🚀 W2 Form PDF

Your Ultimate Guide to W2 Form PDF Generation

Simplify Your W2 Form PDF Process with Ease

- Diverse Templates

- Quick Generation

- Cloud Storage

- Collaboration Tools

- Automated Updates

- User-Friendly Editor

- Consistent Branding

- Dynamic Fields

- Version Control

- Feedback Loop

PaystubHero has solutions to All Your document needs

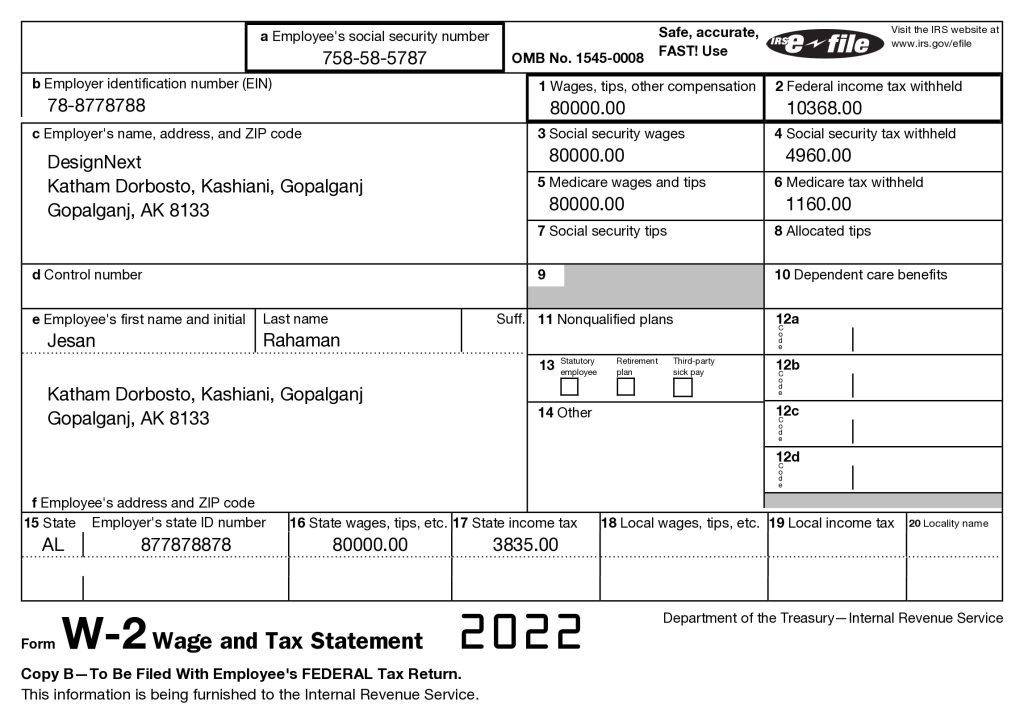

Understanding W2 Form PDF

The W2 form PDF is an essential document for employers and employees in the United States, serving as a digital record of an individual’s annual wages and the taxes withheld by their employer. This form is a cornerstone of the tax filing process, required by the IRS for accurately reporting earnings and tax deductions. In its PDF format, the W2 form becomes a more accessible, secure, and manageable document, facilitating easier storage, retrieval, and submission during tax season.

Beyond its basic function, the W2 form PDF plays a critical role in ensuring compliance with federal tax laws. Employers are mandated to furnish their employees with this form by January 31st each year, making it imperative for businesses to have a reliable method of generating these documents accurately and on time. The transition to a digital PDF format has significantly streamlined this process, allowing for automated data entry, error reduction, and instant distribution, thereby enhancing the efficiency of tax reporting practices.

Moreover, the W2 form PDF aids employees in understanding their compensation structure, including wages, tips, bonuses, and deductions for taxes, social security, and Medicare. This transparency is vital for personal financial planning and accurate tax filing. For employers, the digital format simplifies the complex task of payroll management, ensuring that they meet their legal obligations without the cumbersome paperwork traditionally associated with tax documentation.

In an era where digital transformation is key to operational efficiency, the W2 form PDF stands out as a testament to how technology can simplify mandatory processes, reduce environmental impact through less paper use, and improve overall compliance and satisfaction for both employers and employees. As such, having access to a reliable online generator for W2 forms is not just a convenience but a necessity for modern businesses aiming to streamline their tax reporting and payroll processes.

