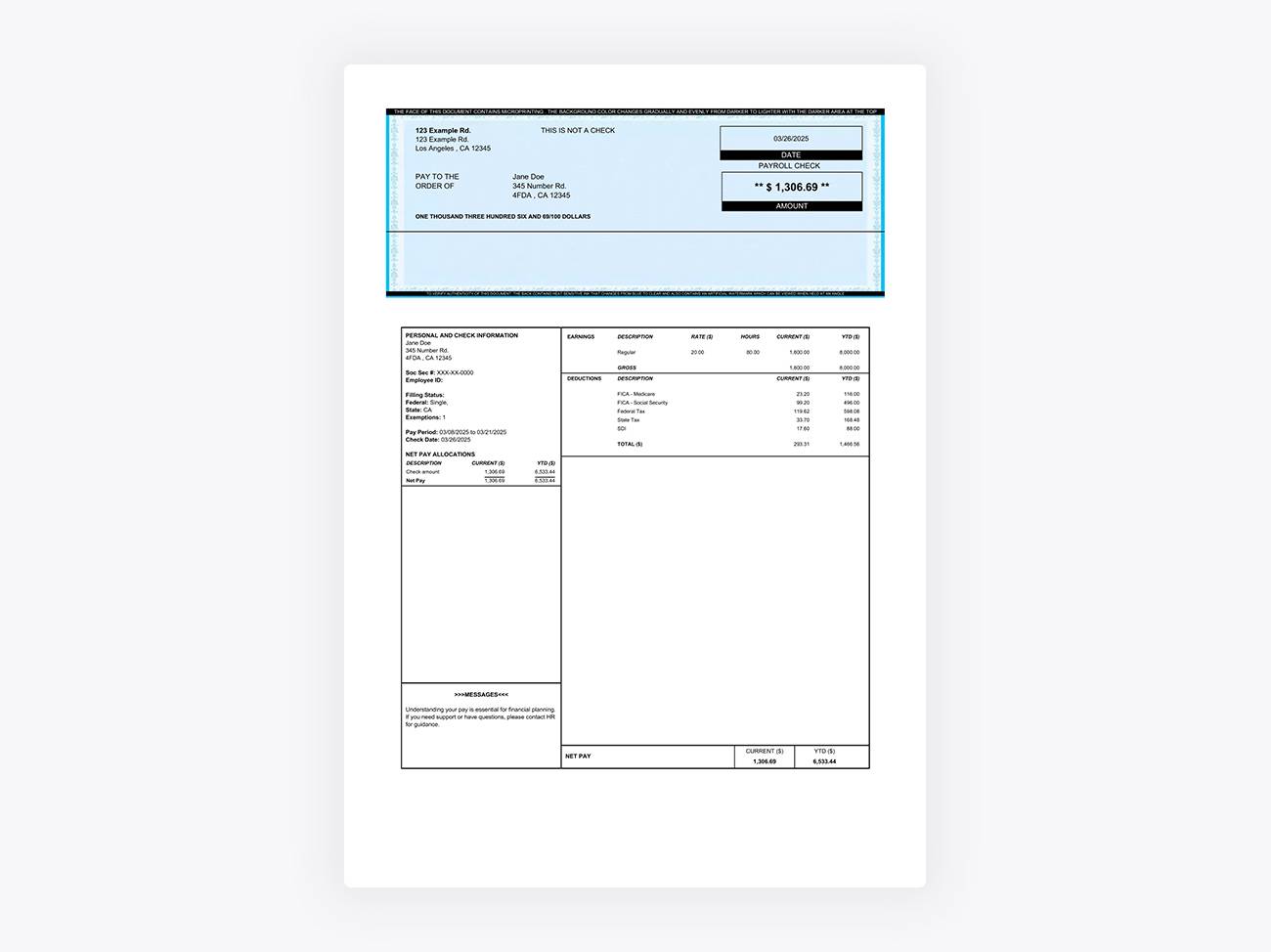

The ADP Pay stub Template

Our ADP pay stub inspired template features a professional, sleek design that highlights all key payment details, ensuring clarity and accuracy for both employers and employees.

