🚀 Self Employment Form 1099

Navigate Self-Employment with Ease: Your Complete Guide to Form 1099

Mastering Self Employment Form 1099: Simplify Your Tax Filing

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

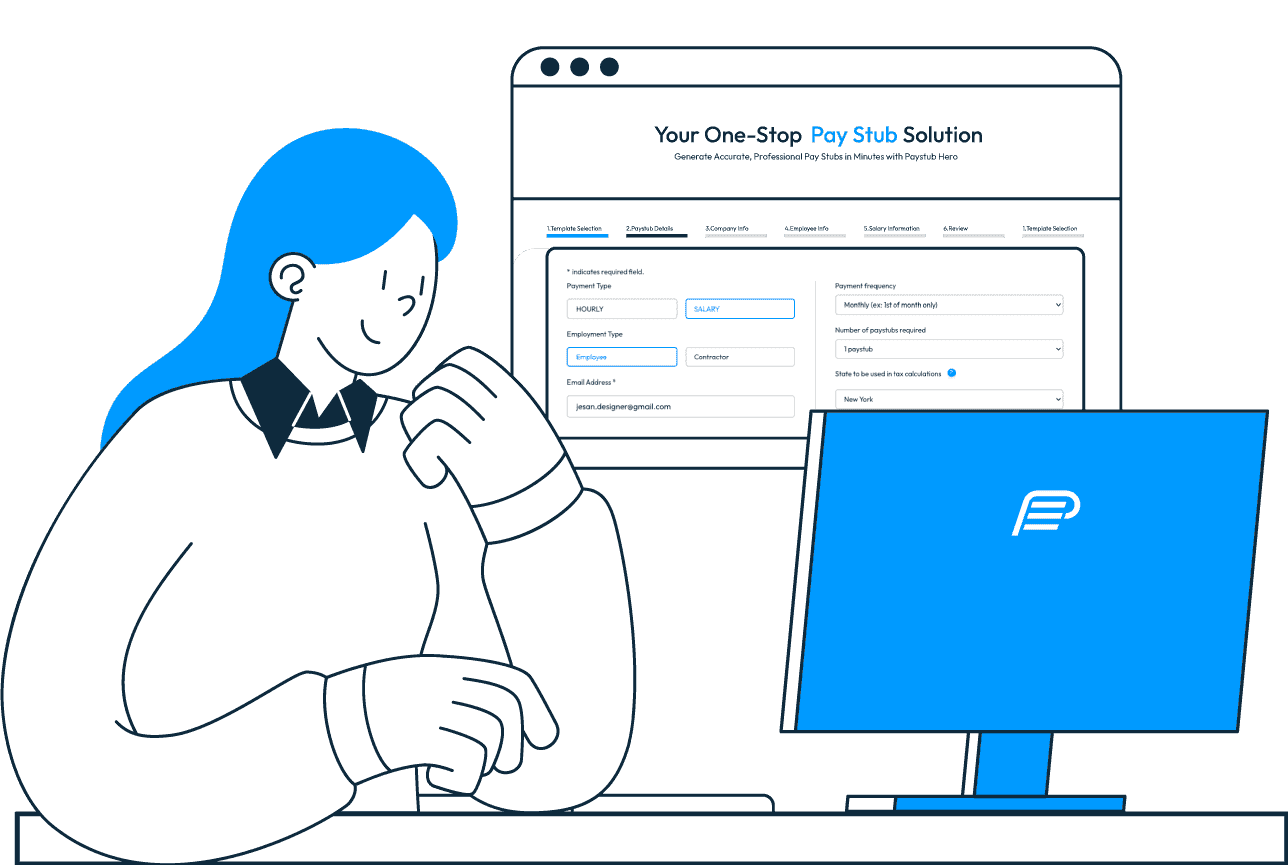

Pay Stub

Generate Accurate, Professional Pay Stubs in Minutes

W-2

Effortlessly Create Your W-2 Forms and Gain Peace of Mind

1099 MISC

Unlock a Seamless Process for Generating 1099 MISC Forms

1099 NEC

Take the Stress out of Tax Season with PayStub Hero’s 1099 NEC

Understanding Self Employment Form 1099

The Self Employment Form 1099 is a pivotal document for freelancers, independent contractors, and small business owners in the United States. This form plays a crucial role in the tax filing process, as it is used to report income earned from self-employment activities to the Internal Revenue Service (IRS). Essentially, Form 1099 serves as a record for any non-employee income, ensuring that the government is aware of all the earnings a self-employed individual receives from various clients or companies.

For those navigating the realm of self-employment, understanding and correctly using Form 1099 is vital. The IRS requires that any individual or entity that pays more than $600 to a service provider in a fiscal year must issue a Form 1099 to both the payee and the IRS. This form not only helps in tracking income for tax purposes but also assists in calculating the necessary self-employment taxes, which include contributions to Social Security and Medicare.

The importance of Form 1099 extends beyond mere income reporting. It is a key component in maintaining transparency and accountability in the financial dealings of self-employed professionals. By accurately reporting income on Form 1099, self-employed individuals can avoid potential audits, penalties, and legal issues that might arise from underreporting income. Moreover, it provides a clear and organized way to manage one’s finances, paving the way for a smoother tax preparation and filing experience.

However, the process of managing and filing Form 1099 can be daunting, especially for those new to self-employment. It involves understanding various types of 1099 forms, such as 1099-NEC (Nonemployee Compensation) and 1099-MISC (Miscellaneous Income), each catering to different types of income and scenarios. Additionally, staying updated with the latest IRS guidelines and deadlines is crucial to ensure compliance and avoid penalties.