The Challenges with W2 Form PDF Generation

In today’s fast-paced business environment, generating W2 forms presents a significant challenge for employers. The manual process of creating W2 forms is not only time-consuming but also fraught with potential for errors, which can lead to costly penalties from tax authorities. Employers must navigate the complex maze of tax regulations, ensuring that each form is accurate and compliant with current laws. This task is further complicated by the need to securely handle sensitive employee information, adding a layer of risk to the process. Small businesses, in particular, struggle with these challenges due to limited resources and expertise in tax compliance. The annual rush to meet the IRS deadline for W2 submissions exacerbates these issues, putting additional pressure on employers to deliver accurate forms on time. The cumulative effect of these challenges is a significant administrative burden that can detract from other critical business operations, highlighting the need for a more efficient, error-proof solution to W2 form generation.

Streamlining W2 Form PDF Creation

In response to the complexities and challenges associated with W2 form PDF generation, our online document generator emerges as a pivotal solution, transforming the way businesses approach this critical task. This innovative platform is engineered to automate and simplify the creation of W2 forms, ensuring accuracy, compliance, and efficiency. By leveraging advanced technology, it eliminates the common pitfalls of manual processing, such as human errors and inconsistencies, thereby safeguarding businesses against potential audits and penalties.

Our solution is designed with the user in mind, featuring an intuitive interface that guides employers through each step of the W2 form creation process. It dynamically updates to reflect the latest tax laws and regulations, ensuring that every document generated is compliant with current standards. This not only reduces the administrative burden on businesses but also instills confidence that they are meeting their legal obligations without the need for extensive tax law knowledge or resources.

Moreover, the platform offers scalability, catering to businesses of all sizes, from small startups to large corporations, and provides secure storage and easy access to historical tax documents. This not only streamlines the tax filing process but also enhances the overall efficiency of financial and payroll management within organizations. By adopting our W2 form PDF generator, businesses can redirect their focus from tedious administrative tasks to their core operations, fostering growth and stability in an increasingly competitive market.

Key Features of Our W2 Form PDF Generator

Our W2 form PDF generator is engineered to address the complexities and challenges of tax document generation, offering a robust solution that combines efficiency, accuracy, and compliance into one user-friendly platform. This innovative tool is designed to streamline the process of creating W2 forms, making it seamless for businesses of all sizes to fulfill their tax obligations without the need for extensive tax knowledge or resources.

The platform’s intuitive interface simplifies the data entry process, reducing the likelihood of errors and ensuring that every W2 form is accurate and compliant with current tax laws. With features like auto-calculation of taxes and instant verification of information, businesses can trust in the integrity of their tax documents. Moreover, our generator facilitates rapid generation of forms, allowing employers to produce and distribute W2 forms well before the IRS deadline, thus enhancing operational efficiency and peace of mind.

Beyond these core functionalities, the generator is equipped with advanced security measures to protect sensitive employee information, ensuring that data privacy is maintained at every step of the process. Additionally, its compatibility with various payroll systems allows for seamless integration into existing workflows, further simplifying the tax reporting process.

Accuracy Guaranteed

Our W2 form PDF generator minimizes human error through automated calculations and validations, ensuring that every form is precise and compliant with the latest tax regulations. This accuracy is vital for maintaining trust and avoiding potential legal issues.

Rapid Generation

Time is of the essence, especially during tax season. Our platform's efficiency allows businesses to generate W2 forms in minutes, not hours, freeing up valuable resources for other critical tasks and enhancing overall productivity.

Legally Compliant

Navigating the complexities of tax laws can be daunting. Our generator is regularly updated to reflect the latest tax codes and regulations, ensuring that your business remains compliant without having to constantly monitor changes in tax legislation.

User-Friendly Interface

Designed with the user in mind, our platform offers a straightforward, intuitive interface that makes W2 form generation accessible to everyone, regardless of their technical expertise or familiarity with tax laws. This ease of use is crucial for ensuring that the process is as stress-free as possible.

These features and benefits collectively ensure that our W2 form PDF generator is not just a tool but a comprehensive solution for businesses aiming to streamline their tax reporting processes, enhance accuracy, and ensure compliance, all while safeguarding employee data and integrating seamlessly into existing systems.

*10% discount going on for the first time. Use coupon code: WELCOME10

Discover the Benefits of Our W2 Form PDF Generator

Enhance Your Tax Reporting with W2 Form PDF Efficiency

Unlocking the Advantages of Efficient W2 Form PDF Generation

Transform Your Approach to W2 Form PDFs with Unmatched Benefits

Streamlined Process

Instant Digital Delivery

Guaranteed Legal Compliance

Cost-Effective Solutions

24/7 Customer Support

Step-by-Step Guide to Creating a W2 Form Image

Follow our simple step-by-step process

1. Input Details

Fill in the employee's financial details.