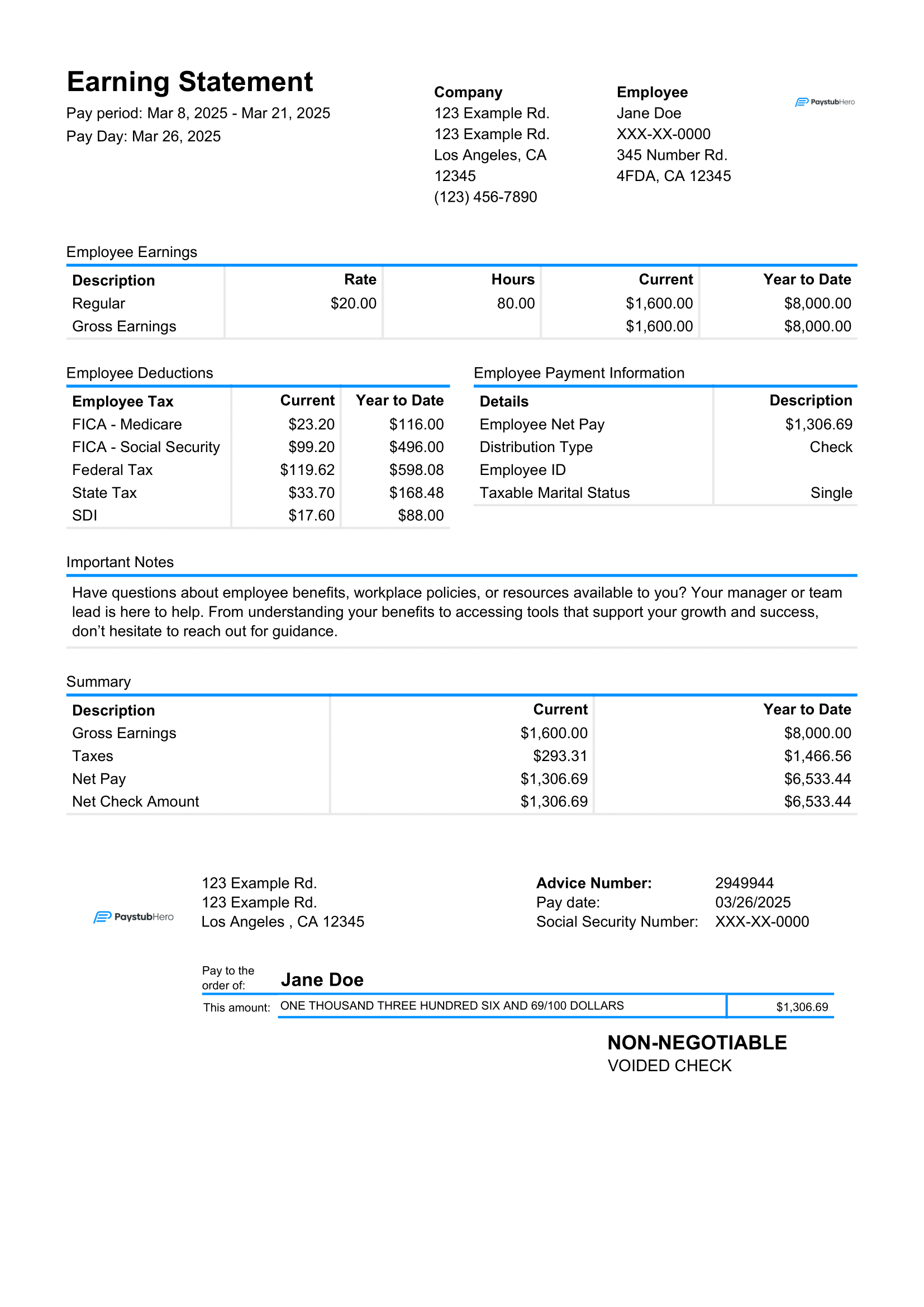

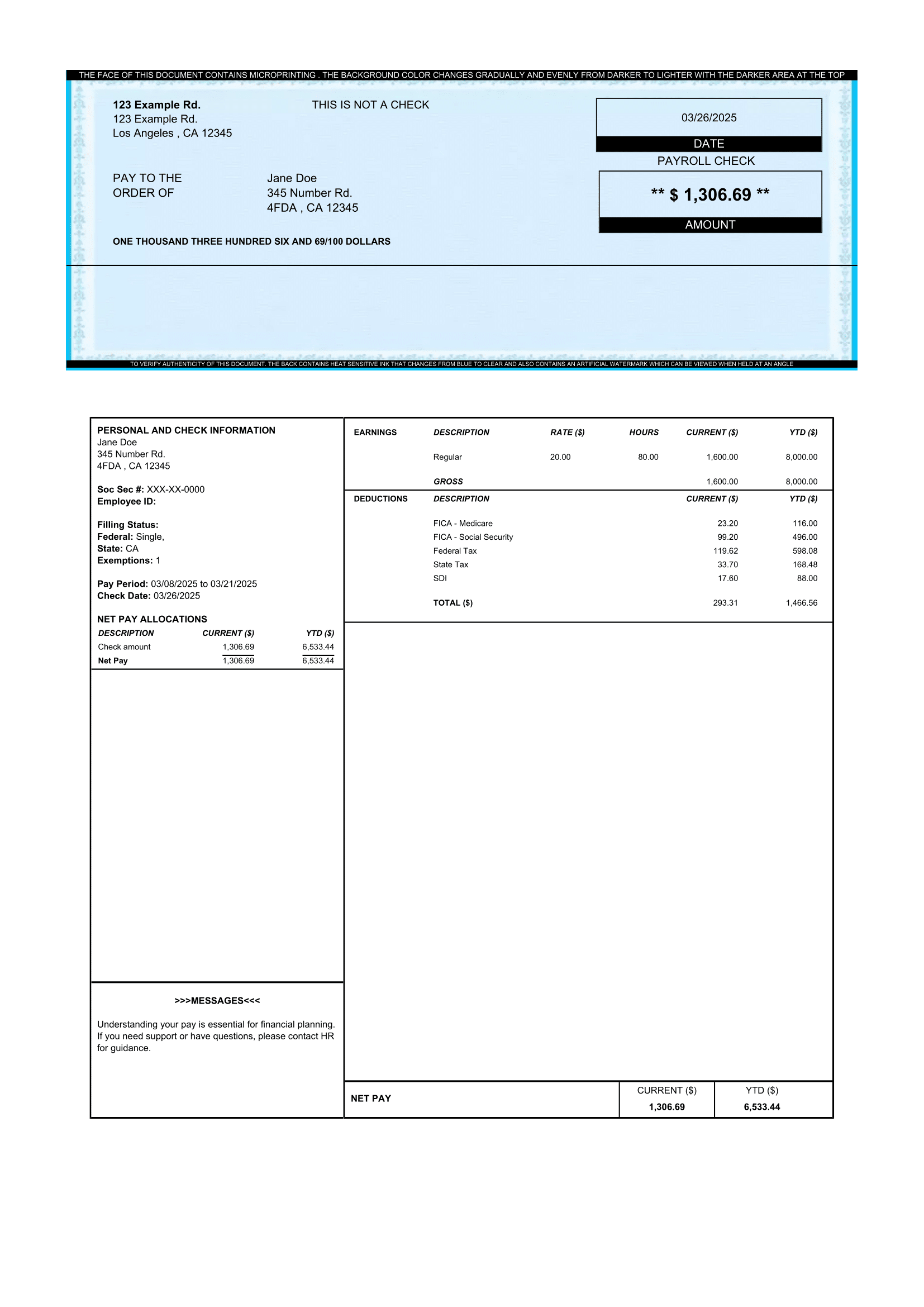

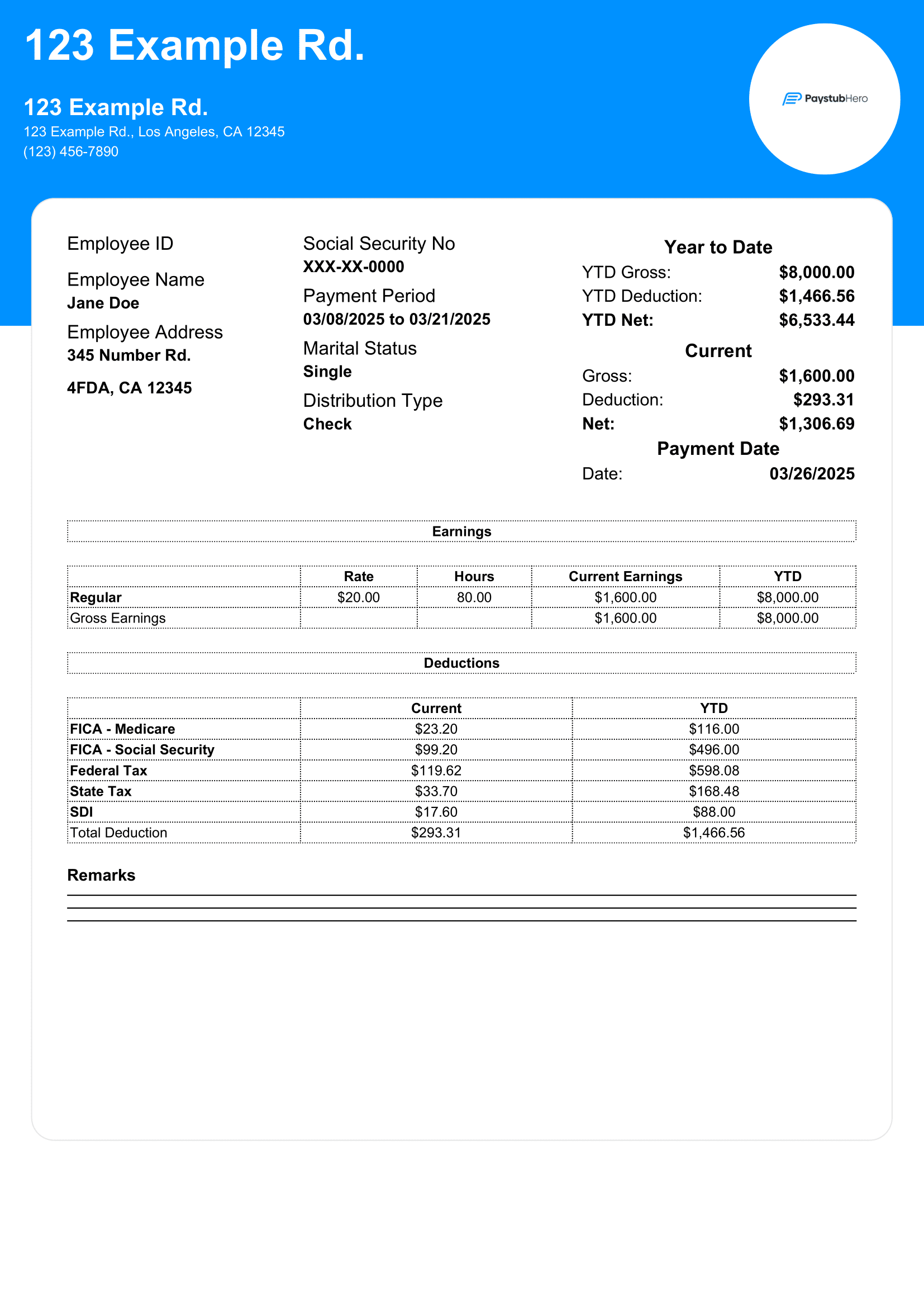

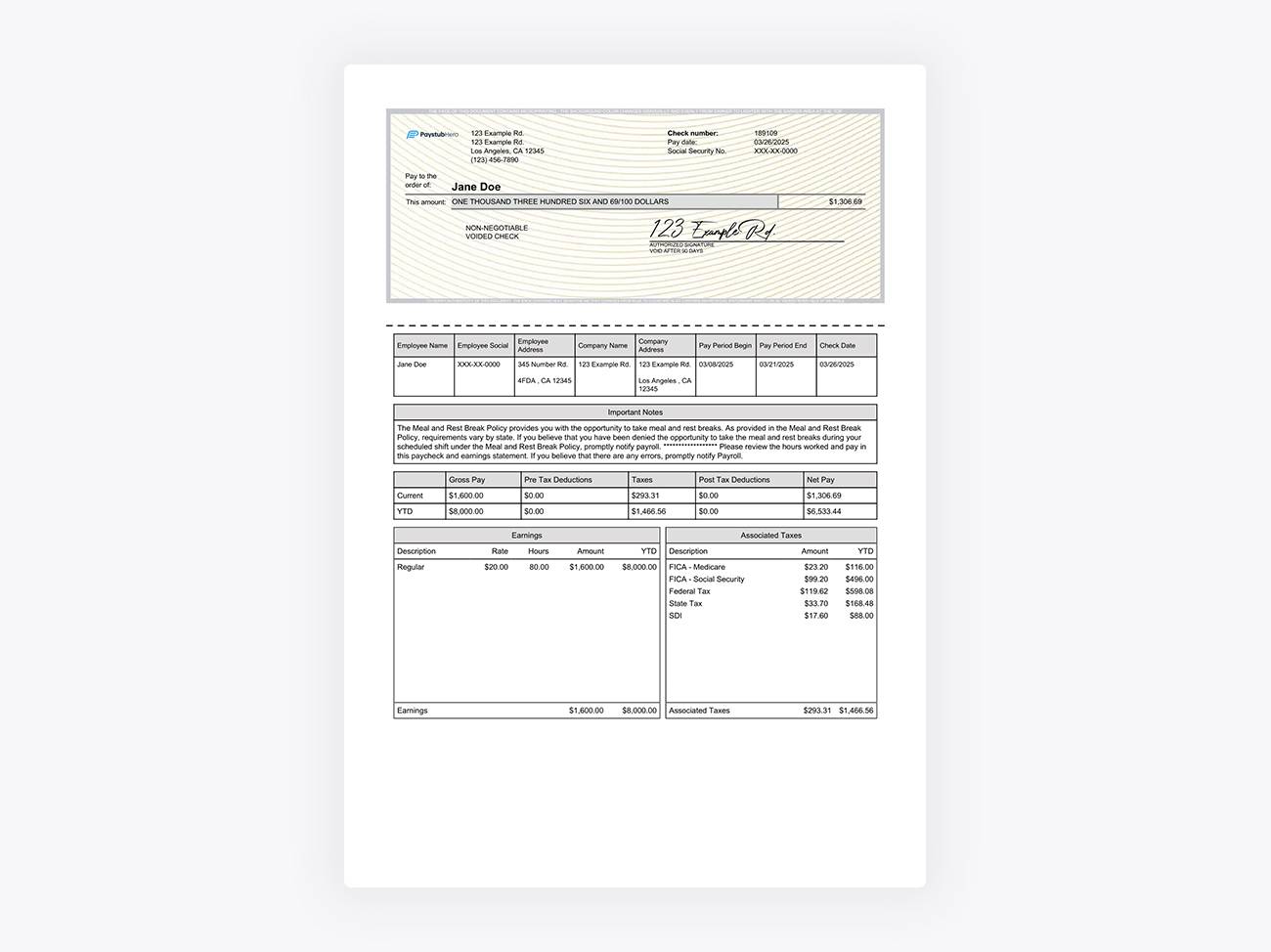

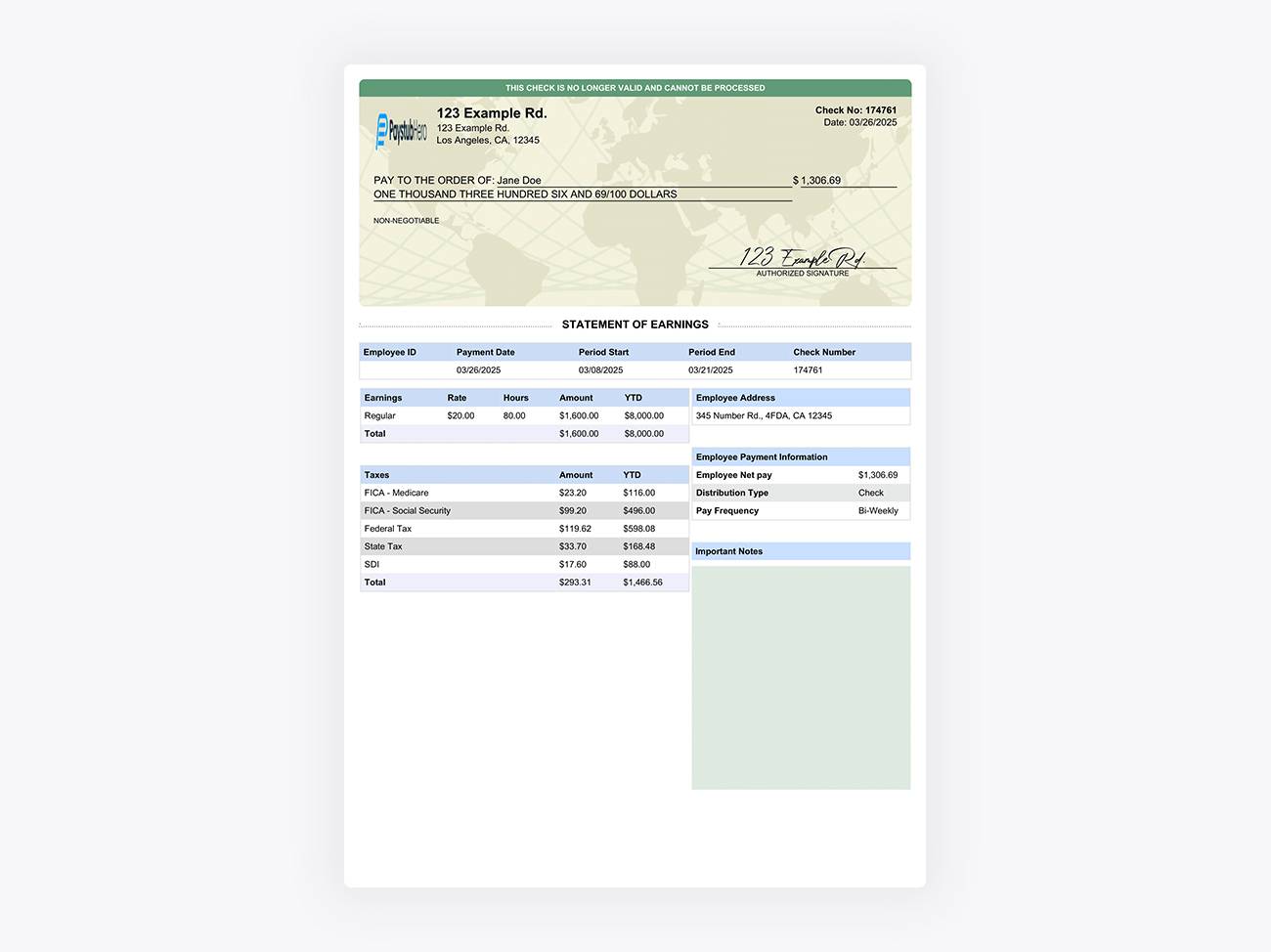

The Walmart Pay stub Template

Our Walmart paystub inspired template offers a clear, easy-to-read format, showcasing all essential payment details for accurate and professional payroll documentation.