In summary, Self Employment Form 1099 is not just a tax form; it’s a fundamental tool for financial management and compliance for anyone in the self-employment sector. Its proper understanding and usage are imperative for accurate tax reporting, legal compliance, and financial stability for self-employed individuals in the USA.

Navigating the Complexities of Form 1099 for Self-Employed Individuals

For many self-employed professionals, managing and filing the Self Employment Form 1099 presents a significant challenge. The intricacies involved in accurately completing this form can be overwhelming, especially for those new to self-employment. Missteps in this process can lead to incorrect tax filings, resulting in potential audits, penalties, and legal issues. Additionally, keeping abreast of the ever-changing tax laws and understanding the specific requirements of different 1099 forms add to the complexity. This situation often creates a stressful environment for self-employed individuals, who must balance these administrative tasks with their primary business activities. The need for a simplified, reliable solution for handling Form 1099 is evident, highlighting a gap in the market that demands attention.

Simplifying Form 1099 Management for Self-Employed Professionals

Addressing the complexities faced by self-employed individuals with Form 1099, our solution offers a streamlined, user-friendly approach to managing this crucial tax document. By leveraging our online platform, users can effortlessly generate accurate and IRS-compliant Form 1099s. This not only minimizes the risk of errors and non-compliance but also significantly reduces the time and stress associated with tax filing. Our tool is designed to keep up-to-date with the latest tax laws, ensuring that users are always compliant with current regulations. Moreover, it provides clear guidance and support throughout the process, making it accessible even to those with limited tax knowledge. This solution empowers self-employed professionals to focus more on their business and less on the administrative burdens of tax documentation, bridging the market gap with an efficient and reliable service.

Enhanced Features of Our 1099 Document Generator for Self-Employed Professionals

Our 1099 document generator is meticulously designed to cater to the unique needs of self-employed individuals, offering a suite of features that streamline the entire process of managing and filing Form 1099. Here’s a detailed look at the key features and their benefits:

Automated Form Completion

Our platform automates the filling of Form 1099, significantly reducing manual effort and the likelihood of errors. This feature ensures that all entries are accurate and compliant with IRS standards, providing peace of mind to users.

Real-Time Tax Law Updates

Stay constantly updated with the latest tax laws and regulations. This feature eliminates the need for users to track changes in tax legislation, ensuring that every Form 1099 generated is in line with current IRS guidelines.

User-Friendly Interface

The platform boasts an intuitive interface that simplifies navigation and form generation. This makes it accessible even to those with minimal experience in tax filing, ensuring a smooth and hassle-free experience.

Secure Data Management

We prioritize the security and confidentiality of your data. Our robust security measures protect sensitive information, giving users confidence in the safety of their financial data.

Customizable Form Options

Tailor your Form 1099 to meet specific needs. Our platform offers customizable options, allowing users to adjust the forms according to their unique business requirements.

24/7 Access and Support

Access the platform and generate forms anytime, anywhere. Coupled with round-the-clock customer support, users can resolve queries and receive assistance whenever needed, ensuring uninterrupted service.

Cloud Storage and Accessibility

All forms are securely stored in the cloud, allowing for easy retrieval and access from any device. This feature provides convenience in managing historical tax records and facilitates easy sharing with accountants or tax professionals.

Comprehensive Guidance and Resources

The platform includes detailed guides and resources to help users understand the nuances of Form 1099. This educational aspect empowers users with knowledge, making them more confident in their tax filing process.

These features collectively address the primary concerns and challenges faced by self-employed individuals in managing Form 1099, offering a solution that is not just a tool, but a comprehensive support system for their tax filing needs.

Maximizing Advantages with Self Employment Form 1099 Generator

Unlock the Full Potential of Self Employment Form 1099 Management

Enhancing Your Tax Experience with Self Employment Form 1099 Tools

Revolutionize Your Approach to Self Employment Form 1099 Filing

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Mastering the 1099 Form Texas Creation with Paystub Hero

A Step-by-Step Guide to Effortlessly Generate Your 1099 Form Texas

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate 1099

Instantly create a digital copy.

4. Download

Access your 1099 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Our Customers Shared Their Love For Us

Get your questions answered

Self Employment Form 1099 is a tax document used in the USA to report income from self-employment. Any individual who earns more than $600 from self-employment in a year is required to file this form. It's essential for accurate tax reporting and compliance with IRS regulations.

Income reported on Form 1099 is subject to self-employment tax, which includes Social Security and Medicare taxes. This form helps in determining the amount of tax you owe based on your self-employment income, ensuring accurate tax payments and compliance.

Yes, our platform enables you to create, manage, and file Form 1099 online. It simplifies the process with guided steps, ensuring accuracy and compliance with IRS standards.

To complete Form 1099, you need personal information (name, address, SSN or TIN) and details of your self-employment income, including the total amount earned from each client who paid you over $600.

Filing Form 1099 can be complex, but our platform makes it easier with a user-friendly interface and step-by-step guidance, reducing the complexity and potential for errors.

Our platform includes validation checks and adheres to the latest IRS guidelines, ensuring that each Form 1099 is accurate and compliant with current tax laws.

If you make an error on Form 1099, our platform allows for easy amendments and re-submission. It's important to correct errors promptly to maintain compliance with IRS regulations.

We prioritize data security with advanced encryption and security measures, ensuring the protection and confidentiality of your personal and financial information.

Our platform offers extensive support, including a customer service team, detailed FAQs, and resource guides, to assist with any Form 1099-related questions or issues.

Yes, we provide a range of resources, including educational articles, video tutorials, and expert insights, to help users understand and navigate the complexities of Form 1099.