2. Review Data

Ensure accuracy before proceeding.

3. Generate W2

Instantly create a digital copy.

4. Download

Access your W2 form image anytime, anywhere.

Our Pricing

Pay Stub

$7.50

/ Per Paystub

Unbeatable Value at Just Only $7.50

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

W-2

$12.99

/ Per W-2

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 MISC

$12.99

/ Per 1099 MISC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

1099 NEC

$12.99

/ Per 1099 NEC

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Invoice

$11.99

/ Per Invoice

Unbeatable Value at Just Only $11.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

Offer Letter

$12.99

/ Per Offer Letter

Unbeatable Value at Just Only $12.99

- 100% Accurate Calculations

- 24/7 Customer Support

- Transparent Pricing

- Highly Customizable

- Fully Compliant

We've Helped 839,492 Customers Create Their Paystub Template Using Our Stub Generator

Frequently Asked Questions

A W2 form PDF is a digital version of the traditional paper W2 form used by employers to report an employee's annual wages and the taxes withheld from their paycheck. This format facilitates easier filing, distribution, and storage. It contains the same information as its paper counterpart, including wages earned, federal and state taxes withheld, Social Security earnings, Medicare earnings, and any other deductions. The shift towards digital forms, like the PDF version, reflects an effort to streamline tax reporting processes, ensuring accuracy and efficiency while reducing environmental impact.

Generating a W2 form PDF typically involves using specialized software or an online platform designed for this purpose. Users enter the relevant employee and wage information into the system, which then automatically calculates the necessary tax withholdings and generates a compliant W2 form in PDF format. This can then be printed or electronically distributed to employees. Our platform simplifies this process, offering a user-friendly interface and ensuring that all generated forms are compliant with IRS guidelines.

Yes, a digital W2 form PDF is just as valid as a paper form for tax reporting purposes, provided it meets the IRS requirements for format and content. The IRS has embraced electronic documents as part of its efforts to modernize and streamline tax reporting and filing processes. Employers must ensure that the electronic delivery system they use complies with IRS guidelines, including consent from employees to receive their W2 form in a digital format.

While individuals cannot submit W2 form PDFs directly to the IRS, employers are required to file all W2 forms, including PDF versions, through the Social Security Administration (SSA). The SSA processes these forms and shares the relevant information with the IRS. Employers can use the SSA's Business Services Online (BSO) platform for electronic submission, which supports the filing of W2 forms in various digital formats.

If you discover an error in your W2 form PDF, you should immediately contact your employer to correct the mistake. Employers are responsible for issuing corrected W2 forms, known as W2c, to both the employee and the SSA. It's crucial to ensure that your tax records are accurate to avoid potential issues with the IRS.

Generating and distributing W2 form PDFs electronically is highly secure, provided that the platform used adheres to stringent security standards, including encryption and secure data storage. Our platform ensures the confidentiality and integrity of your data through advanced security measures, protecting sensitive information from unauthorized access.

The benefits of using a W2 form PDF over traditional paper forms include enhanced efficiency, reduced environmental impact, and improved accuracy. Digital forms streamline the distribution process, allow for easier corrections, and reduce the risk of lost or delayed forms. Additionally, electronic storage simplifies record-keeping and retrieval.

Yes, according to IRS regulations, employees must provide their consent to receive their W2 form in an electronic format instead of a paper copy. This consent ensures that employees are prepared to access and use their digital forms for tax filing purposes. Employers should provide clear instructions on how to give consent and ensure that the consent process complies with IRS guidelines.

Yes, most platforms that generate W2 form PDFs offer the ability to access and download forms from previous years. This feature is invaluable for record-keeping and tax preparation, allowing both employers and employees to retrieve historical tax documents as needed. Our service ensures that your data is securely stored and easily accessible, providing peace of mind and convenience.

Employers looking to transition to electronic W2 form PDF distribution should first ensure they have a reliable and secure platform in place. Next, they must obtain consent from their employees to receive W2 forms electronically. Employers should also provide clear instructions on how to access and download the forms, and ensure their system is compliant with IRS and SSA guidelines for electronic filing and distribution. Adopting electronic distribution can save time and resources while enhancing the overall efficiency of the tax reporting process.