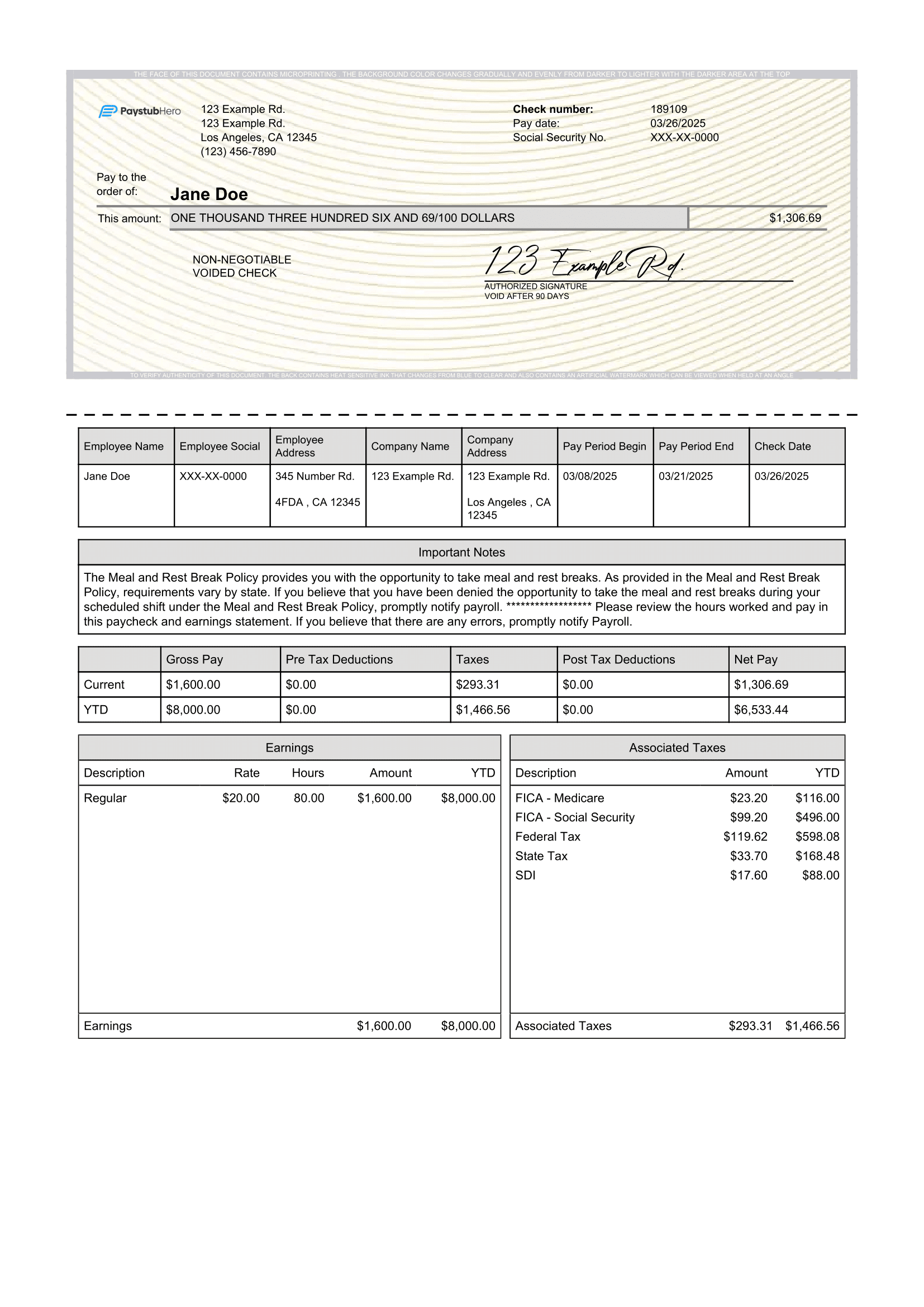

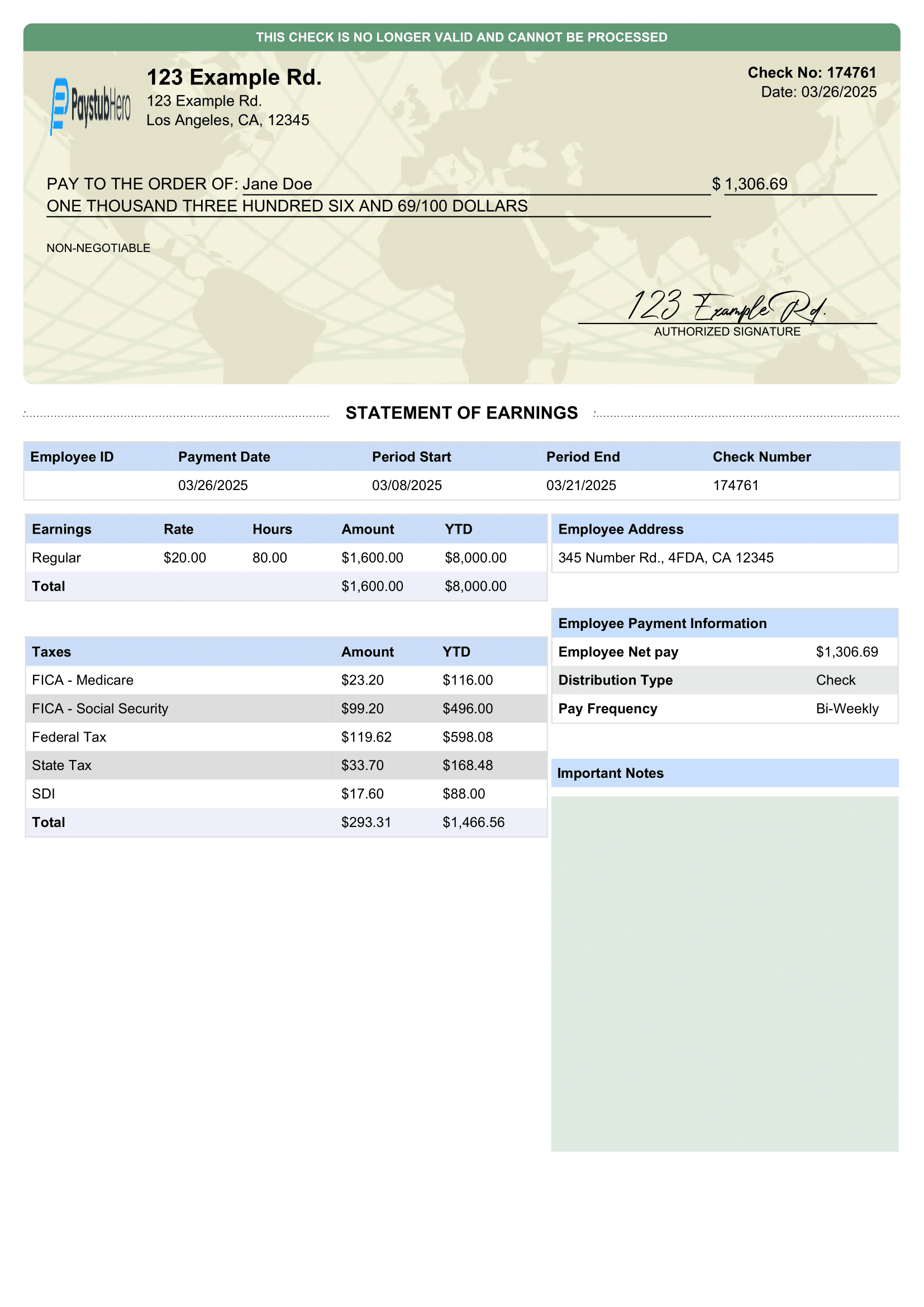

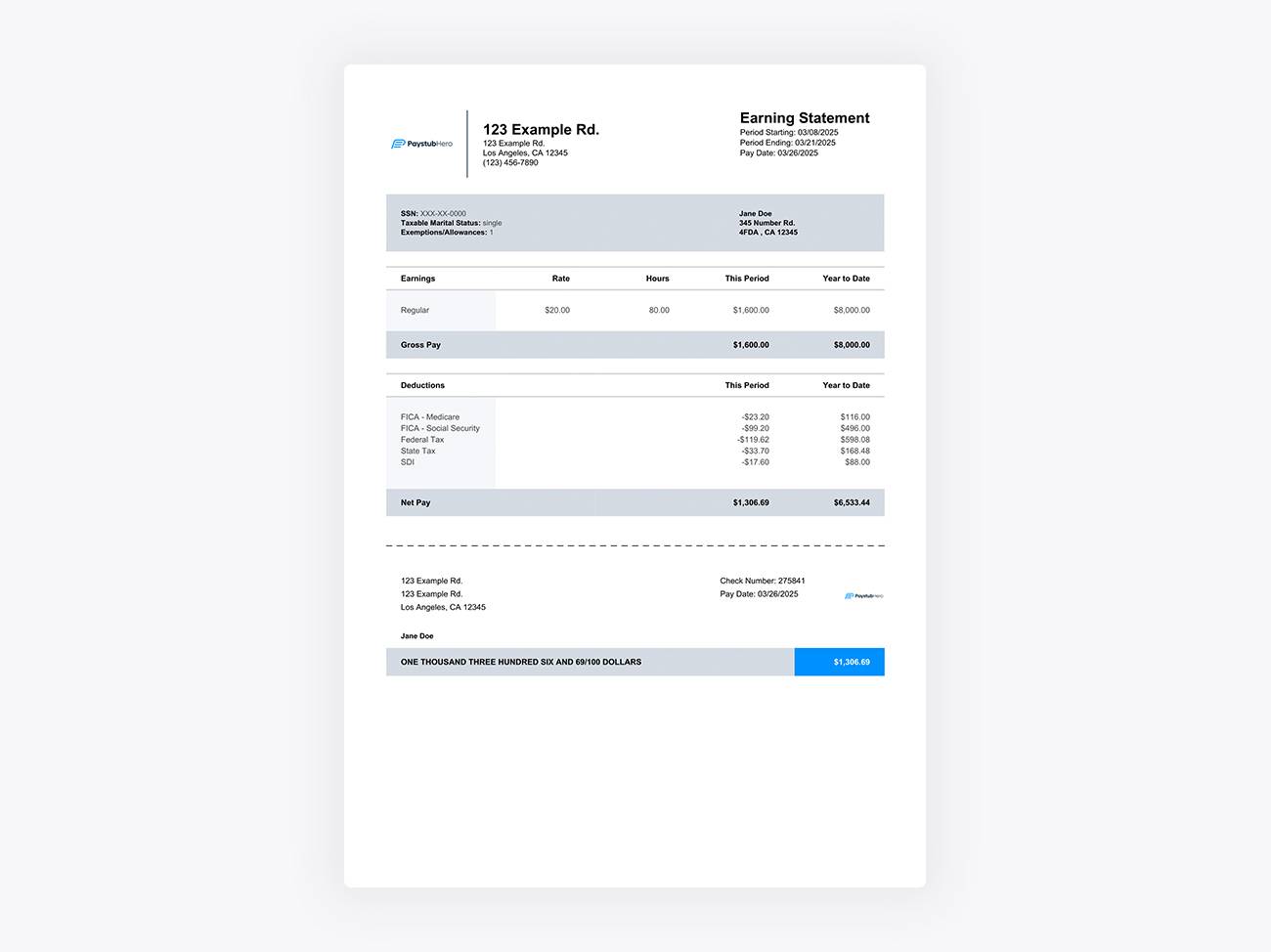

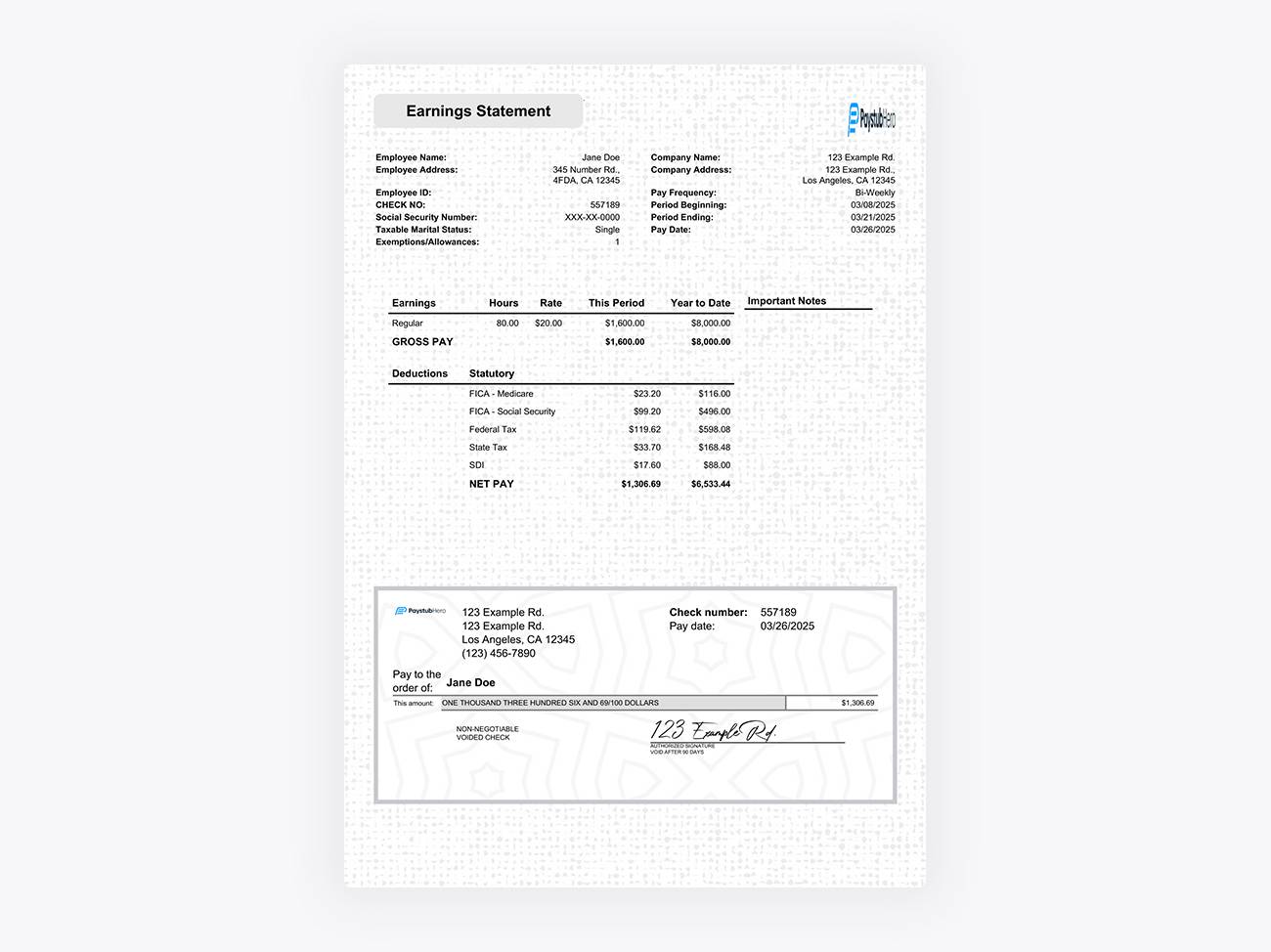

The Target Pay stub Template

Our Target pay stub inspired template provides a modern, streamlined layout, displaying key payment information with precision, ensuring professional payroll records every time. This template is one our most popular!

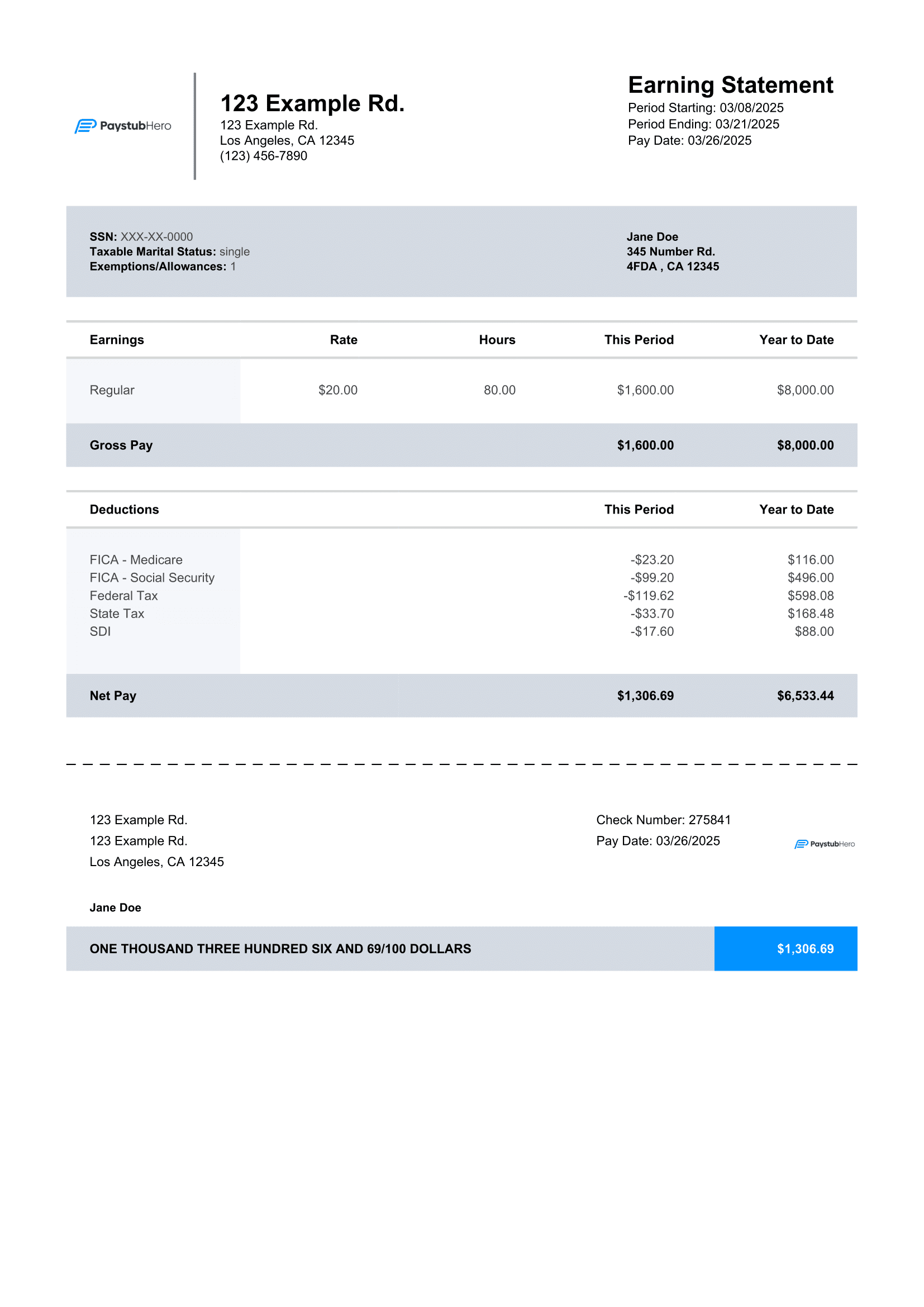

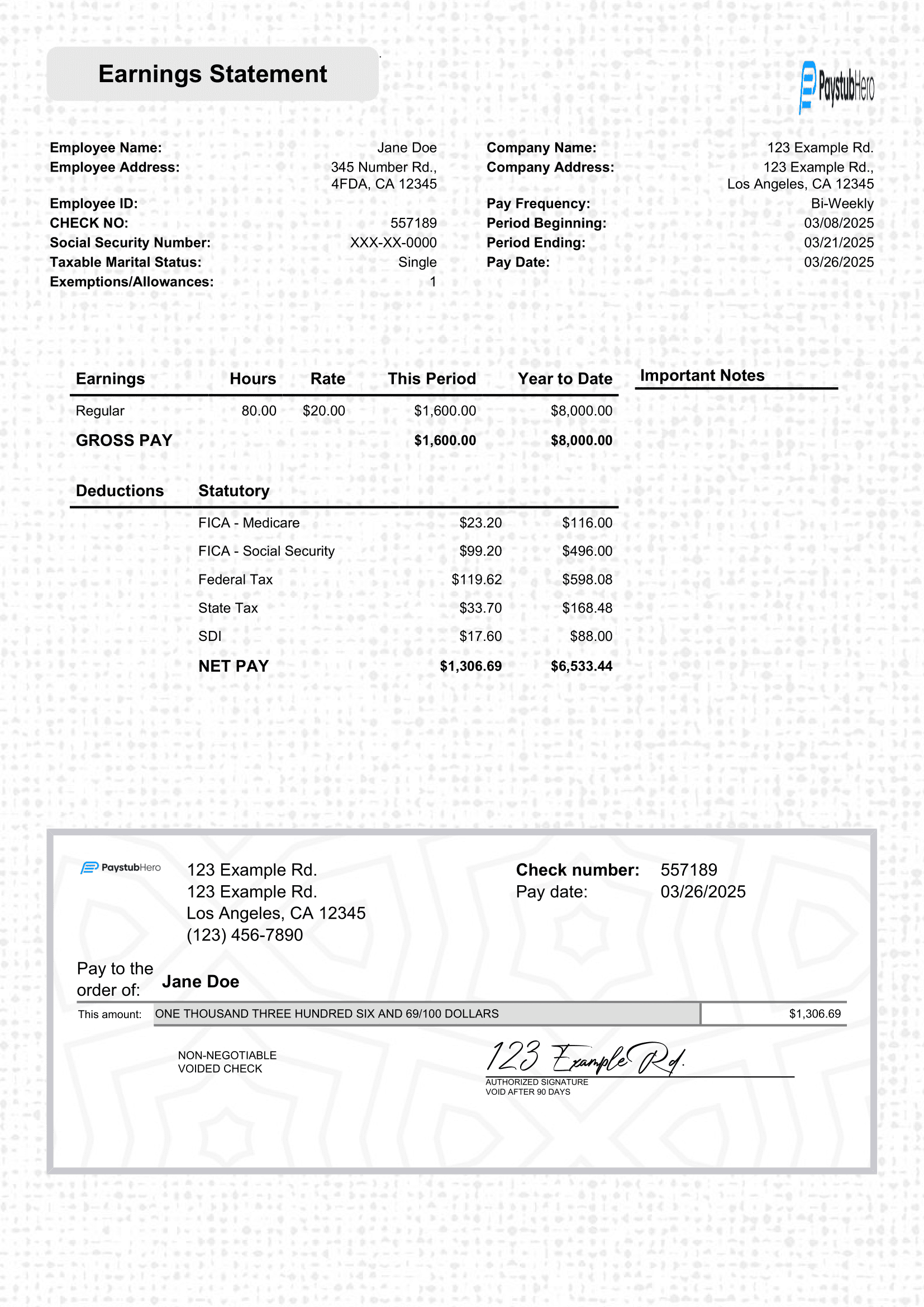

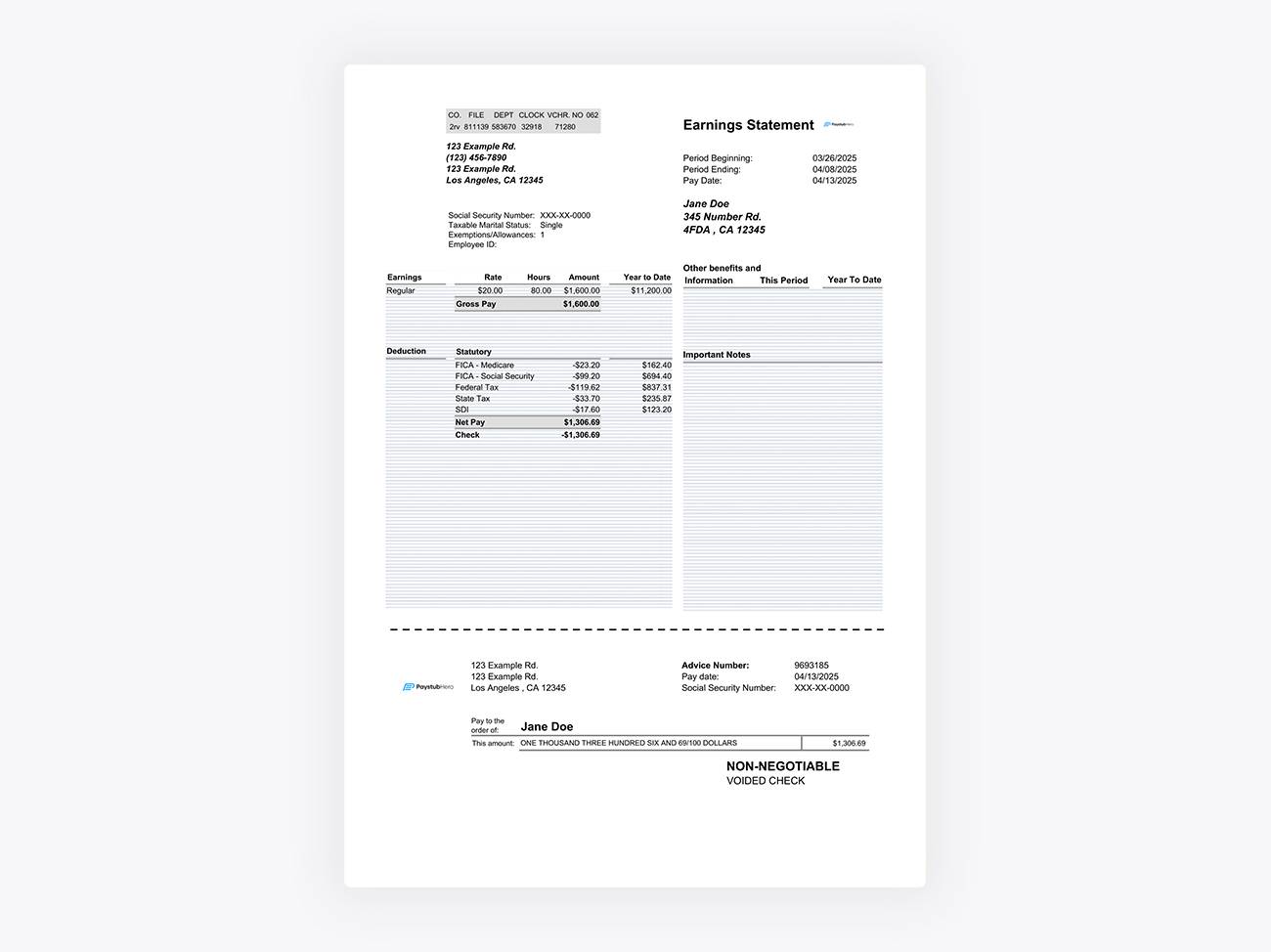

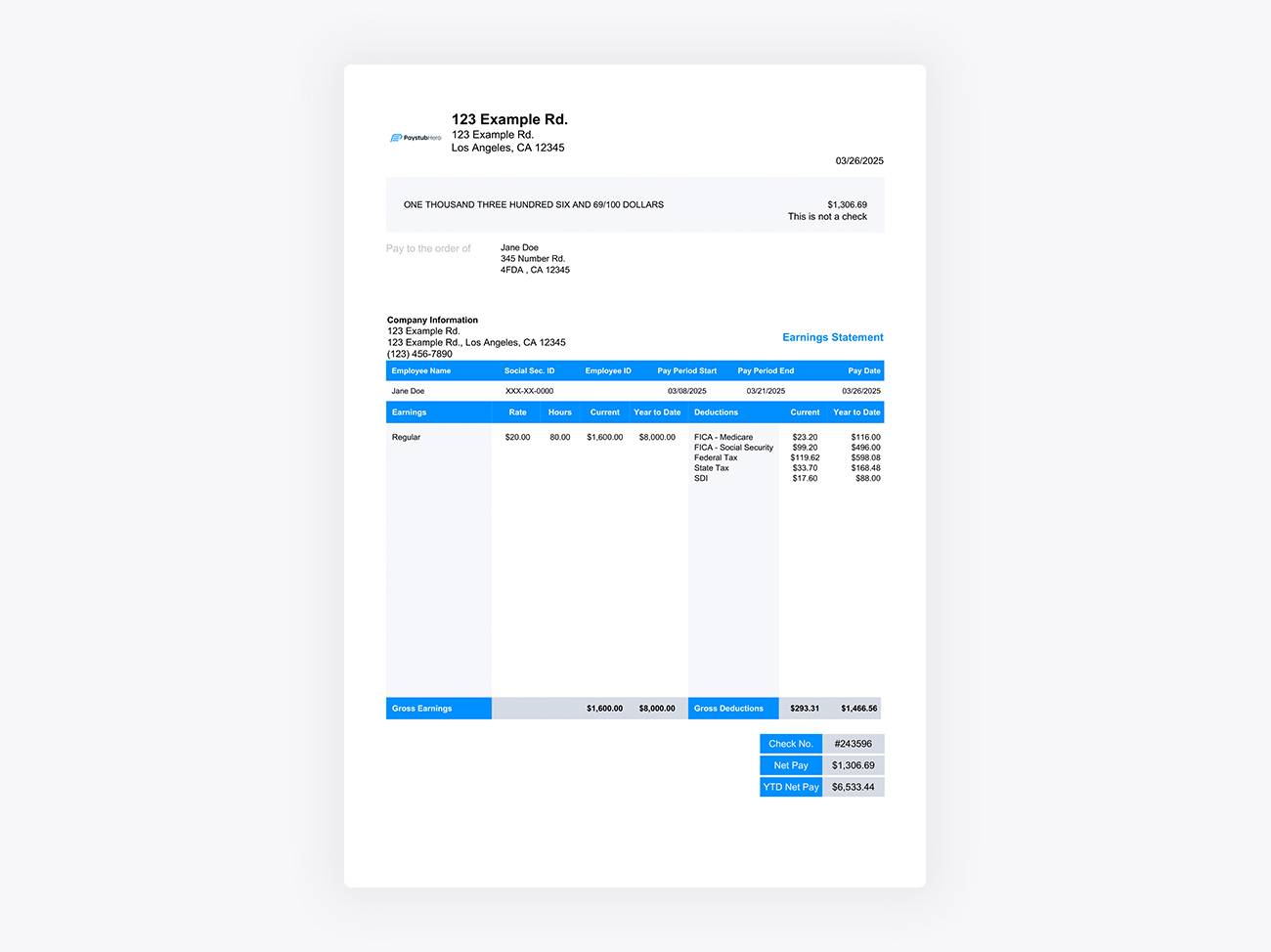

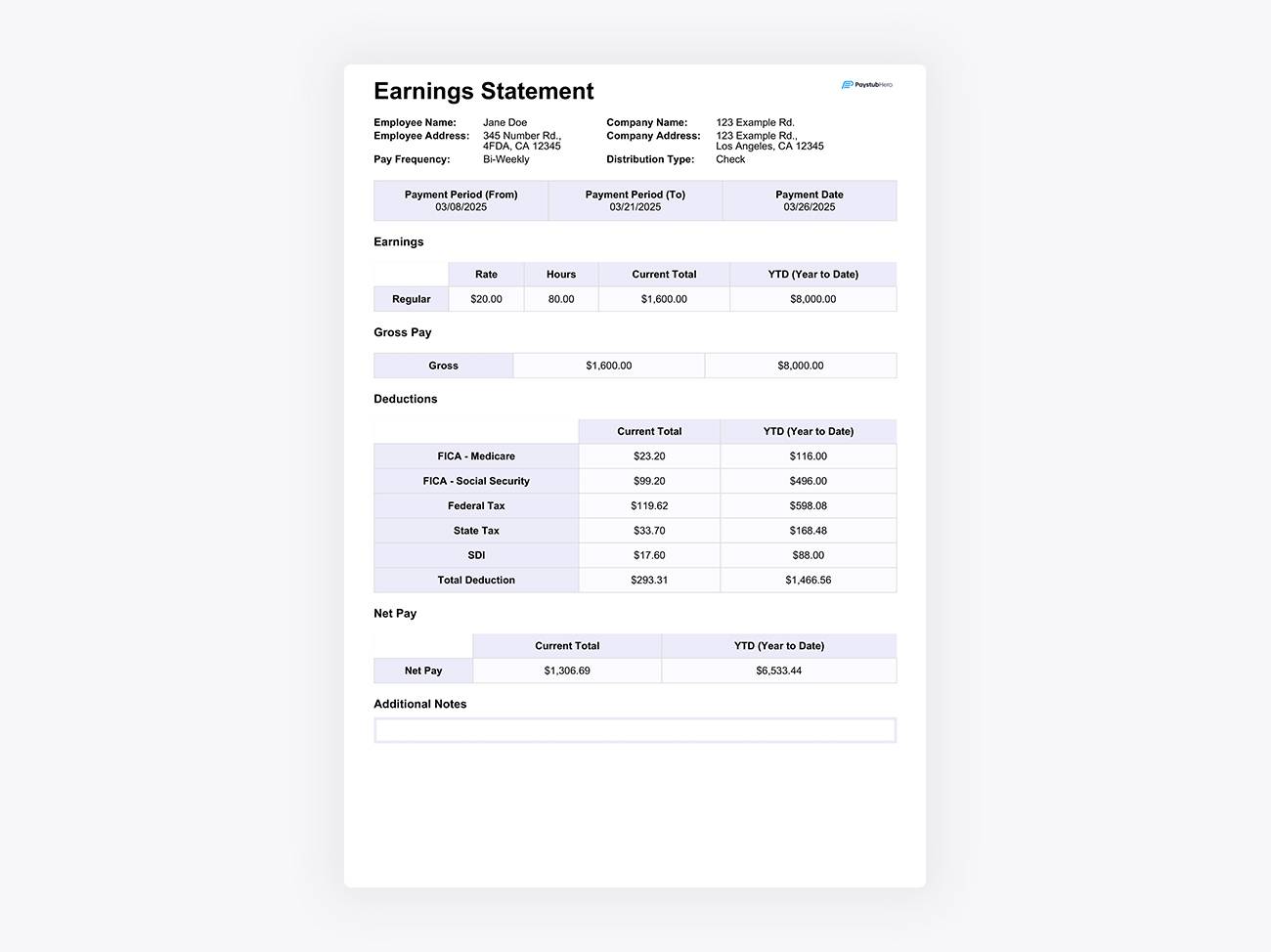

The DG Pay stub Template

Our Dollar General/ DG pay stub inspired template combines simplicity with accuracy, delivering all essential payment details in a clean, easy-to-read format for efficient payroll management.

The 711 Pay stub Template

Our 711 paystub inspired template offers a simple yet effective layout, providing key payment details with clarity and ease. There's also 4 colors to choose from!

The Family Dollar Pay stub Template

Our Family Dollar paystub inspired template features a clean and organized layout, providing an easy way to present all essential payment details with clarity.

The Amazon Paystub Template

Our Amazon paystub template features a detailed, easy-to-read format that clearly outlines all essential payment details for warehouse and delivery team members. This template is perfect for those who enjoy elaborate financial breakdowns.

The Kroger Paystub Template

Our Kroger paystub inspired template delivers a neat and accessible design, showcasing hours, wages, and deductions with precision—perfect for grocery store staff seeking reliable and organized records.

The Doordash Paystub Template

Our DoorDash paystub inspired template is designed with gig workers in mind, offering a clean and organized layout that highlights earnings, tips, and net pay payouts with clarity—perfect for accurate income tracking.

The CVS Paystub Template

Our CVS paystub inspired template features a structured, pharmacy-friendly format that presents all vital payment information in a clear and professional manner, making it ideal for retail and healthcare employees alike.

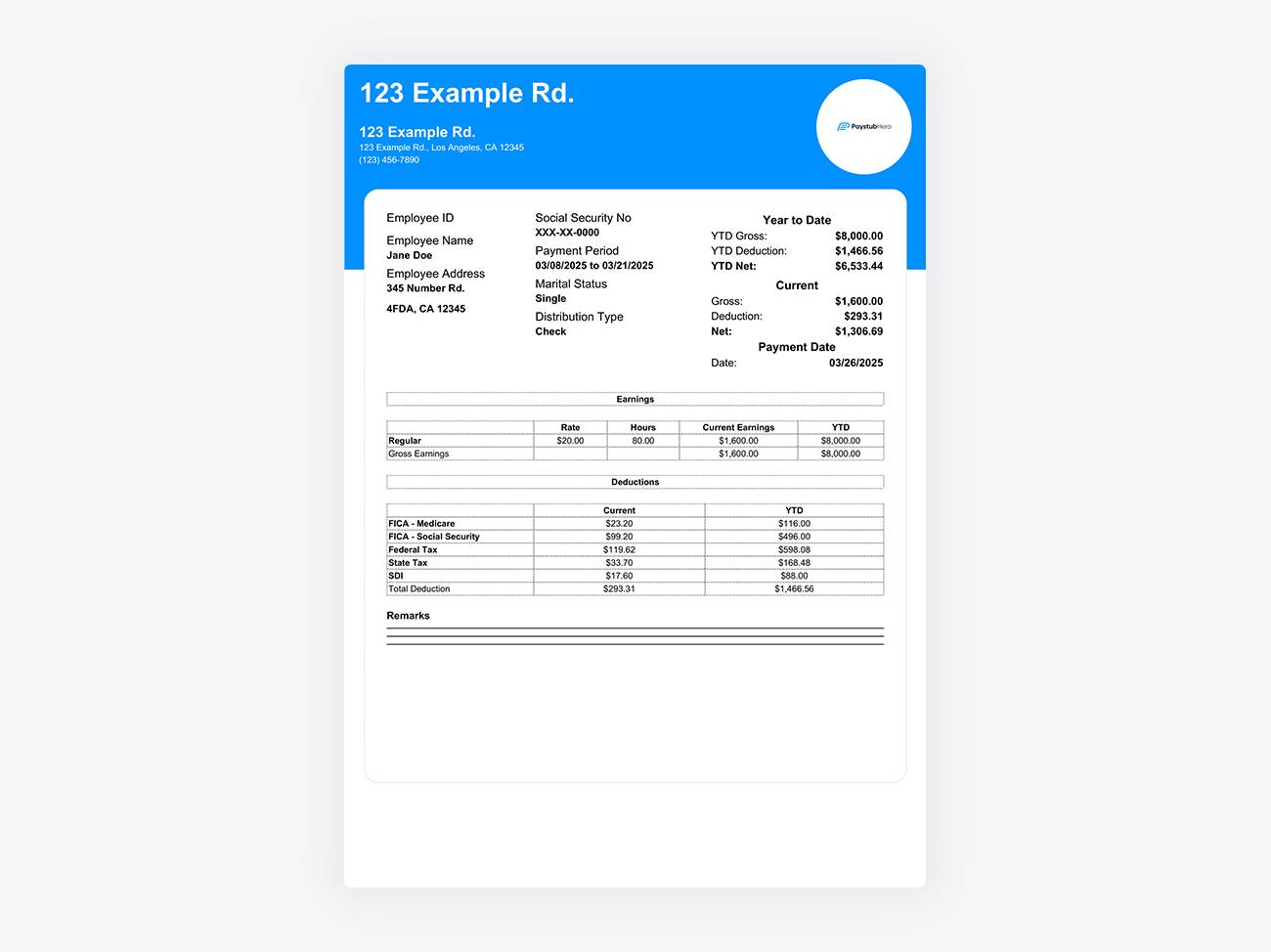

What is a Check Stub Template?

A paystub template is a pre-designed document that outlines the key information regarding an employee’s payment details. It simplifies the process of creating professional paystubs by organizing:

- Gross income

- Deductions (taxes, insurance, etc.)

- Net income

- Payment dates and hours worked

Using a paystub template ensures accuracy and consistency, no matter the business size.

Why Use a Paystub Generator?

A paystub generator offers a quick, efficient way to create accurate paystubs without the hassle of manual calculations. Key benefits include

- Instant PDF downloads

- Customizable fields for business or individual needs

- Automatic calculation of taxes, deductions, and net pay

- User-friendly interface that saves time and effort

- An account where all of your pay stub orders are stored for organization

It’s an ideal solution for freelancers, contractors, and small businesses.

How to Read a Pay Stub

Understanding the breakdown of your paystub is essential for managing your finances. Here’s what you need to know

- Gross Pay: Your total earnings before deductions

- Deductions: Includes taxes, healthcare, and other withholdings

- Net Pay: Your take-home pay after all deductions

- Year-to-Date (YTD): Summarizes your earnings and deductions for the year

This breakdown helps you track your income and ensures everything is calculated correctly.

Who Needs a Check Stub?

Paystubs, also known as Check stubs are necessary for a variety of reasons, and different individuals and businesses may need them, such as

- Freelancers & Contractors: Proof of income for loan applications, tax filings, etc.

- Small Businesses: To issue to employees as part of payroll compliance

- Gig Workers: Easily track your earnings across multiple jobs

No matter your occupation, a paystub helps document your earnings accurately.

Common Mistakes on Paystubs

Mistakes on paystubs can lead to confusion or financial issues. Here are some common errors to avoid

- Incorrect tax or deduction calculations

- Misspelled names or wrong employee details

- Missing or incorrect payment dates

- Forgetting to include year-to-date totals

By using our paystub generator, you minimize the risk of these mistakes and ensure everything is accurate.

Legal Requirements for Paystubs

Did you know that paystub requirements vary by state? Here are some examples of legal requirements:

- California: Must include hourly rates, deductions, and total hours worked.

- New York: Requires detailed deductions and contributions.

- Texas: Doesn’t mandate paystubs but suggests detailed record-keeping.

Always make sure your paystubs comply with your state’s specific laws to avoid potential legal issues.

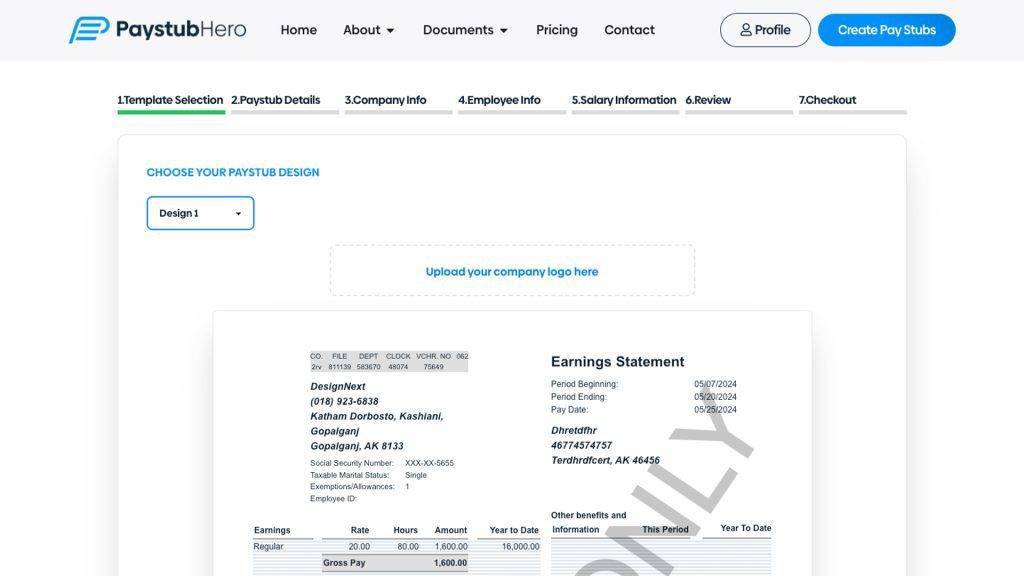

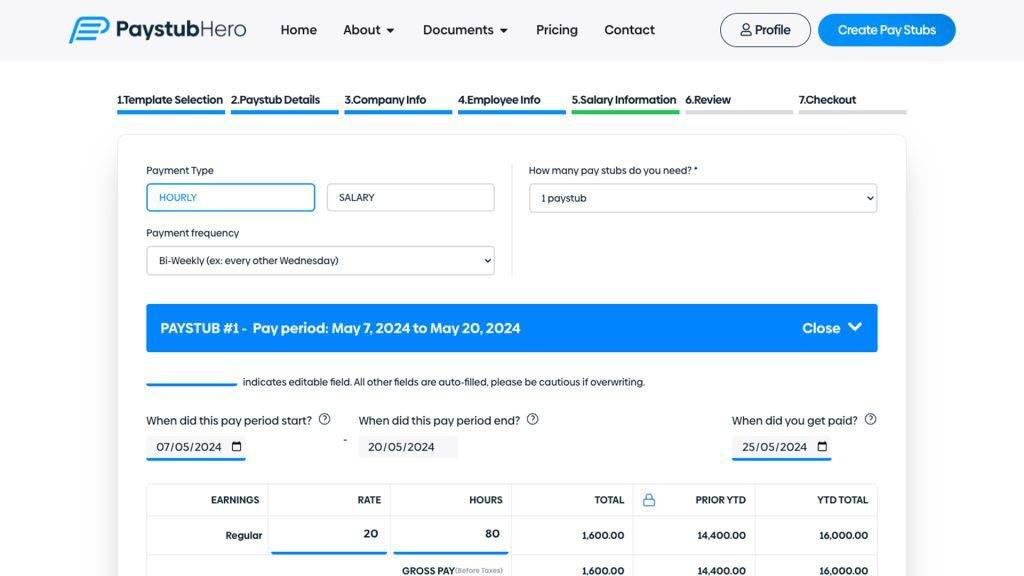

How to use our Check stub maker?

Choose a pay stub template from our 6 designs

Enter Information such as company name, your work schedule and salary details

Download your paycheck stubs directly from your email in PDF format

Experience the PaystubHero Advantage

Enjoy Unparalleled Benefits with Our Pay Stub Generator

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Ready to Create Professional Paystub?

Don’t waste time with complicated processes or risky shortcuts. Our easy-to-use paystub generator is here to help you create accurate, professional paystubs in minutes. Whether you’re an employer, freelancer, or someone needing proof of income, we’ve got the perfect template for you.

Get started today and see how simple it can be!